Читайте также:

|

Solutions to Problem Set A

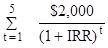

9-1A. (a) IO = FCFt[PVIFIRR%,t yrs]

$10,000 = $17,182 [PVIFIRR%,8 yrs]

0.582 = PVIFIRR%,8 yrs

Thus, IRR = 7%

(b) $10,000 = $48,077 [PVIFIRR%,10 yrs]

0.208 = PVIFIRR%,10 yrs

Thus, IRR = 17%

(c) $10,000 = $114,943 [PVIFIRR%,20 yrs]

0.087 = PVIFIRR%,20 yrs

Thus, IRR = 13%

(d) $10,000 = $13,680 [PVIFIRR%,3 yrs]

.731 = PVIFIRR%,3 yrs

Thus, IRR = 11%

9-2A. (a) I0 = FCFt[PVIFAIRR%,t yrs]

$10,000 = $1,993 [PVIFAIRR%,10 yrs]

5.018 = PVIFAIRR%,10 yrs

Thus, IRR = 15%

(b) $10,000 = $2,054 [PVIFAIRR%,20 yrs]

4.869 = PVIFAIRR%,20 yrs

Thus, IRR = 20%

(c) $10,000 = $1,193 [PVIFAIRR%,12 yrs]

8.382 = PVIFAIRR%,12 yrs

Thus, IRR = 6%

(d) $10,000 = $2,843 [PVIFAIRR%,5 yrs]

3.517 = PVIFAIRR%,5 yrs

Thus, IRR = 13%

9-3A. (a) $10,000 =  +

+  +

+

Try 18%:

$10,000 = $2,000(0.847) + $5,000 (0.718) + $8,000 (0.609)

= $1,694 + $3,590 + $4,872

= $10,156

Try 19%

$10,000 = $2,000 (0.840) + $5,000 (0.706) + $8,000 (0.593)

= $1,680 + $3,530 + $4,744

= $9,954

Thus, IRR = approximately 19%

(b) $10,000 =  +

+  +

+

Try 30%

$10,000 = $8,000 (0.769) + $5,000 (0.592) + $2,000 (0.455)

= $6,152 + $2,960 + $910

= $10,022

Try 31%:

$10,000 = $8,000 (0.763) + $5,000 (0.583) + $2,000 (0.445)

= $6,104 + $2,915 + $890

= $9,909

Thus, IRR = approximately 30%

(c) $10,000 =  +

+

Try 11%

$10,000 = $2,000 (3.696) + $5,000 (0.535)

= $7,392 + $2,675

= $10,067

Try 12%

$10,000 = $2,000 (3.605) + $5,000 (0.507)

= $7,210 + $2,535

= $9,745

Thus, IRR = approximately 11%

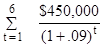

9-4A. (a) NPV =  - $1,950,000

- $1,950,000

= $450,000 (4.486) - $1,950,000

= $2,018,700 - $1,950,000 = $68,700

(b) PI =

= 1.0352

(c) $1,950,000 = $450,000 [PVIFAIRR%,6 yrs]

4.333 = PVIFAIRR%,6 yrs

IRR = about 10% (10.1725%)

(d) Yes, the project should be accepted.

9-5A. (a) Payback Period = $80,000/$20,000 = 4 years

Discounted Payback Period Calculations:

Cumulative

Undiscounted Discounted Discounted

Year Cash Flows PVIF10%,n Cash Flows Cash Flows

| -$80,000 | 1.000 | -$80,000 | -$80,000 | |

| 20,000 | .909 | 18,180 | -61,820 | |

| 20,000 | .826 | 16,520 | -45,300 | |

| 20,000 | .751 | 15,020 | -30,280 | |

| 20,000 | .683 | 13,660 | -16,620 | |

| 20,000 | .621 | 12,420 | -4,200 | |

| 20,000 | .564 | 11,280 | 7,080 |

Discounted Payback Period = 5.0 + 4,200/11,280 = 5.37 years.

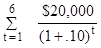

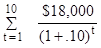

(b) NPV =  - $80,000

- $80,000

= $20,000 (4.355) - $80,000

= $87,100 - $80,000 = $7,100

(c) PI =

= 1.0888

(d) $80,000 = $20,000 [PVIFAIRR%,6 yrs]

4.000 = PVIFAIRR%,6 yrs

IRR = about 13% (12.978%)

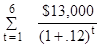

9-6A. (a) NPVA =  - $50,000

- $50,000

= $12,000 (4.111) - $50,000

= $49,332 - $50,000 = -$668

NPVB =  - $70,000

- $70,000

= $13,000 (4.111) - $70,000

= $53,443 - $70,000 = -$16,557

(b) PIA =

= 0.9866

PIB =

= 0.7635

(c) $50,000 = $12,000 [PVIFAIRR%,6 yrs]

4.1667 = PVIFAIRR%,6 yrs

IRRA = 11.53%

$70,000 = $13,000 [PVIFAIRR%,6 yrs]

5.3846 = PVIFAIRR%,6 yrs

IRRB = 3.18%

Neither project should be accepted.

9-7A. (a) Project A:

Payback Period = 2 years + $100/$200 = 2.5 years

Project A:

Discounted Payback Period Calculations:

Cumulative

Undiscounted Discounted Discounted

Year Cash Flows PVIF10%,n Cash Flows Cash Flows

| -$1,000 | 1.000 | -$1,000 | -$1,000 | |

| .909 | -455 | |||

| .826 | -207 | |||

| .751 | -57 | |||

| .683 | ||||

| .621 |

Discounted Payback Period = 3.0 + 57/68 = 3.84 years.

Project B:

Payback Period = 2 years + $2,000/$3,000 = 2.67 years

Project B:

Discounted Payback Period Calculations:

Cumulative

Undiscounted Discounted Discounted

Year Cash Flows PVIF10%,n Cash Flows Cash Flows

| -$10,000 | 1.000 | -$10,000 | -$10,000 | |

| 5,000 | .909 | 4,545 | -5,455 | |

| 3,000 | .826 | 2,478 | -2,977 | |

| 3,000 | .751 | 2,253 | -724 | |

| 3,000 | .683 | 2,049 | 1,325 | |

| 3,000 | .621 | 1,863 | 3,188 |

Discounted Payback Period = 3.0 + 724/2,049 = 3.35 years.

Project C:

Payback Period = 3 years + $1,000/$2,000 = 3.5 years

Project C:

Discounted Payback Period Calculations:

Cumulative

Undiscounted Discounted Discounted

Year Cash Flows PVIF10%,n Cash Flows Cash Flows

| -$5,000 | 1.000 | -$5,000 | -$5,000 | |

| 1,000 | .909 | -4,091 | ||

| 1,000 | .826 | -3,265 | ||

| 2,000 | .751 | 1,502 | -1,763 | |

| 2,000 | .683 | 1,366 | -397 | |

| 2,000 | .621 | 1,242 |

Discounted Payback Period = 4.0 + 397/1,242 = 4.32 years.

| Project | Traditional Payback | Discounted Payback |

| A | Accept | Reject |

| B | Accept | Reject |

| C | Reject | Reject |

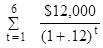

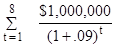

9-8A. NPV9% =  - $5,000,000

- $5,000,000

= $1,000,000 (5.535) - $5,000,000

= $5,535,000 - $5,000,000 = $535,000

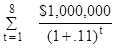

NPV11% =  - $5,000,000

- $5,000,000

= $1,000,000 (5.146) - $5,000,000

= $5,146,000 - $5,000,000 = $146,000

NPV13% =  - $5,000,000

- $5,000,000

= $1,000,000 (4.799) - $5,000,000

= $4,799,000 - $5,000,000 = -$201,000

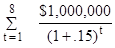

NPV15% =  - $5,000,000

- $5,000,000

= $1,000,000 (4.487) - $5,000,000

= $4,487,000 - $5,000,000 = -$513,000

9-9A. Project A:

$50,000 =  +

+  +

+

+  +

+

Try 23%

$50,000 = $10,000(.813) + $15,000(.661) + $20,000(.537)

+ $25,000(.437) + $30,000(.355)

= $8,130 + $9,915 + $10,740 + $10,925 + $10,650

= $50,360

Try 24%

$50,000 = $10,000(.806) + $15,000(.650) +$20,000(.524)

+ $25,000(.423) + $30,000(.341)

= $8,060 + $9,750 + $10,480 + $10,575 + $10,230

= $49,095

Thus, IRR = just over 23%

Project B:

$100,000 = $25,000 [PVIFAIRR%,5 yrs]

4.00 = PVIFAIRR%,5 yrs

Thus, IRR = 8%

Project C:

$450,000 = $200,000 [PVIFAIRR%,3 yrs]

2.25 = PVIFAIRR%,3 yrs

Thus, IRR = 16%

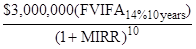

9-10A. (a) NPV =  - $100,000

- $100,000

= $18,000(6.145) - $100,000

= $110,610 - $100,000

= $10,610

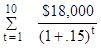

(b) NPV =  - $100,000

- $100,000

= $18,000(5.019) - $100,000

= $90,342 - $100,000

= -$9,658

(c) If the required rate of return is 10% the project is acceptable as in part (a).

(d) $100,000 = $18,000 [PVIFAIRR%,10 yrs]

5.5556 = PVIFAIRR%,10 yrs

IRR = Between 12% and 13% (12.41%)

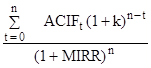

9-11A. (a)  =

=

$10,000,000 =

$10,000,000 =

$10,000,000 =

MIRR = 16.9375%

(b) $10,000,000 =

$10,000,000 =

$10,000,000 =

MIRR = 18.0694%

(c) $10,000,000 =

$10,000,000 =

$10,000,000 =

MIRR = 19.2207%

Дата добавления: 2015-10-30; просмотров: 117 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| END-OF-CHAPTER QUESTIONS | | | SOLUTION TO INTEGRATIVE PROBLEM |