Читайте также:

|

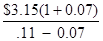

8-1B. Value (Vps) =

= $70.00

8-2B. Growth rate = return on equity x retention rate

= (24%) × (70%) = 16.8%

8-3B. Value (Vps) =

=

= $133.33

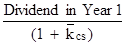

8-4B. Expected Rate of Return

ps =  =

=  =.0426, or 4.26%

=.0426, or 4.26%

8-5B. (a) Expected return =  =

=  =.0844, or 8.44%

=.0844, or 8.44%

(b) Given your 8 percent required rate of return, the stock is worth $40.63 to you.

Value =  =

=  = $40.63

= $40.63

Since the expected rate of return (8.44%) is greater than your required rate of return (8%), or since the current market price ($38.50) is less than the value ($40.63), the stock is undervalued and you should buy.

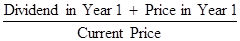

8-6B. Value (Vcs) =  +

+

$52.75 =  +

+

Rearranging and solving for P1:

P1 = $52.75 (1.16) - $6.50

P1 = $54.69

The stock would have to increase $1.94 ($54.69 - $52.75), or 3.68 percent, ($1.94/$52.75) to earn a 16% rate of return.

8-7B. (a)  =

=  +

+

=

=  +.105

+.105

= 0.2137, or 21.37%

= 0.2137, or 21.37%

(b) Vcs =  = $38.46

= $38.46

The expected rate of return exceeds your required rate of return, which means that the value of the security to you is greater than the current market price. Thus, you should buy the stock.

8-8B. Value (Vcs) =

Vcs =

Vcs = $28.39

8-9B. Growth rate = return on equity x retention rate

= (24%) ´ (60%) = 14.4%

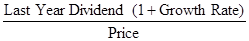

8-10B. Expected Rate of Return ( ) =

) =  + Growth Rate

+ Growth Rate

=

=  + 0.085 = 0.1812, or 18.12%

+ 0.085 = 0.1812, or 18.12%

8-11B. Value (Vcs) =  +

+

Vcs =  +

+

Vcs = $37.37

8-12B. If the expected rate of return is represented by  :

:

Current Price =  +

+

=

=  - 1

- 1

=

=  - 1

- 1

= 0.1136, or 11.36%

= 0.1136, or 11.36%

8-13B. (a)  =

=  =

=  = 11.43%

= 11.43%

(b) Value (Vps) =  =

=  = $40

= $40

(c) The investor's required rate of return (10 percent) is less than the expected rate of return for the investment (11.43 percent). Also, the value of the stock to the investor ($40) exceeds the existing market price ($35). The investor should buy the stock.

8-14B. (a) Expected Rate of Return =  +

+

=  + 0.08

+ 0.08

= 0.1232, or 12.32%

(b) Investor's Value =

=

= $36.00

(c) Yes, the expected rate of return is greater than your required rate of return (12.32 percent versus 11 percent). Also, your value of the stock ($36.00) is higher than the current market price ($25.00).

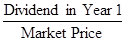

8-15B (a) Dividend yield: Dividend ¸ stock price =  = 2.22%

= 2.22%

(b) Using the nominal average returns of 12.2% for large-company stocks and the 3.8% nominal average return for U.S. Treasury Bills as shown in Table 6-1, the computation would be as follows:

=

=  + beta ´

+ beta ´  -

-

= 3.8% + 0.90 ´ (12.2% - 3.8%) = 11.36%

(c)  =

=  +

+

11.36% =  + g

+ g

.1136 =.0222 + g

g =.0914, or 9.14%

8-16B

Note to Instructor: Before the 10th edition of Financial Management was completed, we had not verified the earnings per share data for First Union Corporation. After the text went to production, we realized that First Union was merged into Wachovia Bank in 2001. We then planned to use the Wachovia earnings per share data, only to discover the significant volatility of the firm’s earnings over the past five years, which appears as follows:

20032002200120001999

Earnings per share (diluted) $3.18 $2.60 $1.45 $0.07 $3.33

Since Wachovia’s earnings per share has actually decreased over the last five years, the growth rate in earnings per share is =1.146 percent (using 4 years to compute the growth rate). Clearly, the historical earnings per share do not provide a reasonable estimate of future earnings per share, which regrettably makes the problem difficult to use without having a meaningful growth estimate. Thus, the problem can only be used to show that relying on historical data does not always provide reasonable results.

8-17B. (a)  =

=  =

=

= 0.1154, or 11.54%

= 0.1154, or 11.54%

(b) Value (Vps) =  =

=  = $22.50

= $22.50

(c) The investor's required rate of return (10 percent) is less than the expected rate of return for the investment (11.54 percent). Also, the value of the stock to the investor, ($22.50) exceeds the existing market price ($19.50), so buy the stock.

8-18B.

(a) Investor's Value =

=

= $29.25

(b) Expected Rate of Return =  +

+

=  + 0.05

+ 0.05

= 0.1288, or 12.88%

(c) Yes, the expected rate of return (12.88%) is greater than your required rate of return (12 percent). Also, your value of the stock ($29.25) is greater than the current market price ($26).

8-19B. (a) Growth rate = return on equity x retention rate

= (13%) ´ (20%) = 2.6%

(b) (i) If retention rate is 35%:

Growth rate = return on equity x retention rate

= (13%) ´ (35%) = 4.55%

(ii) If retention rate is 13%:

Growth rate = return on equity x retention rate

= (13%) ´ (13%) = 1.69%

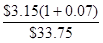

8-20B. (a)  =

=  +

+

cs =  + 0.07

+ 0.07

cs =.1699, or 16.99%

(b) Vcs =  = $84.26

= $84.26

Yes, purchase the stock. The expected return is significantly more than your required rate of return. Also, the stock is selling for $33.75, while it is worth $84.26 to you.

Solutions to Appendix 8A

8A-1. Using the NVDG model,

Vcs =  +

+

where kcs = the investor's required rate of return

EPS1 = the firm's earning per share in year 1

g = the growth rate, which is the firm's earnings retention rate times its return on equity.

PV1 =  - (r x EPS1)

- (r x EPS1)

r = the firm's earnings retention rate

ROE = the firm's return on equity investment

For our problem,

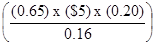

PV1 =  - (0.65 x $5)

- (0.65 x $5)

= $4.0625 - $3.25

= $0.8125

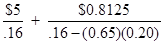

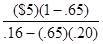

and Vcs =

= $31.25 + $27.08

= $58.33

Using the more traditional dividend-growth model, we get:

Vcs =

Since D1 = EPS1(1 - the retention rate), and

g = the retention rate x return on equity

Vcs =  =

=  = $58.33

= $58.33

8A-2. Given the EPS1 is expected to be $7 and the investor's required rate of return is 18 percent, the value of the stock, assuming no growth opportunities would be:

Vcs =  = $38.89

= $38.89

where kcs = the investor's required rate of return

EPS1 = the firm's earning per share in year 1

To compute the present value of the growth opportunities, NVDG, for each scenario, we use the following equation:

NVDG =

where PV1 =  - (r x EPS1)

- (r x EPS1)

g = the growth rate, which is the firm's earnings retention rate times its return on equity.

r = the firm's earnings retention rate

ROE = the firm's return on equity investment

Given the different possible retention rates and ROEs, we may solve for the respective PV1s. The results are as follows:

Possible Different Retention Rates

ROEs 0% 30% 60%

16% 0.00 -0.23 -0.47

18% 0.00 0.00 0.00

24% 0.00 0.70 1.40

We next calculate the NVDG for each scenario by dividing the above PV1values by kcs- g, which gives the following results:

Possible Different Retention Rates

ROEs 0% 30% 60%

16% 0.00 -1.77 -5.56

18% 0.00 0.00 0.00

24% 0.00 6.48 38.89

Adding the $38.89 price, assuming no growth, to the above NVDGs, we get:

Possible Different Retention Rates

ROEs 0% 30% 60%

16% 38.89 37.12 33.33

18% 38.89 38.89 38.89

24% 38.89 45.37 77.78

Thus, our results show that value is created only when management reinvests at above the investor's required rate of return. That is, growth may actually decrease the firm's value if the profitability of the new investments are not adequate enough to satisfy the investor's required returns.

Дата добавления: 2015-10-30; просмотров: 108 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Solutions to Problem Set A | | | CHAPTER OUTLINE |