Читайте также:

|

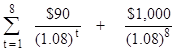

7-1A. Value (Vb) =

® ANSWER -752.23

® ANSWER -752.23

7-2A. If the interest is paid semiannually:

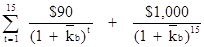

Value (Vb) =

® ANSWER -1,058.26

® ANSWER -1,058.26

If interest is paid annually:

Value (Vb) =

® ANSWER -1,057.47

® ANSWER -1,057.47

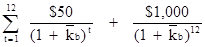

7-3A. $900 =

® ANSWER 4.79% semiannual rate

® ANSWER 4.79% semiannual rate

The rate is equivalent to 9.6 percent annual rate compounded semiannually, or 9.8 percent (1.0482- 1) compounded annually.

7-4A. $945 =

® ANSWER 9.63%

® ANSWER 9.63%

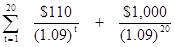

7-5A. $1,150 =

® ANSWER 5.28%

® ANSWER 5.28%

7-6A. a. $1,085 =

® ANSWER 7.06%

® ANSWER 7.06%

b. Vb =

® ANSWER -847.88

® ANSWER -847.88

c. Since the expected rate of return, 7.06 percent, is less than your required rate of return of 10 percent, the bond is not an acceptable investment. This fact is also evident because the market price, $1,085, exceeds the value of the security to the investor of $847.88.

7-7A. a. Value

Par Value $1,000.00

Coupon $ 100.00

Required Rate of Return 0.12

Years to Maturity 15

Market Value $ 863.78

b. Value at Alternative Rates of Return

Required Rate of Return 0.15

Market Value $ 707.63

Required Rate of Return 0.08

Market Value $1,171.19

c. As required rates of return change, the price of the bond changes, which is the result of "interest-rate risk." Thus, the greater the investor's required rate of return, the greater will be his/her discount on the bond. Conversely, the less his/her required rate of return below that of the coupon rate, the greater the premium will be.

d. Value at Alternative Maturity Dates

Years to Maturity 5

Required Rate of Return 0.15

Market Value $ 832.39

Required Rate of Return 0.08

Market Value $1,079.85

e. The longer the maturity of the bond, the greater the interest rate risk the investor is exposed to, resulting in greater premiums and discounts.

7-8A. $1,250 =

® ANSWER 6.36%

® ANSWER 6.36%

7-9A.(a) Vb =

® ANSWER -1,182.57

® ANSWER -1,182.57

(b) (i) Vb =

® ANSWER -925.31

® ANSWER -925.31

(b) (ii) Vb =

® ANSWER -1,573.50

® ANSWER -1,573.50

(c) We see that value is inversely related to the investor's required rate of return.

7-10A.

Value Bond P

Par Value $1,000.00

Coupon $ 100.00

Required Rate of Return 8%

Years to Maturity 5

Market Value $ 1,079.85

Value Bond Q

Par Value $1,000.00

Coupon $ 70.00

Required Rate of Return 8%

Years to Maturity 5

Market Value $ 960.07

Value Bond R

Par Value $1,000.00

Coupon $ 120.00

Required Rate of Return 8%

Years to Maturity 10

Market Value $ 1,268.40

Value Bond S

Par Value $1,000.00

Coupon $ 80.00

Required Rate of Return 8%

Years to Maturity 10

Market Value $ 1,000.00

Value Bond T

Par Value $1,000.00

Coupon $ 65.00

Required Rate of Return 8%

Years to Maturity 15

Market Value $ 871.61

Bond P Q R S T

$1,079.85 $960.07 $1,268.40 $1,000.00 $871.61

Years Ct t*PV(Ct) Ct t*PV(Ct) Ct t*PV(Ct) Ct t*PV(Ct) Ct t*PV(Ct)

1 $100 $93 $70 $65 $120 $111 $80 $74 $65 $60

2 100 171 70 120 120 206 80 137 65 111

3 100 238 70 167 120 286 80 191 65 155

4 100 294 70 206 120 353 80 235 65 191

5 1,100 3,743 1,070 3,641 120 408 80 272 65 221

6 120 454 80 302 65 246

7 120 490 80 327 65 265

8 120 519 80 346 65 281

9 120 540 80 360 65 293

10 1,120 5,188 1,080 5,002 65 301

11 65 307

12 65 310

13 65 311

14 65 310

15 1,065 5,036

4,539 4,198 8,554 7,247 8,398

4,539 4,198 8,554 7,247 8,398

Duration 4.20 4.37 6.74 7.25 9.63

7-11A. a. $1,100 =

® ANSWER 7.14%

® ANSWER 7.14%

b. Vb =

® ANSWER -1,107.79

® ANSWER -1,107.79

c. Since the expected rate of return, 7.14 percent, is more than your required rate of return of 7 percent, the bond is an acceptable investment. This fact is also evident because the market price, $1,100, is less than the value of the security to the investor of $1,107.79.

7-12A. a. $915 =

® ANSWER 6.01%

® ANSWER 6.01%

b. Since the required rate of return(9%) is greater than the expected rate of return(6%), you should not purchase the bond.

7-13A.

Value Bond I

Par Value $1,000.00

Coupon $ 130.00

Required Rate of Return 7%

Years to Maturity 7

Market Value $ 1,323.36

Value Bond II

Par Value $1,000.00

Coupon $ 90.00

Required Rate of Return 7%

Years to Maturity 6

Market Value $1,095.33

Value Bond III

Par Value $1,000.00

Coupon $ 110.00

Required Rate of Return 7%

Years to Maturity 12

Market Value $1,317.71

Value Bond IV

Par Value $1,000.00

Coupon $ 125.00

Required Rate of Return 7%

Years to Maturity 5

Market Value $1,225.51

Value Bond V

Par Value $1,000.00

Coupon $ 80.00

Required Rate of Return 7%

Years to Maturity 10

Market Value $1,070.24

| Bond | I | II | III | IV | V | ||||||

| Bond Value | $1,323.36 | $1,095.33 | $1,317.71 | $1,225.51 | $1,070.24 | ||||||

| Years | Ct | tPV(Ct) | Ct | tPV(Ct) | Ct | tPV(Ct) | Ct | tPV(Ct) | Ct | tPV(Ct) | |

| $130 | $121 | $90 | $84 | $110 | $103 | $125 | $117 | $80 | $75 | ||

| $130 | $227 | $90 | $157 | $110 | $192 | $125 | $218 | $80 | $140 | ||

| $130 | $318 | $90 | $220 | $110 | $269 | $125 | $306 | $80 | $196 | ||

| $130 | $397 | $90 | $275 | $110 | $336 | $125 | $381 | $80 | $244 | ||

| $130 | $463 | $90 | $321 | $110 | $392 | $1,125 | $4,011 | $80 | $285 | ||

| $130 | $520 | 1,090 | $4,358 | $110 | $440 | $80 | $320 | ||||

| 1,130 | $4,926 | $110 | $480 | $80 | $349 | ||||||

| $110 | $512 | $80 | $372 | ||||||||

| $110 | $538 | $80 | $392 | ||||||||

| $110 | $559 | $1,080 | $5,490 | ||||||||

| 1,110 | $5,801 | ||||||||||

| Sum of t*PV(Ct) | $6,973 | $5,415 | $9,622 | $5,033 | $7,863 | ||||||

| Duration | 5.27 | 4.94 | 7.30 | 4.11 | 7.35 | ||||||

7-14A.(a) Vb =

® ANSWER -959.70

® ANSWER -959.70

(b) (i) Vb =

® ANSWER -820.23

® ANSWER -820.23

(b) (ii) Vb =

® ANSWER -1,136.62

® ANSWER -1,136.62

(c) As long as the required rate of return is less than the expected rate of return of 9%, you should purchase the bond Thus, if your required rate of return decreases to 7%, you should purchase the bond.

Дата добавления: 2015-10-30; просмотров: 128 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| END-OF-CHAPTER QUESTIONS | | | SOLUTION TO INTEGRATIVE PROBLEM |