$1,082.00 $959.00 $1,351.18 $1,182.16 $1,045.54

$1,082.00 $959.00 $1,351.18 $1,182.16 $1,045.54

Years Ct t*PV(Ct)Ct t*PV(Ct)Ct t*PV(Ct)Ct t*PV(Ct)Ct t*PV(Ct)

1 $90 $84 $60 $56 $120 $112 $90 $84 $75 $70

2 90 157 60 105 120 210 90 157 75 131

3 90 220 60 147 120 294 90 220 75 184

4 90 275 60 183 120 366 90 275 75 229

5 1,090 3,886 1,060 3,779 120 428 90 321 75 267

6 120 480 90 360 75 300

7 120 523 90 392 75 327

8 120 559 90 419 75 349

9 120 587 90 441 75 367

10 1,120 5,694 90 458 75 381

11 90 470 75 392

12 90 480 75 400

13 90 486 75 405

14 90 489 75 407

15 1,090 5,926 1,075 5,844

4,622 4,270 9,252 10,977 10,053

4,622 4,270 9,252 10,977 10,053

Duration 4.27 4.45 6.85 9.29 9.62

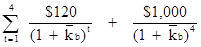

7-11B. a. $1,350 =

® ANSWER 2.66%

® ANSWER 2.66%

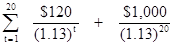

b. Vb =

® ANSWER -1,097.19

® ANSWER -1,097.19

c. Since the expected rate of return, 2.66 percent is much less than your required rate of return of 9 percent, the bond is not an acceptable investment. This fact is also evident because the market price, $1,350, exceeds the value of the security to the investor of $1,097.19.

7-12B. a. $915 =

® ANSWER 8.86%

® ANSWER 8.86%

b. Since the required rate of return(11%) is greater than the expected rate of return(8.86%), you should not purchase the bond.

7-13B. Value Bond J

Par Value $1,000.00

Coupon $ 95.00

Required Rate of Return 10%

Years to Maturity 4

Market Value $984.15

Value Bond P

Par Value $1,000.00

Coupon $115

Required Rate of Return 10%

Years to Maturity 12

Market Value $1,102.21

Value Bond Y

Par Value $1,000.00

Coupon $ 80

Required Rate of Return 10%

Years to Maturity 16

Market Value $843.53

Value Bond Q

Par Value $1,000.00

Coupon $ 70.00

Required Rate of Return 10%

Years to Maturity 20

Market Value $744.59

Value Bond Z

Par Value $1,000.00

Coupon $ 130.00

Required Rate of Return 10%

Years to Maturity 15

Market Value $1,228.18

| Bond | J | P | Y | Q | Z | ||||||||||||

| Bond Value | $984.15 | $1,102.21 | $843.53 | $744.59 | $1,228.18 | ||||||||||||

| Years | Ct | tPV(Ct) | Ct | tPV(Ct) | Ct | tPV(Ct) | Ct | tPV(Ct) | Ct | tPV(Ct) | |||||||

| $95 | $86 | $115 | $105 | $80 | $73 | $70 | $64 | $130 | $118 | ||||||||

| $95 | $157 | $115 | $190 | $80 | $132 | $70 | $116 | $130 | $215 | ||||||||

| $95 | $214 | $115 | $259 | $80 | $180 | $70 | $158 | $130 | $293 | ||||||||

| $1,095 | $2,992 | $115 | $314 | $80 | $219 | $70 | $191 | $130 | $355 | ||||||||

| $115 | $357 | $80 | $248 | $70 | $217 | $130 | $404 | ||||||||||

| $115 | $389 | $80 | $271 | $70 | $237 | $130 | $440 | ||||||||||

| $115 | $413 | $80 | $287 | $70 | $251 | $130 | $467 | ||||||||||

| $115 | $429 | $80 | $299 | $70 | $261 | $130 | $485 | ||||||||||

| $115 | $439 | $80 | $305 | $70 | $267 | $130 | $496 | ||||||||||

| $115 | $443 | $80 | $308 | $70 | $270 | $130 | $501 | ||||||||||

| $115 | $443 | $80 | $308 | $70 | $270 | $130 | $501 | ||||||||||

| 1,115 | $4,263 | $80 | $306 | $70 | $268 | $130 | $497 | ||||||||||

| $80 | $301 | $70 | $264 | $130 | $490 | ||||||||||||

| $80 | $295 | $70 | $258 | $130 | $479 | ||||||||||||

| $80 | $287 | $70 | $251 | $1,130 | $4,058 | ||||||||||||

| $1,080 | $3,761 | $70 | $244 | ||||||||||||||

| $70 | $235 | ||||||||||||||||

| $70 | $227 | ||||||||||||||||

| $70 | $217 | ||||||||||||||||

| 1,070 | $3,181 | ||||||||||||||||

| Sum of t*PV(Ct) | $3,449 | $8,046 | $7,581 | $7,447 | $9,799 | ||||||||||||

| Duration | 3.50 | 7.30 | 8.99 | 10.00 | 7.98 | ||||||||||||

7-14B.(a) Vb =

® ANSWER -1,392.73

® ANSWER -1,392.73

(b) (i) Vb =

® ANSWER -929.75

® ANSWER -929.75

(b) (ii) Vb =

® ANSWER -1,688.20

® ANSWER -1,688.20

(c) As long as the required rate of return is less than the expected rate of return of 8%, you should purchase the bond Thus, if your required rate of return decreases to 6%, you should purchase the bond.

Дата добавления: 2015-10-30; просмотров: 106 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| SOLUTION TO INTEGRATIVE PROBLEM | | | CHAPTER OUTLINE |