Читайте также:

|

8-1A. Value (Vps) =

= $50.00

8-2A. Growth rate = return on equity x retention rate

= (16%) ´ (60%) = 9.6%

8-3A. Value (Vps) =

=

= $116.67

8-4A. Expected Rate of Return

ps =  =

=  =.0463, or 4.63%

=.0463, or 4.63%

8-5A. (a) Expected return =  =

=  =.085 = 8.5%

=.085 = 8.5%

(b) Given your 8 percent required rate of return, the stock is worth $42.50 to you.

Value =  =

=  = $42.50

= $42.50

Since the expected rate of return (8.5%) is greater than your required rate of return (8%), or since the current market price ($40) is less than the value ($42.50), the stock is undervalued and you should buy.

8-6A. Value (Vcs) =  +

+

$50 =  +

+

Rearranging and solving for P1:

P1 = $50 (1.15) - $6

P1 = $51.50

The stock would have to increase $1.50 ($51.50 - $50) or 3 percent ($1.50/$50) to earn a 15% rate of return.

8-7A. (a)  =

=  +

+

cs =  +.10

+.10

cs =.1889, or 18.9%

(b) Vcs =  = $28.57

= $28.57

Yes, purchase the stock. The expected return is greater than your required rate of return. Also, the stock is selling for only $22.50, while it is worth $28.57 to you.

8-8A. Value (Vcs) =

Vcs =

Vcs = $24.50

8-9A. Growth rate = return on equity x retention rate

= (18%) ´ (40%) = 7.2%

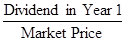

8-10A. Expected Rate of Return ( ) =

) =  + Growth Rate

+ Growth Rate

= + 0.095

= + 0.095

= 0.193, or 19.3%

= 0.193, or 19.3%

8-11A. Value (Vcs) =  +

+

Vcs =  +

+

Vcs = $39.95

8-12A. If the expected rate of return is represented by  :

:

Current Price =  +

+

=

=  - 1

- 1

=

=  - 1

- 1

= 0.1823, or 18.23%

= 0.1823, or 18.23%

8-13A.

(a)  =

=  =

=

= 0.1091, or 10.91%

= 0.1091, or 10.91%

(b) Value (Vps) =  =

=  = $36

= $36

(c) The investor's required rate of return (10 percent) is less than the expected rate of return for the investment (10.91 percent). Also, the value of the stock to the investor ($36) exceeds the existing market price ($33), so buy the stock.

8-14A.(a) Expected Rate of Return =  +

+

=  + 0.08

+ 0.08

= 0.1407, or 14.07%

(b) Investor's Value =

=

= $57.02

(c) Yes, the expected rate of return (14.07%) is greater than your required rate of return (10.5 percent). Also, your value of the stock ($57.02) is greater than the current market price ($23.50).

8-15A (a) Dividend yield: Dividend ¸ stock price =  = 0.0229, or 2.29%

= 0.0229, or 2.29%

(b) Using the nominal average returns of 12.2% for large-company stocks and the 3.8% nominal average return for U.S. Treasury Bills as shown in Table 6-1, the computation would be as follows:

=

=  + beta ´

+ beta ´  -

-

= 3.8% + 1.10 ´ (12.2% - 3.8%) = 13.04%

(c)  =

=  +

+

13.04% =  + g

+ g

.1304 =.0229 + g

g =.1075, or 10.75%

8-16A

Johnson & Johnson

| 2003 | 2002 | 2001 | 2000 | 1999 | |

| EPS (diluted) | $2.40 | $2.16 | $1.84 | $1.61 | $1.39 |

| Dividend | $0.925 | $0.795 | $0.70 | $0.62 | $0.55 |

Stock Price (6/24/04): $55.75

Growth rate: $2.40 = $1.39 (1 + i)4

i =.1463, or 14.63%

cs =

cs =

cs =

cs =

cs =.0190, or 1.90%

cs =.0190, or 1.90%

8-17A.

(a)  =

=  =

=

= 0.18, or 18%

= 0.18, or 18%

(b) Value (Vps) =  =

=  = $32.14

= $32.14

(c) The investor's required rate of return (14 percent) is less than the expected rate of return for the investment (18 percent). Also, the value of the stock to the investor ($32.14) exceeds the existing market price ($25), so buy the stock.

8-18A.

(a) Investor's Value =

=

= $24.15

(b) Expected Rate of Return =  +

+

=  + 0.05

+ 0.05

= 0.1232, or 12.32%

(c) No, the expected rate of return (12.32%) is less than your required rate of return (15 percent). Also, your value of the stock ($24.15) is less than the current market price ($33).

8-19A. (a) Growth rate = return on equity x retention rate

= (17%) ´ (30%) = 5.1%

(b) (i) If retention rate is 40%:

Growth rate = return on equity x retention rate

= (17%) ´ (40%) = 6.8%

(ii) If retention rate is 25%:

Growth rate = return on equity x retention rate

= (17%) ´ (25%) = 4.25%

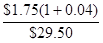

8-20A. (a)  =

=  +

+

cs =  + 0.04

+ 0.04

cs =.1017, or 10.17%

(b) Vcs =  = $18.20

= $18.20

No, do not purchase the stock. The expected return is less than your required rate of return. Also, the stock is selling for $29.50, while it is only worth $18.20 to you.

Дата добавления: 2015-10-30; просмотров: 108 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| END-OF-CHAPTER QUESTIONS | | | Solutions to Problem Set B |