Читайте также:

|

| Free Cash Flow: | ||||||

| Operating Cash Flow | $6,950,000 | $9,722,400 | $13,418,000 | $6,950,400 | $2,066,000 | |

| Minus: Change in Net Working Capital | $100,000 | $1,860,000 | $840,000 | $1,120,000 | ($1,960,000) | ($1,960,000) |

| Minus: Change in Capital Spending | $10,000,000 | $0 | $0 | $0 | $0 | $0 |

| Free Cash Flow: | ($10,100,000) | $5,090,400 | $8,882,400 | $12,298,400 | $8,910,400 | $4,026,000 |

| NPV | $16,232,618 | |||||

| PI | 2.6 | |||||

| IRR | 68.6% |

Accept project

10-10B.

(a) NPVA =  - $650

- $650

= $727.20 - $650

= $77.20

NPVB =  - $4,000

- $4,000

= $5,000 - $4,000

= $1,000

(b) PIA =

= 1.1188

PIB =

= 1.25

(c) $650 = $800 [PVIFIRRA%,1 yr]

0.8125 = PVIFIRRA%,1 yr

Thus, IRRA = 23%

$4,000 = $5,500 [PVIFIRRB%,1 yr]

0.7273 = [PVIFIRRB%,1 yr]

Thus, IRRB = 37.5%

(d) If there is no capital rationing, project B should be accepted because it has a larger net present value. If there is a capital constraint, the problem then focuses on what can be done with the additional $3,350 freed up if project A is chosen. If Unk's Farms can earn more on project A, plus the project financed with the additional $3,350, than it can on project B, then project A and the marginal project should be accepted.

10-11B.

(a) Payback A = 3.125 years

Payback B = 4.5 years

B assumes even cash flow throughout year 5.

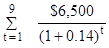

(b) NPVA =  - $50,000

- $50,000

= $16,000 (3.696) - $50,000

= $59,136 - $50,000

= $9,136

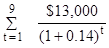

NPVB =  - $50,000

- $50,000

= $100,000 (0.593) - $50,000

= $59,300 - $50,000

= $9,300

(c) $50,000 = $16,000 [PVIFAIRRA%,5 yrs]

3.125 = PVIFAIRRA%,5 yrs

Thus, IRRA = 18%

$50,000 = $100,000 [PVIFIRRB%,5 yrs]

.50 = PVIFIRRB%,5 yrs

Thus IRRBis just under 15%.

(d) The conflicting rankings are caused by the differing reinvestment assumptions made by the NPV and IRR decision criteria. The NPV criterion assume that cash flows over the life of the project can be reinvested at the required rate of return or cost of capital, while the IRR criterion implicitly assumes that the cash flows over the life of the project can be reinvested at the internal rate of return.

(e) Project B should be taken because it has the largest NPV. The NPV criterion is preferred because it makes the most acceptable assumption for the wealth maximizing firm.

10-12B.

(a) Payback A = 1.5385 years

Payback B = 3.0769 years

(b) NPVA =  - $20,000

- $20,000

= $13,000 (2.322) - $20,000

= $30,186 - $20,000

= $10,186

NPVB =  - $20,000

- $20,000

= $6,500 (4.946) - $20,000

= $32,149 - $20,000

= $12,149

(c) $20,000 = $13,000 [PVIFAIRRA%,3 yrs]

Thus, IRRA = over 40% (42.57%)

$20,000 = $6,500 [PVIFAIRRB%,9 yrs]

Thus, IRRB = 29.3%

(d) These projects are not comparable because future profitable investment proposals are affected by the decision currently being made. If project A is taken, at its termination the firm could replace the machine and receive additional benefits while acceptance of project B would exclude this possibility.

(e) Using 3 replacement chains, project A's cash flows would become:

YearCash flow

0 -$20,000

1 13,000

2 13,000

3 - 7,000

4 13,000

5 13,000

6 - 7,000

7 13,000

8 13,000

9 13,000

NPVA =  - $20,000 -

- $20,000 -

= $13,000(4.946) - $20,000 - $20,000 (0.675)

- $20,000 (0.456)

= $64,298 - $20,000 - $13,500 - $9,120

= $21,678

The replacement chain analysis indicated that project A should be selected as the replacement chain associated with it has a larger NPV than project B.

Project A's EAA:

Step 1: Calculate the project's NPV (from part b):

NPVA = $10,186

Step 2: Calculate the EAA:

EAAA = NPV / PVIFA14%, 3 yr.

= $10,186 / 2.322

= $4,387

Project B's EAA:

Step 1: Calculate the project's NPV (from part b):

NPVB = $12,149

Step 2: Calculate the EAA:

EAAB = NPV / PVIFA14%, 9 yr.

= $12,149 / 4.946

= $2,456

Project A should be selected because it has a higher EAA.

10-13B.

(a) Project A's EAA:

Step 1: Calculate the project's NPV:

NPVA = $20,000 (PVIFA10%, 7 yr.) - $40,000

= $20,000 (4.868) - $40,000

= $97,360 - $40,000

= $57,360

Step 2: Calculate the EAA:

EAAA = NPV / PVIFA10%, 7 yr.

= $57,360 / 4.868

= $11,783

Project B's EAA:

Step 1: Calculate the project's NPV:

NPVB = $25,000 (PVIFA10%, 5 yr.) - $40,000

= $25,000 (3.791) - $40,000

= $94,775 - $40,000

= $54,775

Step 2: Calculate the EAA:

EAAB = NPV / PVIFA10%, 5 yr.

= $54,775 / 3.791

= $14,449

Project B should be selected because it has a higher EAA.

(b) NPV¥,A = $11,783 /.10

= $117,830

NPV¥,B = $14,449 /.10

= $144,490

10-14B.

(a)

Present Value

Profitability of Future

ProjectCostIndexCash FlowsNPV

A $4,000,000 1.18 $4,720,000 $ 720,000

B 3,000,000 1.08 3,240,000 240,000

C 5,000,000 1.33 6,650,000 1,650,000

D 6,000,000 1.31 7,860,000 1,860,000

E 4,000,000 1.19 4,760,000 760,000

F 6,000,000 1.20 7,200,000 1,200,000

G 4,000,000 1.18 4,720,000 720,000

COMBINATIONS WITH TOTAL COSTS BELOW $12,000,000

ProjectsCostsNPV

A&B $ 7,000,000 $ 960,000

A&C 9,000,000 2,370,000

A&D 10,000,000 2,580,000

A&E 8,000,000 1,480,000

A&F 10,000,000 1,920,000

A&G 8,000,000 1,440,000

B&C 8,000,000 1,890,000

B&D 9,000,000 2,100,000

B&E 7,000,000 1,000,000

B&F 9,000,000 1,440,000

B&G 7,000,000 960,000

C&D 11,000,000 3,510,000

C&E 9,000,000 2,410,000

C&F 11,000,000 2,850,000

C&G 9,000,000 2,370,000

D&E 10,000,000 2,620,000

D&F 12,000,000 3,060,000

D&G 10,000,000 2,580,000

E&F 10,000,000 1,960,000

E&G 8,000,000 1,480,000

F&G 10,000,000 1,920,000

A&B&C 12,000,000 2,610,000

A&B&E 11,000,000 1,720,000

A&B&G 11,000,000 1,680,000

A&E&G 12,000,000 2,200,000

B&C&E 12,000,000 2,650,000

B&C&G 12,000,000 2,610,000

Thus projects C&D should be selected under strict capital rationing as they provide the combination of projects with the highest net present value.

(b) Because capital rationing forces the rejection of profitable projects it is not an optimal strategy.

Дата добавления: 2015-10-30; просмотров: 114 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Solutions to Problem Set B | | | CHAPTER OUTLINE |