Читайте также:

|

| Free Cash Flow: | ||||||

| Operating Cash Flow | $6,614,000 | $8,198,000 | $9,782,000 | $5,822,000 | $3,512,000 | |

| Minus: Change in Net Working Capital | $100,000 | $1,900,000 | $500,000 | $500,000 | ($1,250,000) | ($1,750,000) |

| Minus: Change in Capital Spending | $7,000,000 | $0 | $0 | $0 | $0 | $0 |

| Free Cash Flow: | ($7,100,000) | $4,714,000 | $7,698,000 | $9,282,000 | $7,072,000 | $5,262,000 |

| NPV | $15,582,572.99 | |||||

| PI | 3.19 | |||||

| IRR | 85% |

Should accept project.

10-14A.(a) NPVA =  - $500

- $500

= $636.30 - $500

= $136.30

NPVB =  - $5,000

- $5,000

= $5,454 - $5,000

= $454

(b) PIA =

= 1.2726

PIB =

= 1.0908

(c) $500 = $700 [PVIFIRR%,1 yr]

0.714 = PVIFIRR%,1 yr

Thus, IRRA = 40%

$5,000 = $6,000 [PVIFIRR%,1 yr]

0.833 = [PVIFIRR%,1 yr]

Thus, IRRB = 20%

(d) If there is no capital rationing, project B should be accepted because it has a larger net present value. If there is a capital constraint, the problem then focuses on what can be done with the additional $4,500 freed up if project A is chosen. If Dorner Farms can earn more on project A, plus the project financed with the additional $4,500, than it can on project B, then project A and the marginal project should be accepted.

10-15A.(a) Payback A = 3.2 years

Payback B = 4.5 years

B assumes even cash flow throughout year 5.

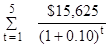

(b) NPVA =  - $50,000

- $50,000

= $15,625 (3.791) - $50,000

= $59,234 - $50,000

= $9,234

NPVB =  - $50,000

- $50,000

= $100,000 (0.621) - $50,000

= $62,100 - $50,000

= $12,100

(c) $50,000 = $15,625 [PVIFAIRRA%,5 yrs]

3.2 = PVIFAIRR%,5 yrs

Thus, IRRA = 17%

$50,000 = $100,000 [PVIFIRRB%,5 yrs]

.50 = PVIFIRRB%,5 yrs

Thus, IRRB = 15%

(d) The conflicting rankings are caused by the differing reinvestment assumptions made by the NPV and IRR decision criteria. The NPV criterion assumes that cash flows over the life of the project can be reinvested at the required rate of return or cost of capital, while the IRR criterion implicitly assumes that the cash flows over the life of the project can be reinvested at the internal rate of return.

(e) Project B should be taken because it has the largest NPV. The NPV criterion is preferred because it makes the most acceptable assumption for the wealth maximizing firm.

10-16A.

(a) Payback A = 1.589 years

Payback B = 3.019 years

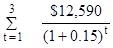

(b) NPVA =  - $20,000

- $20,000

= $12,590 (2.283) - $20,000

= $28,743 - $20,000

= $8,743

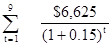

NPVB =  - $20,000

- $20,000

= $6,625 (4.772) - $20,000

= $31,615 - $20,000

= $11,615

(c) $20,000 = $12,590 [PVIFAIRRA%,3 yrs]

Thus, IRRA = 40%

$20,000 = $6,625 [PVIFAIRRB%,9 yrs]

Thus, IRRB = 30%

(d) These projects are not comparable because future profitable investment proposals are affected by the decision currently being made. If project A is taken, at its termination the firm could replace the machine and receive additional benefits while acceptance of project B would exclude this possibility.

(e) Using 3 replacement chains, project A's cash flows would become:

YearCash flow

0 -$20,000

1 12,590

2 12,590

3 - 7,410

4 12,590

5 12,590

6 - 7,410

7 12,590

8 12,590

9 12,590

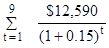

NPVA =  - $20,000 -

- $20,000 -

= $12,590(4.772) - $20,000 - $20,000 (0.658) - $20,000 (0.432)

= $60,079 - $20,000 - $13,160 - $8,640

= $18,279

The replacement chain analysis indicated that project A should be selected as the replacement chain associated with it has a larger NPV than project B.

Project A's EAA:

Step 1: Calculate the project's NPV (from part b):

NPVA = $8,743

Step 2: Calculate the EAA:

EAAA = NPV / PVIFA15%, 3 yr.

= $8,743 / 2.283

= $3,830

Project B's EAA:

Step 1: Calculate the project's NPV (from part b):

NPVB = $11,615

Step 2: Calculate the EAA:

EAAB = NPV / PVIFA15%, 9 yr.

= $11,615 / 4.772

= $2,434

Project A should be selected because it has a higher EAA.

10-17A.(a) Project A's EAA:

Step1: Calculate the project's NPV:

NPVA = $20,000 (PVIFA10%, 7 yr.) - $50,000

= $20,000 (4.868) - $50,000

= $97,360 - $50,000

= $47,360

Step 2: Calculate the EAA:

EAAA = NPV / PVIFA10%, 7 yr.

= $47,360 / 4.868

= $9,729

Project B's EAA:

Step 1: Calculate the project's NPV:

NPVB = $36,000 (PVIFA10%, 3 yr.) - $50,000

= $36,000 (2.487) - $50,000

= $89,532 - $50,000

= $39,532

Step 2: Calculate the EAA:

EAAB = NPV / PVIFA10%, 3 yr.

= $39,532 / 2.487

= $15,895

Project B should be selected because it has a higher EAA.

(b) NPV¥,A = $9,729 /.10

= $97,290

NPV¥,B = $15,895 /.10

= $158,950

10-18A.(a)

Present Value

Profitability of Future

ProjectCostIndexCash FlowsNPV

A $4,000,000 1.18 $4,720,000 $ 720,000

B 3,000,000 1.08 3,240,000 240,000

C 5,000,000 1.33 6,650,000 1,650,000

D 6,000,000 1.31 7,860,000 1,860,000

E 4,000,000 1.19 4,760,000 760,000

F 6,000,000 1.20 7,200,000 1,200,000

G 4,000,000 1.18 4,720,000 720,000

COMBINATIONS WITH TOTAL COSTS BELOW $12,000,000

ProjectsCostsNPV

A&B $ 7,000,000 $ 960,000

A&C 9,000,000 2,370,000

A&D 10,000,000 2,580,000

A&E 8,000,000 1,480,000

A&F 10,000,000 1,920,000

A&G 8,000,000 1,440,000

B&C 8,000,000 1,890,000

B&D 9,000,000 2,100,000

B&E 7,000,000 1,000,000

B&F 9,000,000 1,440,000

B&G 7,000,000 960,000

C&D 11,000,000 3,510,000

C&E 9,000,000 2,410,000

C&F 11,000,000 2,850,000

C&G 9,000,000 2,370,000

D&E 10,000,000 2,620,000

D&F 12,000,000 3,060,000

D&G 10,000,000 2,580,000

E&F 10,000,000 1,960,000

E&G 8,000,000 1,480,000

F&G 10,000,000 1,920,000

A&B&C 12,000,000 2,610,000

A&B&G 11,000,000 1,680,000

A&B&E 11,000,000 1,720,000

A&E&G 12,000,000 2,200,000

B&C&E 12,000,000 2,650,000

B&C&G 12,000,000 2,610,000

Thus projects C&D should be selected under strict capital rationing as they provide the combination of projects with the highest net present value.

(b) Because capital rationing forces the rejection of profitable projects it is not an optimal strategy.

Дата добавления: 2015-10-30; просмотров: 107 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Section I. Calculate the change in EBIT, Taxes, and Depreciation (this becomes an input in the calculation of Operating Cash Flow in Section II). | | | SOLUTION TO INTEGRATIVE PROBLEMS |