|

Читайте также: |

Midterm

Report

“Project Cost controlling tools and techniques”

Created by:

Aiganym Kauynbay

Checked by:

Darhan Kuralhanov

Almaty 2015

Content:

1. Introduction

2. Main body

2.1. Cost control definition

2.2. Planning tools or techniques

2.3. Earned Value Analysis (EVA)

· Financial Databases for EVA,

· Earned Value Definitions

· Establishing Earned Value Budgets

· Determining Earned Value

· Variance Analysis

· Forecasting

2.4. Project Estimating techniques

· The Stable Activities

· The Dependent Activities

· The Uncertain Activities

2.5. The End Date

2.6. The Total Cost

2.7. The Additional Steps for Project Cost Control

3. Conclusion

4. References

5. Appendices

1. Introduction

In the Control Costs process of the Project Cost Management knowledge area, there are some tools and techniques recommended by the Project Management Institute (PMI). In this report, I will describe each one.

Start With Estimates and Projected Budget

Having accurate project estimates and a robust project budget is necessary to deliver within the project budget. Both Estimating Costs and Determining Budget are project planning processes. Without keeping an eye on the actual costs while the project is being implemented, the project will most likely never be delivered on-budget. There are several techniques used to monitor and control the cost of a project, each of which is discussed below:

· Earned Value Management

· Forecasting

· To-Complete Performance Index (TCPI)

· Variance Analysis

· Performance Reviews

· Earned Value Management or Analysis

Earned Value Management (EVM) is a mathematical method by which you can measure the actual performance of a project. You will use EVM to monitor your project in terms of schedule and cost. For example, suppose your project is on track as per the schedule. Through EVM, you will be able to understand whether the project is also on-budget. If it is not, you can take corrective action. EVM principles can be extended to Forecasting, TCPI, and Variance Analysis. EVM is an input to project performance reviews. Therefore, it is critical for you to understand EVM formulae so that you can use them as inputs to other cost control techniques.

Forecasting

EVM provides formulae to forecast the future performance of a project. The forecast is based on the current actual performance. As a project manager, having the ability to tell whether your project will be delivered on-time and on-budget is critical. Let’s take an example to understand this.

Suppose you have completed 25 percent of your project. As per the schedule you are on track. However, after completing 50 percent of the project, you realize your project is delayed. By using forecasting formulae you can determine the degree of delay. This will also enable you to investigate the cause of delay and the corrective action, such as Crashing, required to get the

project back on track. In addition, to the schedule delay you can use EVM Forecasting formulae to determine the actual cost of the project on completion and take measures to rectify any anomaly before it is too late.

If the project is delayed or over-budget, you can use To-Complete Performance Index (TCPI) to determine the project performance required to complete the project as budgeted or estimated. TCPI also leverages the EVM formulate.

Variance analysis is the comparison of expected project performance to the actual cost performance. This analysis helps you understand the causes of variance, if any. Preventative and corrective actions are determined based on the variance analysis.

Performance reviews in projects are required to check the health of a project. This usually involves Cost and Schedule as the main parameters to assess. However, other parameters, such as Scope, Quality, and Team Morale may be used. Reviews may include the client, Product Owner, other Project Managers.

2. Main body

Cost Control is the process for "influencing the factors that create cost variances and controlling changes to the project budget. Like other controlling processes the process of project control therefore includes such tasks as handling influencing factors, managing actual changes, detecting wished und unwished changes by comparing the reported real values with the approved cost base line and determining corrective actions.

The project resource/budget plan is a description of how the business resources will be applied to the project activities. It includes the identification and deployment of the team's human resources and the planned financial impact of the project on the financial accounts and reports of the business. Resource/budget planning links with schedule planning and scope planning since the resources are required to perform the project activities (scope) at a particular time (schedule).

Many organizations have customized tools or templates to assist the project team with resource/budget planning that are linked to the organization's human resources or financial systems. I have found six resource/budget planning tools or techniques to be helpful, depending upon the uncertainty and complexity of the project. These are the Team List, the Responsibility Matrix, and the Staffing Management Plan, all of which apply to assigning and managing human resources on the project. For budgeting, I recommend the Spend Plan, the Project Budget, and the Appropriations Request. There are two topics that are integrally related with budgeting but are also integrally related to other project management topics so they have received their own topic page. These are Project Estimating techniques and Earned Value Analysis.

The Earned Value Analysis (EVA) technique takes into consideration the project context for the planned and actual expenditures and integrates the project scope, schedule, and resource characteristics into a comprehensive set of measurements. This page will outline the use of Earned Value Analysis by addressing Financial Databases for EVA, Earned Value Definitions, Establishing Earned Value Budgets, Determining Earned Value, Variance Analysis, and Forecasting.

The Earned Value technique allows for the temporary and intermittent nature of project work by scheduling the expenditures based upon the project plan, including the spikes and valleys in resources requirements. Further, Earned Value tracks how much money has been spent on the project in relation to how much project work has been accomplished. This takes into consideration all that has happened on the project such as schedule delays or acceleration. The variances that have occurred can then be separated into those due to timing, either ahead or behind schedule; and those due to mis-estimating the work; true under-runs or over-runs. Finally, the indices and variances generated by the Earned Value technique will aid the project management team in forecasting the financial conditions at project completion.

Financial Databases for EVA

The EVA techniques manipulate information gleaned from three essentially independent sources of financial data. Each of these are a cost baseline for the project. Each looks at the project from a different perspective.

The planned project expenditures (Planned Value) from project start until the present time. This is established at the time the project was initially planned and represents the original intent of the project team. It is developed by summing up all of the project task estimates and time-phasing them based upon the project schedule.

The actual project expenditures (Actual Cost) as of the present time. This is collected by the business financial cost accounting systems. These are all the costs associated with the work that has been completed on the project up through the present instant in time.

The actual project progress (Earned Value) which is the originally planned expenditures for the work that has been accomplished up to this time. This is determined by the tasks that are completed or the progress made on the tasks that are underway. The key to this measurement is that the values for each task are based upon the originally estimated values for the task. Each task is assigned a "value" that is embodied in the original task estimate. When the task is completed, the estimated value represents the value earned by completing the work on the project task - regardless of how much that work actually cost.

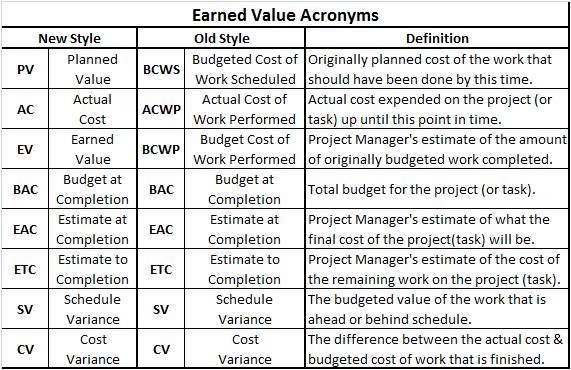

Earned Value Definitions:

EVA is known for its acronyms. This table shows the acronym, using both the old naming convention and the new naming convention. Each of the acronyms is defined in more detail below.

Planned Value (PV) is developed by first determining all of the work, or tasks, that must be accomplished for a successful project result. The work within each of the tasks, whether done internally or outsourced, is estimated. That estimate is converted into a monetary value which represents the dollar portion of "planned value" of the task, essentially saying that the task has that worth to the business. This value is then scheduled to occur based upon when the task is scheduled to occur within the project plan. Once the amount and timing is established, the PV for the task or activity is set. It can only be changed by implementing a project change.

Actual Cost (AC) is the number that finance often is most concerned about because this represents the actual cash that the business has had to expend on the project. The AC is determined based upon the accounting system's method for cost accumulation. Where possible, it is most helpful to collect the costs based upon a project charge number or account number that is associated with the costs. This number may change every day based upon whether project work was conducted upon that day.

The Earned Value (EV) comes from an assessment by the project management team as to the amount of progress they have made on each task in the project. Often this is difficult to measure precisely and is based upon a judgment call by appropriate individuals within the project. Tasks that are completed have earned the entire value for that task. Tasks that have not been started have not earned any value for that task. Tasks that are partially complete may have earned some value for the work that has been done. The total amount of value available for a task to earn is the value assigned to that task at the time of project planning--in other words, the Planned Value for that task. It is easy to determine EV for tasks that have been completed (EV is the task PV) and for tasks that have not started (EV is zero). The difficulty comes when estimating the EV for a task that is underway. Suffice it to say, most organizations have set some specific ground rules in this area to ensure the EV is not under-stated or over-stated. Methods for determining EV are discussed below.

Establishing Earned Value Budgets:

EVA is based upon task or activity planning data and therefore requires that a relatively rigorous planning approach is used, often using the bottom-up estimating rather than top-down. The project PV at any point in time is determined by summing the task-level budgets for the time period in question. Accuracy in the task level budgets is required both in the amount of effort estimated for the task but also in the timing of when those efforts will be expended. The key here is that we want to estimate the project task timing in the same way that the financial system will record the AC for the task. In most businesses, the personnel costs are collected and analyzed either weekly or biweekly because of the need to run payroll. Therefore I recommend that the in-house labor in a task should be spread evenly during the task duration, which is called "level-loading," while tasks that have external expenses often are recorded in a lump sum based upon when the supplier submits an invoice. For instance, an invoice received from a testing service would come in as a charge on one day although the testing may have occurred over a period of several months. In those cases it is often better to "event-load" based upon the expected timing of the receipt of the invoice. It is even possible to use a combination of timing approaches when estimating the PV for a task.

Selecting the appropriate timing is important so as not to create confusion later when we determine variances. A variance due to planning the timing of a task expense differently than the time when the expenses actually occurs, even though the amount is accurate, still generates the need for a variance report. Creating a task-level budget that accurately reflects the timing of expenses will reduce the need for a variance report for timing reasons. Variance reports will focus on true under-runs or over-runs.

Determining the Earned Value (EV) for a partially completed task is at the heart of EVA. Therefore it is important that the EV be as accurate as possible. However, EV is a judgment call while a task is underway. If the project management team under-states or over-states the EV, they can change whether a project is perceived to be running well or in significant trouble. Over time some approaches have been developed for estimating EV. These provide guidance to the project management team and can improve the accuracy of the EV.

The best approach is to have detailed tasks planning with a percentage of PV assigned to each item or interim milestone within the task. Then as soon as that item is complete, that amount of EV has been earned. However, this does require very detailed task planning and often that planning has not been done, either to save time or because there are no obvious interim steps within the task.

Another technique is the "0-100" technique. In this approach, no EV credit is allowed for a task until the task is completed. This is a good approach for short, discrete tasks, such as "Place Purchase Order."

The "50-50" technique is also commonly used. In this approach half of the EV is credited to a task once the task is started and the other half is credited once the task is complete. This is usually done when the task is relatively long and will span multiple reporting periods. This emphasizes the start of tasks and encourages tasks leaders to begin work as soon as possible on a task.

My personal favorite of the quick estimates is the "30-70" technique. In this approach 30% of the EV is credited to a task at the time of the task start and the remaining 70% is credited when the task ends. This is a good approach to use when a task has an uncertain estimate, such as software debugging. There is the recognition that work is underway, but the emphasis is on completing the task.

Earned Value Variance Analysis (EVA) provides excellent insight into project variances. Through EVA a project manager can understand how schedule variances are impacting cost variances and vice versa. Without EVA, the project manager is at a disadvantage when trying to explain to finance why the expenditures were other than expected.

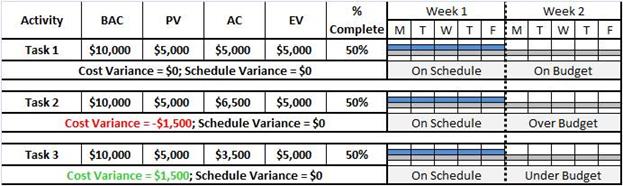

Once we have the PV, AC, and EV for a project, we can begin to calculate project variances and determine the current status of the project. The first variance I will discuss is Cost Variance (CV). This is the amount of under-run or over-run the project has experienced. As with all of the measurements, I can address the Current CV, which is the variance this month, or the Cumulative CV which is the variance since the project started.

CV = EV - AC

In EVA, a negative CV is an over-run and a positive CV is an under-run.

With the Earned Value technique, the CV is calculated by subtracting the AC from the EV. This is essentially asking, "How close am I to what I thought it would cost do the work I have accomplished as compared to what it actually cost to do the work that is accomplished." Because both EV and AC are only considering the work that is actually accomplished, the errors due to schedule variance are removed. The first set of figures shows how a project that is on schedule, but is either in an under-run or over-run condition, would be reflected in both a Gantt chart and with EVA data. The task is a two week task that started one week ago. The task is on schedule, meaning it is 50% complete and therefore the EV is the PV.

Next we will consider Schedule Variance (SV). This is the amount ahead of schedule or behind schedule the project is currently experiencing. An interesting point about SV is that it is measuring schedule but the units are dollars. SV measures the VALUE of the work that is ahead or behind schedule, not the number of days or weeks. As with all of our measurements, we can address the Current SV, which is the variance this month, or the Cumulative SV which is the variance since project start.

SV = EV - PV

In the Earned Value technique, a negative SV is a behind-schedule condition and a positive SV is an ahead-of-schedule condition.

When considering the value of work that is ahead or behind schedule, the value of any under-runs or over-runs needs to be excluded. The Earned Value technique compensates for this. With the Earned Value technique, the SV is calculated by subtracting the PV from the EV. This is essentially saying, "The value of the work that I have completed minus the value of the work that I had planned to have completed by this time." Because both EV and PV are only considering the work using the originally estimated value of the work, the errors due to cost variance are removed and variances are due only to timing.

A project may have spent the exact amount of money up to a point in time that had been budgeted for that time period. However, if only half of the work had been accomplished, the EV would be one half of the PV. This would indicate a significant behind schedule condition and a significant over-run, even though the money that had been spent was exactly what had been in the plan for spending up to that point. The problem is that now there is no money budgeted to do the work that was scheduled to have been done but has not been completed.

The SV and CV variances are sometimes provided in percentage form rather than in actual value.

Forecasting Using Earned Value

The variance calculations for SV and CV give us specific values of under-run/over-run. We can also calculate indices that give us trends and that can assist in the estimating of final project cost. The two indices generated in the Earned Value technique are the Schedule Performance Index (SPI) and the Cost Performance Index (CPI).

SPI = EV / PV

The SPI is the ratio of Earned Value over Planned Value. When the EV is greater than the PV, we are doing more work than scheduled and the project is accelerating. The SPI will be greater than 1 in that case. When EV is less than PV, we are doing less work than scheduled and the project is being delayed. The SPI will be less than 1.

CPI = EV / AC

The CPI is the ratio of Earned Value over Actual Cost. When the EV is greater than the AC, we are completing the work for less than the estimate and the project is under-running. In that case the CPI is greater than 1. When the EV is less than the AC, then the cost to complete the work was greater than the initial estimate, or value, of the work. In this case we are over-running and the CPI is less than 1.

This estimate takes into consideration the current business conditions and the relevant project experience to date. It is referred to as the Estimate at Completion (EAC). The EAC is the answer to the original question. It includes all of the money spent so far on the project and an estimate of what must still be spent to complete the project work.

EAC = AC + ETC

The Earned Value technique uses the variances and indices to calculate an EAC. This is done by taking the results of what has been spent already on the project, the AC, and adding to that an estimate of the cost to do the remaining open work on the project. This estimate for the remaining work is referred to as the Estimate to Completion (ETC).

It is obvious that in order to have an accurate estimate for the final project cost, the EAC, we need to calculate the ETC. There are several methods. These four are the most widely accepted.

Method 1. In this case I consider that whatever cost variance that has occurred on completed tasks is an isolated event. I do not think it is a trend and therefore the original estimate for the cost to complete the remaining work is unchanged. In this case the ETC is the value of all the work on the project that has not been done yet. It is determined by taking the total value of the work on the project (BAC) less the work that has been completed (EV).

ETC1 = BAC - EV

Method 2. In this case we consider that whatever cost variance that has occurred is a good indicator of what we can expect in the future, so we will extrapolate the trend through to the end of the project. This is done by determining the remaining work on the project (see Method 1) and dividing that by the CPI; which indicates the trend of under-run or over-run.

ETC2 = (BAC - EV) / CPI

Method 3. In this case we assume that there is a need to complete the project on time. Therefore, if the project is behind schedule, an effort will be made to accelerate the remaining tasks. This acceleration will cost money so the remaining work is also divided by the SPI; which indicates the trend of schedule variance that must be overcome to complete on time. Normally when this method is used, the estimate for the remaining work is based upon the Method 2 approach of considering any over-run or under-run trend.

ETC3 = (BAC - EV) / (CPI * SPI)

Method 4. At times we become convinced that the original estimate is so far off, or that the variances are either isolated or clear trends, that we create a new estimate for the remaining work. This is often done when schedule acceleration techniques such as crashing or fast-tracking are used.

ETC4 = New estimate for the remaining work

The project management team uses whichever method they believe is the most accurate way to estimate the cost of the remaining work. Ultimately this is a judgment call based upon their understanding of the project.

Estimating the effort, time, and resources needed to complete project activities is one of the most challenging tasks that project managers must face. This is because of the inherent uncertainty associated with many activities.

Projects are unique. That is one of the differences between projects and processes. This uniqueness often creates uncertainty. Uncertainty because the activity is unique to the project, or the activity is being accomplished by a resource that is not a practiced expert, or the interaction of this activity with other project activities is unique in this project. All of these can create problems when estimating effort, time or resources.

Uncertainty in one aspect of an estimate leads to uncertainty on the other aspects. If the effort needed to complete the scope is uncertain - for instance the number of hours of work needed to complete an analysis - the time and resources needed will be uncertain. If the timing of when an activity starts or ends is uncertain, the resource availability and amount of effort required may change. If the resource assigned to an activity is uncertain, the number of hours required to complete the activity and the timing of the availability of the resource will be uncertain.

However, the good news is that not all project activities are uncertain. In many cases, the activity is one that is well defined and the organization routinely accomplishes it. When possible a project team is formed so that an expert is doing the work and the availability of the expert is predictable. In those cases an accurate estimate can be quickly generated.

Estimating the effort, time, and resources needed to complete project activities is one of the most challenging tasks that project managers must face. This is because of the inherent uncertainty associated with many activities.

I'll discuss three types of activities and what type of estimating approach should be used with each of them. Those are the Stable Activities, the Dependent Activities, and the Uncertain Activities. Of course there is a fourth category which is the unknown activity. These can't be estimated but must be accounted for in the project reserves. A Traditional or Discovery project often will have a small reserve (or possibly none at all) - at least for that portion of the project that is approved. Whereas an Adaptive or Extreme project may need a large reserve. Also, as complexity increases typically the level of reserve increases since there is a greater possibility of unrecognized activities. After discussing the three types of activities, I will explain some of the more common techniques for estimating project activities and their strengths and weaknesses. The techniques will include Analogous, Parametric Modeling, 3 Point Estimate, Expert Judgment, Published Data Estimates, Vendor Bid Analysis, Reserve Analysis, Bottom Up Analysis, and Simulation. A discussion of estimating the cost of completing a project that is underway is addressed in the page on Earned Value Analysis. In the end discuss how to estimate a project when the key boundary condition is the End Date or the Total Cost of the project and the effort is tailored to fit this constraint.

Stable Activities are those that are well understood and predictable. For activities in this category, the estimating is usually straightforward. I will typically use analogous, expert judgment, a parametric model, or published estimating data for these types of activities. Based upon the information available to the project team members, use the appropriate technique and set the estimate.

Dependent Activities are whole activities where the time or effort is highly dependent upon some project attribute or characteristic that is not yet know or knowable at the time the original estimate is furnished. For instance, the amount of time needed to complete testing will depend upon whether the test is successful on the first try or whether a retest is required. For these types of activities, an assumption is made that will drive the estimated effort, time and resources. This assumption is a risk and should be tracked on the Risk Register. If the assumption is incorrect, the time or money required to do the activity may be very different from the estimate. If a conservative estimate is used, this is a positive risk. If an aggressive estimate is used, this is a negative risk.

For these Dependent Activities, I often use the 3 Point Estimate, Expert Judgment, or Analogous Estimate. Also, if a project activity is outsourced and it is a Dependent Activity, I will consider what assumptions are used by the supplier and do a Vendor Bid Analysis. If there are a large number of Dependent Activities in the project, I will factor that into the project Reserve Analysis.

Uncertain Activities are the most difficult to estimate. There is often very little data to support a precise estimate. In addition, there are many factors that could effect the estimate so I can't just make one assumption and track that in my risk register. An example of an Uncertain Activity is a requirements definition task on a Complex project. There are numerous stakeholders who have different opinions of what is needed. Getting all of them to agree on the requirements will be an iterative process with the number of iterations being completely unpredictable. Yet if this task is not done well, there are likely to be major problems later in the project getting the stakeholders to agree that the project deliverables have been met. Uncertain Activities typically are listed in the Risk Register since the timing and cost are impossible to estimate accurately.

For these Uncertain Activities rely on the 3 Point Estimate to set the activity boundaries, although Published Data or Parametric Models can also be used to do this. Then I use Analogous or Expert Judgment to set the actual estimate. These activities must be considered in the Reserve Analysis. Often the estimate on these activities can be improved by decomposing the work of the activity and conducting a Bottom Up Analysis on that work. This will isolate the uncertain portions of the activity and allows for accurate estimates where possible.

Estimating Based Upon Project End Date

In some cases, the project end date is set even before the scope and deliverables are defined. In those cases, a high-level time line is created starting from the end date and going backward to the present time. Given the amount of time allocated for the major activities, the project team considers the needed deliverables and available resources during the time period. Essentially, the schedule side of the triangle is fixed and the scope and resource sides are varied so as to create a viable project. Often this will require an iterative estimating approach. Once the high level plan is established, estimates for the activities are developed and then iterations are done varying resources and scope until a viable estimate can be created. The Risk Register will be dominated by schedule risk items. Sometimes, an estimate cannot be created. In those cases, the project should not even be initiated, since it is doomed.

Estimating Based Upon Project Total Cost

In some cases, the project total cost is set even before the scope and schedule are defined. In those cases, a high-level allocation of the budget is created between the likely project deliverables. Each major activity is then estimated and if the estimate is greater than the allocated cost, the timing of resources or scope and deliverables are varied until the project is able to meet the budget goals. This is often an iterative process that may take many iterations until it completes.

The Additional Steps for Project Cost Control

It is advisable to constantly review the budget as well as the trends and other financial information. Providing reports on project financials at regular intervals will also help keep track of the progress of the project.

This will ensure that overspending does not take place, as you would not want to find out when it is too late. The earlier the problem is found, the more easily and quickly it could be remedied.

All documents should also be provided at regular intervals to auditors, who would also be able to point out to you any potential cost risks.

3. Conclusion

Simply coming up with a project budget is not adequate during your project planning sessions.

You need to always keep in mind the risks that come with cost escalation and need to prevent this as best as you can. For this, use the above techniques explained and constantly monitor the project costs.

Mentioned Methods

Cost change control system is the set of procedures and rules by which changes of the cost baseline can methodically be introduced into the project.

Performance measurement analysis is a method for comparing the reported reality and the (pre)defined cost baseline. For being able to do that one often uses the Earned Value Technique:

Planned Value "[...] is the budgeted cost for the work scheduled to be completed on an activity or WBS component up to a given point of time". (If an activity should totally cost X and the work grows linearly over the planned time than the PV for the half of the working time is 50% of X).

Earned Value (EV) "[...] is the budgeted amount for the work actually completed on the schedule activity or WBS component during a given time period" (The maximally earnable value of an activity is its total cost. If an activity has been fulfilled for 25% the earned value is 25% of the earnable value).

Actual Cost (AC) "[...] is the total cost incurred in accomplishing work on the on the schedule activity or WBS component during a given time period".

Cost Variance (CV) "[...] is earned value minus actual cost (EV - AC). Hence, if CV is positive you have won, if it's negative you've lost money. CV at the end of the project is "budget at completion (BAC)" minus really total costs.

Schedule Variance (SV) is similar CV, but refers to planned values: SV = EV - PV.

Cost Performance Index (CPI) is defined as CPI = EV/AC: "A CPI value less than 1.0 indicates a cost overrun of the estimates. A CPI value greater than 1.0 indicates a under run of the estimates." Note: CPI is also known as "cost-efficiency indicator".

Cumulative CPI (CPIC) is "the sum of periodic earned values (EVC) divided by the sum of the individual actual costs (ACC)" CPIC=EVC/ACC.

Schedule Performance Index (SPI) is defined as SPI = EV/PV.

Forecasting uses techniques for determining new cost values on the basis of the made experiences during the project. Especially if one has a CPI indicating a cost overrun of the estimates one might ask what the results will be if this observation will be taken as base for the future. Here one uses the following concepts:

Estimate to complete (ETC) are the necessary costs to complete the activity / WBS unit. This value might be...... newly estimate... computed on the base of atypical variances by accumulating the really earned values: ETC = (BAC - EVC)... computed on the base of typical variances by accumulating the really earned values and weighting the result with the observed cumulative cost performance index ETC = (BAC - EVC)/CPIC. This means: if you have overrun the estimates in the past you will probably do it in future too. And that should be respected by the estimate to complete.

Estimate at completion (EAC) computes the newly estimated total costs by adding the actually already spent costs and the newly estimated costs to complete. With respect to the three possibilities to get ETCs you have three methods to get EAC:

"EAC using a new estimate" (EAC = ACC + ETC)

"EAC using remaining budget" (EAC = ACC + (BAC - EVC)): add the actually cumulated cost and the estimate to complete on the base of atypical variances, assuming that the cost overruns won't happen again.

"EAC using CPIC" (EAC = ACC + ((BAC - EVC)/CPIC)): add the actual cumulated cost and the estimate to complete on the base of typical variances, assuming that the cost overruns will happen again and should be respected by weighting the values by the Cost Performance Index

Variance at completion (VAC) "[...] is the difference between the budget at completion (BAC) and estimate at completion (EAC)

Project performance reviews use performance measurement analysis and forecasts to "[...] compare cost performance over time, schedule activities or work packages overrunning and underrunning budget (planned value), milestones due, and milestones met.

The previous sections focused upon the identification of the budgetary and schedule status of projects. Actual projects involve a complex inter-relationship between time and cost. As projects proceed, delays influence costs and budgetary problems may in turn require adjustments to activity schedules. Trade-offs between time and costs of project planning in which additional resources applied to a project activity might result in a shorter duration but higher costs. Unanticipated events might result in increases in both time and cost to complete an activity. For example, excavation problems may easily lead to much lower than anticipated productivity on activities requiring digging.

While project managers implicitly recognize the inter-play between time and cost on projects, it is rare to find effective project control systems which include both elements. Usually, project costs and schedules are recorded and reported by separate application programs. Project managers must then perform the tedious task of relating the two sets of information.

The difficulty of integrating schedule and cost information stems primarily from the level of detail required for effective integration. Usually, a single project activity will involve numerous cost account categories. For example, an activity for the preparation of a foundation would involve laborers, cement workers, concrete forms, concrete, reinforcement, transportation of materials and other resources. Even a more disaggregated activity definition such as erection of foundation forms would involve numerous resources such as forms, nails, carpenters, laborers, and material transportation. Again, different cost accounts would normally be used to record these various resources. Similarly, numerous activities might involve expenses associated with particular cost accounts. For example, a particular material such as standard piping might be used in numerous different schedule activities. To integrate cost and schedule information, the disaggregated charges for specific activities and specific cost accounts must be the basis of analysis.

A straightforward means of relating time and cost information is to define individual work elements representing the resources in a particular cost category associated with a particular project activity. Work elements would represent an element in a two-dimensional matrix of activities and cost accounts. A numbering or identifying system for work elements would include both the relevant cost account and the associated activity. In some cases, it might also be desirable to identify work elements by the responsible organization or individual. In this case, a three dimensional representation of work elements is required, with the third dimension corresponding to responsible individuals. More generally, modern computerized databases can accommodate a flexible structure of data representation to support aggregation with respect to numerous different perspectives.

With this organization of information, a number of management reports or views could be generated. In particular, the costs associated with specific activities could be obtained as the sum of the work elements appearing in any row. These costs could be used to evaluate alternate technologies to accomplish particular activities or to derive the expected project cash flow over time as the schedule changes. From a management perspective, problems developing from particular activities could be rapidly identified since costs would be accumulated at such a disaggregated level. As a result, project control becomes at once more precise and detailed.

4. References

http://www.brighthubpm.com/monitoring-projects/57317-tools-used-to-monitor-and-control-costs-in-projects/

http://www.tutorialspoint.com/management_concepts/project_cost_control.htm

http://www.projectmanagementguru.com/controlling.html

http://pmbook.ce.cmu.edu/12_Cost_Control,_Monitoring,_and_Accounting.html

5. Appendices

Дата добавления: 2015-10-23; просмотров: 168 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Чтение и зачистка следов колдовства | | | Економіко-організаційна характеристика підприємства |