Читайте также:

|

[D3] [D4] [D5]

[D3] [D4] [D5]

|

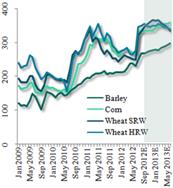

Price boost. World grain prices impacted an income margin of traders and demonstrated rather high volatility. The spread between winter and fall prices reached up to 10% and the overall trend was directed upwards with an average annual growth of 20% over the last 3 years. Absence of destabilizing factors corroborates the aforesaid trend.

Price boost. World grain prices impacted an income margin of traders and demonstrated rather high volatility. The spread between winter and fall prices reached up to 10% and the overall trend was directed upwards with an average annual growth of 20% over the last 3 years. Absence of destabilizing factors corroborates the aforesaid trend.

Devaluation brings additional margin. Such factors as prevalence of UAH expenses in prime cost of agricultural companies whose significant part of revenues comes from exports and prospective devaluation (up to 9.18 USD/UAH in 2013 according to the IMF) create grounds for profitability growth in the grain trade market and provide ample opportunities for price competition in the global markets.

|

|

Land moratorium: easy to abolish, difficult to switch. There are grounds for growing expectations for cancellation of the moratorium on land sales which may result in increase of financial leverage of agricultural companies and affect investment policy. Yet significant changes will not occur in the short-term outlook taking into account valid land lease contracts and lack of legal mechanisms to organize a land market in general, and problems with the land cadaster in particular. Therefore, influence of the aforementioned risk on liquidity of manufacturers and performance of grain traders is minimal.

Land moratorium: easy to abolish, difficult to switch. There are grounds for growing expectations for cancellation of the moratorium on land sales which may result in increase of financial leverage of agricultural companies and affect investment policy. Yet significant changes will not occur in the short-term outlook taking into account valid land lease contracts and lack of legal mechanisms to organize a land market in general, and problems with the land cadaster in particular. Therefore, influence of the aforementioned risk on liquidity of manufacturers and performance of grain traders is minimal.

Costs may hold a threat. Expansion of the grain market may be restricted by: 1) increase in gas prices; 2) low diversification of fertilizer suppliers (Russia provides 75.7% of NPK and 93.7% of nitrogen fertilizers; Belarus supplies 96.7% of Potash); 3) grain storage in current elevators which is limited to 3-4 months to prevent decrease in value; 4) state monopoly of railroads that are one of the means to carry grains to seaports. Thereby each of these factors is a potential threat to raise expenses of grain manufacturers and traders.

|

| Disclosure: CFA Institute shall own the copyright in all materials prepared by or for CFA Ukraine, Teams, Graders or Faculty Advisers in connection with the CFA Institute Research Challenge. The Written Report and Presentations prepared for the Challenge may not be used for any purpose other than participation in the CFA Institute Research Challenge. |

[D1]Думаю, что стоит еще вставить общую фразу типа «Роль Украины на мировом рынке зерна растет» Тем более есть почти целая строка для этого

[D2]Сомневаюсь в правильности формулировки на англ. Поэтому нужно все самери проверить

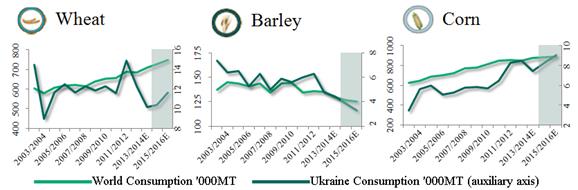

[D3]В легенде, как по мне, стоит 000 МТ на ths МТ. И подвинуть в соответствии с датами прогнозов прямоугольники на диаграммах

[D4]Спорил с Димой по поводу того, чтобы сделать потребление Украины гистограммой(столбцы), мировое же потребление оставить графиками. Что скажете?

[D5]Дайте мне эксель файлы, сделаю графики больше

Дата добавления: 2015-09-06; просмотров: 196 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Shares of Companies in Grain Export of Ukraine Structure of Ukrainian Grain Import by Countries, 2011 | | | КОММЕНТАРИИ ПО ОЦЕНИВАНИЮ ТЕКУЩЕЙ УСПЕВАЕМОСТИ |