|

Читайте также: |

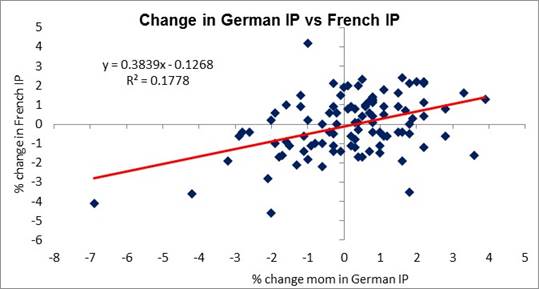

Yesterday’s UK industrial production for May didn’t fail to disappoint. Following the below-consensus German and UK IP, can today’s French IP do any better? Only because estimates are already pretty weak already: -0.8% mom (vs +2.2% in April). Italian IP is expected to do a bit better, probably because mean reversion from the previous month is in the opposite direction of France’s, suggesting it might show a small rise: +0.3% mom in May vs -0.3% mom in April. The other noteworthy Eurozone indicator out today is the final June CPI for Germany. The forecasts there are the preliminary numbers, +0.1% mom and +1.9% yoy on an EU harmonized basis. As for speakers, the ECB’s Noyer, Costa and Asmussen will be talking during the day. Perhaps Mr. Asmussen will want to clarify the ECB’s clarification of his comments yesterday about how long an “extended period” is? (He told Reuters that Mr. Draghi’s statement that rates would remain low for “an extended period” meant longer than a year, and that he would not rule out further policy measures. The ECB quickly issued a statement saying that “no guidance was given as to the exact length of this period of time.”)

The big event of the day though is the release of the minutes from the rate-setting US Federal Open Market Committee (FOMC) meeting of June 18th- 19th. We’ve heard so much from so many Fed officials recently that the FOMC minutes might not shed that much more light on the situation. The key will be the discussion on the risks around the Fed’s growth outlook. Those risks are in effect the risks around “tapering off” and are therefore crucial for the market. Of particular interest in that regard will be any discussion about the employment situation and the falling participation rate. The falling participation rate means that the Fed’s 6.5% unemployment threshold for tightening now means a less healthy labor market than it did when the Fed introduced this criterion. Are they going to adjust that criterion? People are likely to turn immediately to the end of the minutes to see if once again there is a section entitled “Review of Exit Strategy Principles” and to see if there has indeed been any change in those principles, although it’s highly unlikely that there would be any change that the many FOMC members who’ve spoken recently hadn’t mentioned already. Fed Chairman Bernanke will be speaking later in the day and may clear up any confusion ignited by the release of the minutes.

Otherwise, no major US indicators out today, just the weekly MBA mortgage applications and wholesale inventories for May (expected to be up 0.3% mom, vs +0.2% mom in April).

Дата добавления: 2015-10-29; просмотров: 87 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| К 100-летию присуждения Нобелевской премии | | | Наталия Антонова |