Читайте также:

|

Case Study - Brent Spa

This is a now famous case where Shell and the UK government agreed that the optimum disposal of a redundant North Sea platform was to tow it to deep water and sink it. Environmental lobby groups, led by Greenpeace campaigned strongly against this plan, representing it as irresponsible dumping. Publicity stunts such as attempts to board the platform added to the drama and popularised the cause. Anger spread beyond UK and there were attacks on Shell petrol stations in Germany. Shell suddenly bowed to pressure and agreed to dismantle the platform on shore but the climb down embarrassed the government, who had strongly supported disposal at sea.

Subsequent studies revealed that the Greenpeace campaign had been based on flawed data and that Shell actually had an environmentally sound solution. However this did not sway public opinion. Analysis shows that the core issue in the case is that Shell was thought to be secretive and arrogant, while Greenpeace was expressing legitimate concerns.

Some years later when BP had to dispose of another platform it learnt from the case and adopted a very different strategy, engaging a large range of stakeholders in an advisory group. Although environmental groups were unhappy with some aspects of the BP plan, they did not publicly campaign against the plan. The BP disposal plan proceeded without any expressions of public disquiet.

Case Study - Fuel Price Protests

In 1999/2000, rapidly escalating oil prices and oil company profits created an impression of profiteering. This was exacerbated by substantial rises in government taxes on fuel. Because the fuel price problem came on top of other concerns about the UK haulage industry competitiveness, and the viability of UK farming, these concerns all became linked in people’s minds. There was a feeling of outrage and when protests against fuel prices led to disruption of supply, the outrage boiled over. The issue became highly politicised at national level and the oil companies were branded as pariahs.

Analysis after the event showed that the key issue was that people thought that prices were being manipulated for profit, and this was exacerbated by a suspicion that oil companies had underinvested in infrastructure. Thus the real concerns were security of supply and the fairness of price movements. The actual level of the price was not so much an issue. The solution was therefore to show that oil companies were taking action to improve supply security and to demonstrate that prices were not being manipulated. A key change was that companies stopped making national announcements about price changes. It was realised that announcing changes made it look like the prices were being controlled. Instead, price changes became matters of local market forces rather than national marketing policy, and price changes occurred in more frequent smaller steps. The success of this strategy was demonstrated when oil prices hit record heights in 2005/6 and there was very little reaction. However this time the gas industry came under attack – they were still publishing national price changes.

Case Study - Onshore Drilling Operations

The south of England contains many areas of natural beauty, increasingly under pressure from growing urbanisation. It is also an area which offers potential for the location of hydrocarbon resources. In this context, a flurry of planning applications for the drilling of exploratory wells by several international oil companies in the 1980s proved controversial and inevitably led to widespread public opposition. While careful planning and operative training can make the establishment and operation of drilling facilities remarkably less intrusive than might be thought, communities are often unwilling to make “benefit of the doubt” decisions because of assumptions (often well founded) of arrogance and patronising attitudes on the part of the developer

Analysis showed that technical people faced with public hostility tend to become defensive and that this is interpreted by the public as arrogance and aggression, and this in turn exacerbates public fears. The solution in these cases lay in careful consultation (with the operator in listening mode); openness; willingness to compromise; and avoidance of confrontation. In the latter context the use of improved techniques for the provision of information and the appropriate deployment of the involved geologists and engineers--“real people”--provided the degree of professional reassurance which many of the opposed individuals sought. In particular, clear commitment to site remediation after the drilling operations; and the understanding of the critical difference between “exploration” and “development”, assuaged fears.

Case Study - Changing Rescue and Recovery

Effective systems for the rescue and recovery of people working in the offshore oil industry are a key element of safety. Traditionally the system used modified ex-fishing vessels to “stand-by” each offshore platform. A review of safety in the early 2000s by one major offshore operator (BP) determined that the existing system did not offer optimum effectiveness, especially in terms of picking people out of the water. A project was then introduced to consider the substitution of standby vessels by specially dedicated search and rescue helicopters. Alarmed by the threat to their business, operators of standby vessels mounted a campaign in opposition to the proposal, exacerbating fears among employees and other stakeholders that safety would be compromised rather than enhanced.

Analysis showed that a critical factor in stakeholder attitudes in this case was the belief that the decision to make changes had already been taken by management. This was not the case but the perception had to be vigorously addressed. Consequently a major consultation exercise was put in train involving a wide cross section of employees, unions, and statutory authorities. A key element was emphasis on the fact that the company was in “listening mode” and willing realistically to consider input from diverse stakeholders as to modifications to the original proposals. Over a period of months the rolling programme of multiple-aspect consultation created a modified proposal which still met the key criterion of a significant improvement in offshore rescue and recovery. The proposal won widespread acceptance for implementation.

Case Study - Tyre Incinerator Siting

Some 300,000 tons per annum of waste tyres were going to landfill in UK. Landfill disposal is not environmentally sound and landfill capacity in UK is running out. On the other hand, tyres have a high calorific values and incinerating them can generate energy. However the image of waste incinerators is extremely poor and the public usually strongly oppose the siting of an incinerator, particularly one dealing with something as noxious as burning tyres. The first site was proposed in Guildford but community outrage, supported by NGO and media campaigns led to the plan being abandoned.

Analysis showed that the key was to choose a site where there was some opportunity to align with local interests. An alternative site was proposed in Wolverhampton and there was a campaign of open community engagement, which focussed on the industrial heritage of the area and its association with tyre manufacture. The local council and businesses supported the scheme because it created jobs and communicated their support via local media. The plant went ahead without any public protest.

Case Study - UK First Hydrogen Refuelling Station

Hydrogen is a highly explosive gas and the decision by BP to trial its first refuelling station at a petrol station in a residential area of London angered many local residents, the council, and the MP. BP’s rational was that similar facilities had operated without incident on industrial estates elsewhere in Europe and now was the time to test the technology in a public petrol station. The community saw this as confirmation that they were guinea pigs and a sense of conflict became entrenched.

Analysis of the situation revealed that BP had dealt poorly with complaints about the impact of the existing petrol station and hence built up a local reputation for being uncaring. The management was of course completely unaware of this situation. The solution was face to face meetings with the residents to allow them to express their concerns to real people. When the anger subsided it became clear that the primary concern was not safety but social intrusion. There was a fear that the hydrogen facility would grow into a major depot and industrialise the area. BP was able to provide credible assurances about the long term future of the site and instigated measures to reduce the impact of the existing station and to screen residents. This restored goodwill and a subsequent planning application to extend the trial was unopposed by the community.

Case Study - Chemical Plant Expansion

Despite a history of proactive community relations and strong local employment links, significant local objections were received when an Amoco chemicals plant in Belgium announced plans for significant expansion. Without community support the planning application was in danger of failing altogether, and at best would be a protracted process impacting the economic case for the project.

Analysis of the situation revealed that the traditional means of plant--community liaison was not connecting with the vast majority of the local population. Management thought they were connecting to the local people but the people just saw a “cosy club” between plant management and local politicians. The solution was to create a much more representative consultation process which in due course identified the main issue as one of noise pollution, exacerbated by the proximity of motorway traffic. Discussions between the plant and local authorities agreed a major noise abatement programme which satisfied the concerns of the majority of the community and cleared the way for the planning process to succeed.

Conclusion

Preserving a strong reputation revolves around effectively communicating and building solid relationships. Communication between a bank and its stakeholders can be the foundation for a strong reputation. Timely and accurate financial reports, informative newsletters, and excellent customer service are important tools for reinforcing a bank's credibility and obtaining the trust of its stakeholders.

Reputational risk is managed through strong corporate governance. Setting a tone of strong corporate governance starts at the top; an institution's board of directors and senior management should actively support reputational risk awareness by demanding accurate and timely management information.

How should a bank's reputational risk be managed internally? The following are just a few examples of key elements for managing reputational risk:

· Maintaining timely and efficient communications among shareholders, customers, boards of directors, and employees

· Establishing strong enterprise risk management policies and procedures throughout the organization, including an effective anti-fraud program

· Reinforcing a risk management culture by creating awareness at all staff levels

· Instilling ethics throughout the organization by enforcing a code of conduct for the board, management, and staff

· Developing a comprehensive system of internal controls and practices, including those related to computer systems and transactional websites

· Complying with current laws and regulations and enforcing existing policies and procedures

· Implementing independent testing and transactional testing on a regular basis

· Responding promptly and accurately to bank regulators, oversight professionals (such as internal and external auditors), and law enforcement

· Establishing a crisis management team in the event there is a significant action that may trigger a negative impact on the organization

Building a financial institution's reputation may take years, but it certainly can be damaged or even destroyed very quickly. Reputational risk exists in a combination of factors that financial institutions face every day. Boards of directors and senior management are responsible for measuring and monitoring reputational risk and therefore must remain vigilant and active in providing the safeguards to prevent loss of reputation. Assessing and managing the risk effectively and properly are one of the keys to a financial institution's continued viability and success.

Bibliography

1. Bank Risk Management – Research paper by David H. Pyle, 2010

2. Risk management in banking – Banker’s Academy, Dr. Linda Eagle, 2011

3. A framework for the analysis of reputational risk – Sergio Scandizzo, 2011

4. Reputation risk – Michel Rochette, 2007

5. Understanding Reputational Risk – William J. Brown, 2009

6. www.risk.net - an official site of financial institutions risks

7. www.economist.com - an official website of business articles and news

8. www.businessarticles.com - an official website of financial articles from the USA

9. www.reputationriskconsultants.co.uk - an official website of UK Risk Consultant

10. https://www.wikinvest.com/account/portfolio/regx/start - an official site of Wiki-Invest

11. http://specials.rediff.com/money/2008/jul/15slide1.htm - an official website of Rediff News

Appendices

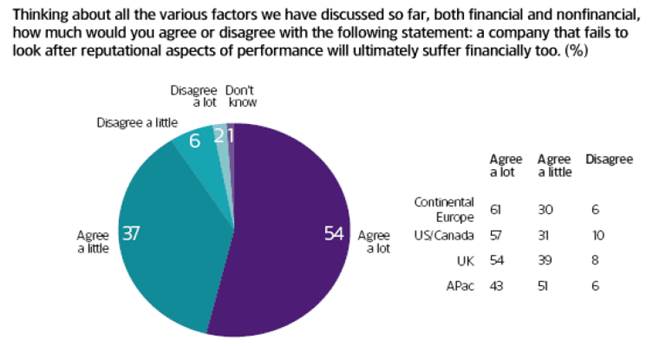

Pic.1. Reputation and financial impact: corporate reputation watch.

GLOSSARY

1. FSE-Financial Service Authority - Орган Управления Финансовыми Услугами

2. Claw-back -1.when a company takes back new shares that it had offered to its present shareholders, but they do not want to buy and offers them to other investors; 2. When an authority gets back money from a person who previously received it from them – запрос возврата

3. Swing trading - a sudden and noticeable change in the level rate, or position of something- свинг-трейдинг

4. KBW Bank Index – Index of 24 banking companies; a benchmark of the banking sector trades on Philadelphia Stock Exchange (Keefe, Bruyette and Woods)- Индекс КБВ

5. A lump sum – a compact sum of money for payment - единовременная выплата

6. Initial mortgage rates – the period of an introductory or “teaser” interest rate on mortgage - начальная ставка ипотеки

7. Prime rate – is the interest rate charged by banks to their most creditworthy customers – ставка по кредитам для первоклассных заемщиков

8. Pivotal role - used to describe the extreme importance of something- основная роль

9. Exchange Traded Funds - refunds or investment trusts that hold portfolios of stocks, etc. which closely track the movements of a specific - Биржевые индексные фонды

10. to invigorate – to give a life and energy, to stimulate- укреплять

11. robustness – powerfully built – устойчивость

12. crunch – to do very complicated calculations on large accounts of data in order to find out about something- сложные расчеты

13. FOMC- Federal Open Market Committee – Федеральный комитет по операциям на открытом рынке

14. algorithmic trading - trading which is conducted automatically with computers- алгоритмическая торговля

15. latency - is a measure of time delay experienced in a system, the precise definition of which depends on the system and the time being measured – время ожидания

16. Constituent Changes – a unit with a hierarchical structure - составляющие изменения

17. composite index – is an index made up of more than one column– сводный индекс

18. sub index - A group of securities that is part of an index – составляющий индекс

19. yardstick – a standard for making a judgment - критерий

20. livedoor - is an Internet service provider that runs a web portal and numerous other businesses

21. arrest warrants - is a warrant issued by and a Judge on behalf of the state, which authorizes the arrest and detention of an individual, or the search and seizure of ones property – ордер на арест

22. diluted stock – all the stock of a company considered together, especially after a share issue and dividends are spread over a large number of shares - разводненные акции

23. sleeper stock – a small stock that has not been performing particularly well, but that may do well in the future – спящая акция

24. freightage – the amount charged for carrying large quantities of goods from one place to another in a ship, plane, train and etc. – фрахтовка

25. third market – in the US, a market in which listed securities are bought and sold privately without using the stock market – третий рынок

26. no-par stock – stock that doesn’t have a particular value attached to it when it is issued – акции без номинала

27. benchmark index – one of the main indices for particular stock market – эталонный индекс

28. dividend cover – a company’s profits for a particular period measured in a relation to the amount that it pays out in dividends for the period of time – дивидендное покрытие

29. debt arrears – debt or interest that was not paid when it should have been and is still owed – долговые обязательства

30. a ttorney – a person who has the legal right to do things and make decisions on someone else’s behalf – доверенное лицо

31. intraday high – the highest level ever reached in a financial market on a particular day – самый высокий в протяжении сутки

32. incubation investment – investment in new companies which are failing to achieve their expected targets – инвестиции инкубации

33. linchpin – the most important thing or person in a system, plan etc. – опора

34. captive market – бесконкурентный рынок

35. non-callable notes – notes that cannot be repaid to lenders before the date originally fixed – неотзывные примечания

36. capped rate – an interest rate on a loan that can change, but can’t go above a certain value that is fixed at the time when the loan is taken out – покрытый уровень процентной ставки

37. delta shares – shares in small companies that are not often actively traded are not listed on SEAQ

38. tender – an offer to buy shares, which will be sold to the investor who offers the highest amount

39. dirty float – when a currency that is supposed to be floating is actually being kept close to a particular value by the actions of a country’s central bank – грязное изменение

40. LIBA – London Investment Banking Association – Лондонская инвестиционно-банковская ассоциация

41. Loan-loss provision – a provision made by bank for loans that will probably not be repaid – резерв на возможные потери, выданного кредита

42. Loan leverage – the amount that bank has lent in relation to its share capital – кредитный левередж (рычаг)

43. Bailment – the right to use someone else’s property without becoming its owner – зависимое держание

44. Clearing bank – one of the High Street banks that issues and accepts cheques and passes them through the banking system – клиринговый банк

45. Eligible bank – in Britain one of the banks officially approved to accept certain bills of exchange that the Bank of England will then accept – банк, уделенный специальными правами

46. Endorsed cheque – a cheque on which the person the cheaue is made out to has written someone else’s name so that the other person can receive the money – чек, имеющий передаточную надпись

47. Spin-out – a separate and partly independent company formed from parts of an existing company – отпочкование

48. Price floor – a level below which prices are not allowed to fal l – ценовой потолок/корридор

49. Vulture fund – a fund that invests in companies in difficulty, hoping to gain control of them and improve their performance – фонд «хищник»

50. Outstanding invoice – an invoice that has not been paid – неуплаченный счет-фактура

51. Lodgment – an amount of money that is paid into a bank account, or the act of paying money into a bank account – депонирование денежной суммы

Дата добавления: 2015-10-23; просмотров: 91 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Importance of Reputation to Stakeholders | | | Тематика курсовых проектов |