Читайте также:

|

The Government of the Russian Federation

The Federal State Autonomous Institution of Higher Education

""National Research University - Higher School of Economics"

Faculty of Management

Department of Company Marketing

PROJECT REPORT

Wissotzky Tea: Back to Russia

Advisor: Professor O.K.Oyner, PhD (Economics)

Authors: Artemchuk Anton 620

Ayrapetyan Khoren 620

Bessarabov Sergey 622

Bondarenko Elena 621

Gubina Irina 620

Kersh Evgeniya 622

Klimanov Denis 622

Lagutaeva Daria 622

Litovka Anastasiya 622

Malova Ekaterina 622

Maslova Elena 620

Ryazantsev Andrey 622

Savenkova Anna 621

Sazonova Olga 622

Senin Alexander 622

Smirnova Ksenya 621

Trofimova Tatyana 621

Moscow, 2011

Оглавление

Introduction......................................................................................................................... 3

Analysis of external and internal environment.................................................... 3

Tea market is close to saturation, almost 100% of Russians consume tea. The growth in number of new consumers is not significant, but this leads for the new competition dimension - companies introduce new brands and new solutions in product packaging............................................................................................ 4

Strategic options, priorities and choice................................................................... 8

Short Run Strategy....................................................................................................................................................... 8

Long Run Strategy......................................................................................................................................................... 9

STP and the brand story................................................................................................ 10

Target Audience.......................................................................................................................................................... 10

Positioning..................................................................................................................................................................... 10

Brand story.................................................................................................................................................................... 11

Product options for all channels, packaging....................................................... 13

Channels policy and marketing communications for all channels............... 19

Retail and PoSM.......................................................................................................................................................... 20

Social Activity.................................................................................................................... 21

Marketing Plan and Results Anticipated................................................................ 21

Conclusion............................................................................................................................ 23

Appendix 1. Lipton Mapping Outdoor.......................................................................... 24

Appendix 2. Examples of press advertisements and POSM.................................. 25

African Collection..................................................................................................................................................... 25

Winter Collection...................................................................................................................................................... 27

Green Line....................................................................................................................................................................... 29

Platinum Collection.................................................................................................................................................. 30

Masala Tea..................................................................................................................................................................... 31

Magic Garden................................................................................................................................................................ 33

Ordinary type of ads.................................................................................................................................................. 34

Introduction

In this paper will be considered the promotion campaign for the Wissotzky Tea. The concept of the all campaign is the “History”, which is based on traditions, quality, great taste, prestigiousness and history. Packages – the parcels, which are brought especially for customers from distant lands. The character of the campaign is F.W.Wissotzky – the descendant of the Wissotzky Family.

The basic idea – the history of Wissotzky Tea throughout the ages – a parcel brought from a distant land to a Tea Lover, for whom tea consumption is very important in every moment in his life. The writer is the descendant of the Wissotzky tea dynasty. He welcomes the Tea Lover to enjoy the variety of blends and the richness of taste.

In this paper the core idea and all the instruments will be considered. The campaign “History” will be devoted to our target audience – men and women aged under 21 year, active life, healthy lifestyle etc. Special POSM and banners in the most popular sites will highlight all points of sales of the Wissotzky Tea in magazines and the Internet for our target audience. Also special social activities will be done, such as special “tea-guys” in the streets or social events in the open air (e.g. Afisha picnic etc.) will be mentioned.

First part will be devoted to the analysis of the external and internal environment. Second part will consider the strategic options that we have in Russian Tea market, priorities for the further 5 years of the campaign ad our final choice for the channels and their peculiarities. In the third part segmentation, targeting, positioning (STP) and the brand story of the concept will be presented. In the fourth part all product options will be presented with the packaging overview. In the fifth part of this paper channels (away from home, HoReCa and digital) policy will be considered. The sixth part will be devoted to marketing communications in mentioned above channels and the pricing for all marketing communications will be mentioned as a final step of the campaign. All pictures and layouts of the promotion campaign will be attached in appendixes.

Analysis of external and internal environment

Headlines:

· In 2010 sales of tea grow by 3% in total volume and by 9% in current value terms

· The volume growth in the off-trade is 3% and the on-trade 2% in 2010

· Fruit/Herbal tea registers the strongest performance in off-trade volume terms with growth of 7% in 2010

· The unit price of tea grows by 6% to RUB 621 per kg in the off-trade channel in 2010

· Top four operators within tea remain Orimi Trade OOO, Mai Kompanya OAO, Ahmad Tea Fabrika OOO and Unilever Rus OOO (first two are local producers)

Trends:

Tea market is close to saturation, almost 100% of Russians consume tea. The growth in number of new consumers is not significant, but this leads for the new competition dimension - companies introduce new brands and new solutions in product packaging.

Tea continues its growth in value terms in 2010 – 9% vs last year, mainly due to price increase (inflation) and market premiumization.

Fruit and herbal tea shows huge growth and the tendency is positive for the future sales increase (now account for only 5% of total tea market), while black tea segment is stable, but already is the biggest segment in the Russian market (accounts for almost 80% of the total market). Black tea is mainly present in economy and standard price segment, while other types of tea are more upper mainstream and premium.

Sales growth was similar within the on-trade and off-trade channels. Despite the general slowdown in growth within the on-trade channel, tea sales remained relatively strong, supported by the fact that tea is cheaper than coffee and other hot drinks, thus people felt able to afford a visit to a cafeor restaurant, in order to enjoy a cup of tea with friends, or just relax and spend some time. Moreover this channel gave them the opportunity to try more exotic or expensive types of tea without committing to the purchase of an entire pack.

Competitive landscape:

Top four operators in tea remained Orimi Trade OOO, Mai Kompanya OAO, Ahmad Tea Fabrika OOO and Unilever Rus OOO. The strong leader Orimi Trade OOO had a 25% share in off-trade value terms. This company operates in all the tea subcategories, which helps enable it capture a large share. Its Princess Gita brand is the leader in black tea with a 12% value share. Greenfield is a relatively new brand of Orimi Trade, holding a 25% value share in green tea. The Tess brand was a new product development in the fastest-growing fruit/herbal tea subcategory. The company achieved significant consumer loyalty due to affordable unit price and good-quality products.

The trend of redistribution of sales towards the segment of premium tea started in 2010. Premium and upper-mainstream teas share grows from 7.3% to 15.2% in 5 years (estimated, from 2005 to 2010). Over the past year several industry leaders launched new products in this segment. It is also worth noting that players continued to expand the range of the most successful brands through new flavoured versions. With regard to the most significant innovations in packaging, pyramid tea bags with individual foil packaging for each unit can be seen as belonging to the premium segment.

Competitors for Wyssotzky tea were selected based on the following key criteria:

• Similarity of the product line

• Price level

• Promotion specifics

Based on these features, “strong” market players (with more or less significant market share) are, descending order:

• Greenfield (Orimi trade)

• Ahmad Tea (Ahmad Tea London Ltd)

• Tess (Orimi trade)

• Mlesna (Mlesna England co ltd)

• Riston (Riston teas ltd)

• Twinings (Associated british foods plc)

• Newby (Newby teas of London)

• Messmer (Laurens Spethmann Holding AG & Co)

• Maître de Thé (Technologies Françaises Alimentaires)

Other competitors, which have very little market share, but are widely distributed within premium retail stores, are:

• Quai sud

• Heath & heather

• Clipper

• Ronnefeldt

• Dammann

• Today was fun

• Kowa

• Dr. Stuart's

• Fortnum&mason

• Whittard of chelsea

• Harney&sons

Share dynamics in value for the top premium and upper-mainstream players is the following (total tea market, shares of premium brands, all segments, bars present total market in mln RUR):

Premium teas share grows from 7.3% to 15.2% in 5 years – clear evidence for market premiumization.

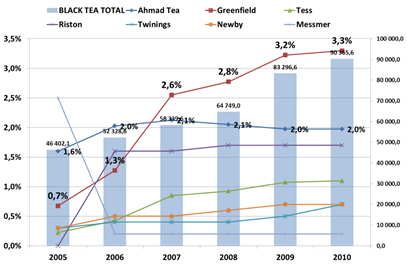

Segment-by-segment dynamics is slightly different from the total picture (while Greenfield is strong market leader in all premium tea segments, other competitors account for different positions). Black tea (black tea market, shares of premium brands, bars present total black tea market in mln RUR):

Greenfield shows significant growth on the background of stable competitors.

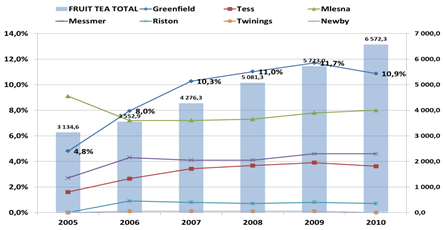

Fruit/herbal tea (fruit/herbal tea market, shares of premium brands, bars present total fruit/herbal tea market in mln RUR):

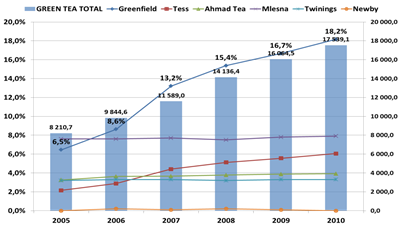

Green tea (green tea market, shares of premium brands, bars present total green tea market in mln RUR):

Greenfield and tess (both brands of one company) show sustainable growth while others are stable.

Prospects:

· There is an expected growth of 3% in volume terms for the total tea market in Russia, this growth will not significantly exceed 2010 result, because mainly companies continue to develop qualitatively and not in volume terms due to high level of market saturation

· For the next few years experts forecast active competition, advertising and price wars. There are going to emerge several extensions of the already well-known brands, and private labels could be a significant threat for the already existing competitors, which could force them to decrease prices

· More and more companies are moving to the domestic packaging, because it could be much cheaper due to the difference in import tariffs for both variants.

· There is a tendency to increase export of the Russian tea to the other countries because of the market saturation (mainly CIS countries)

Strategic options, priorities and choice

In this part of the paper the strategy of the campaign will be presented.

The aim of the campaign is the market penetration of new Tea – Wissotzky Tea. We divide our strategy in two stages: short run (SR – till 3rd year) and long run (LR – after the 3rd year of sells).

Дата добавления: 2015-10-23; просмотров: 140 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Задание № 5.1 Архитектура: 2 длинных и один короткий конвейер, длинная команда после каждой короткой | | | Short Run Strategy |