Читайте также:

|

RECOMMENDATION

Goal: write a 6-8 pages essay in which you do your best to convince readers to share your understanding of systems approach.

Deadline: 30/03/2012

Length: 6-8 pages, 13-14 TNR typed, double-spaced, number your pages.

Criteria for grading: each paper will be judged according to the following criteria

- a well-structured and convincing account of a problems study

- identification of the research problem (what problem do you study?)

- description of your system, boundaries, supra – and subsystems

- feedback loops in your system

- analysis and discussion

- its demonstration of clarity, depth, and complexity of thought

- conclusions

- many spelling and grammar mistakes.

- list of references

Structure:

- Introduction

- Research problem

- Description of system

- Systems models

- Analysis and discussion

- Conclusion

O.S. Subanova

Problems of endowment spending: the system approach

Introduction

The basic concept of an endowment is a fund of money created by donor’s stipulation that requires the gift to be invested in perpetuity or for a specified term. The fund is invested and a determined percent of the portfolio is used for the purposes restricted by the endowment gift or, if it is unrestricted, by the intent of the university administration. Thus, the endowment becomes the gift that lives forever and helps universities maintain affordability by providing revenue to subsidize the operating budget [1].

Endowments typically grow over time through a combination of donations and investment returns. But it may be different year-by-year and universities have established various rules for spending their endowment earnings that smooth the effects of charitable giving resizing, high or low investment returns and operational management costs. University endowments are an important source of revenue which allocate to student financial aid, faculty chairs or professorships, scientific research and etc.

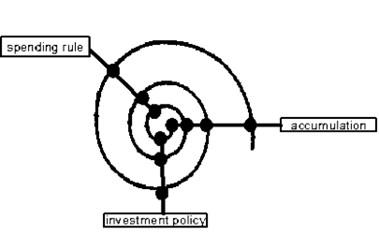

An endowment is not a singular entity. It’s an accumulation of different donations that are put together for investment purposes. It usually consists of many of different funds and most of these funds are restricted meaning that they can only be spent for legally binding purposes that have been specified by the donors. Endowments typically grow over time through a combination of donations and investment returns and decrease in size from payouts for student financial aid, teaching, create professorships, research and innovation, staff and administration salaries and etc. In many cases, three notions that probably come to mind when considering endowment management are accumulation of gifts, investment policy and spending rule. Managing the endowment is not a “stand-alone” endeavour; it’s a perpetual process (Figure 1)

Figure 1: The endowment management process framework

The accumulation of endowment is, in effect, a form of saving, presumably for expenditure in the future [2]. Endowments are managed for the long-term to strike a balance between money that are spent immediately and the obligation to preserve it for future generations. “Intergenerational equity” means, in the words of Yale economist 1981 Nobel laureate James Tobin, “to protect the interest of the future against the demands of the present”. Future generations of students have as much entitlement to the benefits of the endowments as those currently enrolled, and their rights must be protected.

In other words, future generation of students receive at least the same level of support from an endowment as the current generation enjoys. Factors affecting intergenerational equity are: gift flows, returns and inflation, asset allocation (a target percentage (or percentage range) in stocks, bonds, cash and other asset classes that is consistent with the purpose for which the endowments are invested) and spending policy/spending rate (what sum should be spent per year and how this amount should change as circumstances change (e.g. unusually high or low investment returns, or new gifts received).

Each university adopts its own strategy and spending models to maximize its endowment’s value to support both current activities and future needs. As Merton (1991) noted two universities with similar objectives and endowments can have very different optimal portfolios and expenditure patterns if their non-endowment sources of cash flow are different. Examples of such sources include public and private-sector grants, patents, gifts, university business income and etc.[3]. Taking account of those assets can cause the optimal spending. Table 1 summarized popular spending approaches.

Table 1: Endowment spending approaches

| # | Name | Description |

| Ad Hoc | Spending rule varies from year-to-year based on the needs | |

| Income based | Spend all current income | |

| Inflation based | Increase spending each year based on rate of inflation | |

| Banded approach | Last year’s spending plus an inflation rate, but bound by ranges (e.g. no more than 6% nor less than 3%) | |

| Pure asset-based | Pre-specified percentage of moving average of market value – typically 5% of a three year moving average of market values | |

| Spending reserve | Segregation of 5% -10% of market value in separate account, invested in 90 day treasury bills. Reserve is drawn down when endowment performance is less than policy target. | |

| Hybrid rule (e.g. “Yale rule”, “Stanford rule”) | “Yale rule”: 70% of the allowable spending in the prior fiscal year adjusted for inflation plus 30% of 5% of the endowment’s current market value. Spending is a weighted average of a inflation rule and a pure asset-based rule. Typically, the weight placed on the inflation part is between 60 – 70%, and the weight on the asset- based part is therefore 40-30%. |

According different analytical studies, nearly three-quarters of all American colleges and universities target their endowment spending at about 5% of a three-year rolling average of total endowment market value. In Russia all of universities invest their endowments through asset management companies (it’s against the law to manage with their own staff) that is why they don’t have an enigma of asset allocation and disclaim responsibility of the day-to-day endowment investment management. Obviously, contract with professionals means additional costs of managing which reduce the endowment’s value, especially in difficult years when return may be negative (commissions and management fees are paid in any cases).

Research problem

When considering a judgment such as “what is more important, money that are spent immediately for current student financial aid, research, scholarships and etc. or money that are re-invested to preserve the endowment’s value for the future” one of the most significant problem is to define the level of spending. Unfortunately, the spending level for present must be set before the real return is known. The proposed approach based on hybrid rule and can be explained by segregates the endowment into three parts: the original endowment, the stabilization fund and the “service” part for management costs.

The stabilization fund as Mehrling (2005) defined is as a kind of bank account with overdraft privileges, but one that has the same return as the endowment. On average, the account is zero, but when there is a period of abnormally high returns, the account becomes positive, and when there is a period of abnormally low returns, the accounts becomes negative [3]. The “service” part is a sum which includes various commissions and management fees. This amount can be estimated at the beginning of the year.

The model used is of the following form:

SPt =α∗ENDOWMENTt−1+β∗STABFUNDt− 1+SERVt

The variables are defined as follows: SPt is current spending from endowment; ENDOWMENTt−1 is an endowment wealth at the end of the previous fiscal period; STABFUNDt−1 is the stabilization fund balance at the end of the previous fiscal period; SERV t is the “service” part for current period; both α and β are spending rates which set.

This model can be modified over time though α and β. The endowment managers, according to their opinion, setting α and β via quantitatively assess the importance of the various criteria such as endowment wealth, the nominal rate of return, endowment management costs, university needs (tuition fees, scholarships, research and grants, etc.), market situation, gifts flow and many others. In unusually favorable financial times, decision-makers may be able to make upward adjustments in endowment spending (for example, α > 0.05), while in unusually unfavorable times they may need to estimate β = 0.

So far the objective of the research is not to determine the correct spending rates α and β, but to explore what criteria and success factors are needed to estimate it.

Дата добавления: 2015-10-28; просмотров: 111 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| ОСНОВНЫЕ ПРОЦЕДУРЫ системного анализа | | | АМЕРИКАНСКИЙ ПРАГМАТИЗМ 4 страница |