Читайте также:

|

Prospects for Iran in the fourth quarter

Monday, September 10 2012

An Oxford Analytica Prospect

Iran faces a challenging fourth quarter as it seeks to reconfigure its economy in the face of Western sanctions that have substantially reduced oil revenues and shut it out of the global financial system. Tehran could also face a series of crises on the foreign front, with Israel considering the option of a pre-US election strike on Iran's nuclear facilities, and an escalating rebellion that threatens to topple its key regional ally in Damascus.

Strategic summary

What next

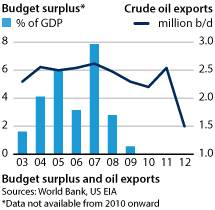

The government will bank on a combination of new economic and trade initiatives to mitigate the impact of sanctions on its revenues. Yet it will face a rising budget deficit as sanctions cause a 25% year-on-year decline in oil revenues. An Israeli strike on Tehran is unlikely this quarter, but the risk of regional conflict will remain high as Syria's civil war intensifies.

Analysis

Tehran will focus for the remainder of the year on shoring up the economy as sanctions cause a sharp drop in oil revenues and make international financial transactions difficult. It will launch new initiatives aimed at reducing oil dependency as part of Supreme Leader Ali Khamenei's 'resistive economy' strategy.

Countering sanctions

It will seek to counter its isolation from the global financial system by conducting more trade through barter or local currency transactions. Both India and Pakistan are planning to export wheat to Iran through this method.

As Dubai shuts down its banking services to Iran in the face of the latest US sanctions, Tehran is pushing for new banking relations with its neighbours. It is now calling for the establishment of joint banks to support mutual trade and will guarantee licensing to any Turkish bank interested in opening inside Iran. Iran will also seek to strike more private deals that are not reliant on purchasing tenders. A recent purchase of 400,000 metric tonnes of wheat from the Baltic, Black Sea and EU regions bypassed the need for international fund transfers.

Economic vulnerabilities

While this multi-pronged approach to combating sanctions will have some success in lessening the blow, its overall impact will be limited. Thus, the economy will continue to struggle on various levels:

Oil revenues will not recover to 2011 levels

The government will likely delay further subsidy liberalisation

Oil revenues

Oil exports have fallen from 2.0 million barrels per day (b/d) in 2011 to 1.5 million b/d in June 2012. Higher oil prices have partly compensated for the decline, but export revenues have still fallen by 25% compared to this point last year. Annual oil income from key Asian importers Japan, South Korea and India is down over 20% from last year (see IRAN: Economy lacks long-term solution to sanctions - September 5, 2012).

The next quarter is likely to see a partial recovery, with Asian imports recovering to pre-July levels. However, they will still be substantially below 2011 levels. Moreover, the extent of this recovery will be limited by the capacity of Iran's tanker fleet, which it is using to circumvent an EU ban on insuring Iranian oil shipments. The cost of this and other measures, such as protecting Asian-bound tankers with 1 billion dollars in Iranian-provided insurance, will absorb some of the increase in revenues (see IRAN: Sanctions raise pressure on troubled oil sector - July 2, 2012).

Дата добавления: 2015-10-28; просмотров: 88 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Танец из жалости | | | Сравниваем контроллеры PlayStation 4 и Xbox One |