Читайте также:

|

Unit II

Banking and Finance

Vocabulary

Exercise 1. Read and memorize the following words and word- combinations.

| 1. banking | банківська справа |

| 2. finance | фінанси |

| 3. merchant bank syn. investment bank (G.B.) | торговельний банк |

| 4. to receive and hold deposits | отримувати та володіти вкладами |

| 5. to exchange foreign currencies | обмінювати іноземні валюти |

| 6. to deal with | мати справу з |

| 7. to manage customers’ accounts | керувати рахунками клієнтів |

| 8. to deposit money | покласти в банк гроші |

| 9. interest | процент |

| 10. to charge | призначати |

| 11. margin | маржа |

| 12. intermediary | посередник |

| 13. fee | плата |

| 14. merger | злиття (підприємства) |

| 15. to issue government bonds | випускати урядові облігації |

| 16. insurance company | страхова компанія |

| 17. full range of | повний ряд |

| 18. to fluctuate | коливатися |

| 19. to develop confidence | проявляти довір’я |

| 20. sound | надійний |

| 21. principal | основна сума |

| 22. to apply for a loan | звертатися за позикою |

| 23. to estimate | оцінювати |

| 24. precautions | застереження |

| 25. to collect money | збирати гроші |

| 26. costs syn. expenditures, expenses; charges | витрати |

| 27. physical asset | матеріальні активи; майно |

| 28. debenture capital | зайомний капітал |

| 29. preference shares | привілейована акція |

| 30. ordinary (deferred)shares | звичайна акція |

| 31. Financial Department | фінансовий відділ |

| 32. capital budgeting | кошторис капіталовкладень |

| 33. equity | інвестиційний капітал |

| 34. to finance operations syn. to finance activities | фінансувати операції |

| 35. working capital | оборотній капітал |

| 36. accessible | доступний |

| 37. treasurer | казначей |

| 38. controller | контролер, бухгалтер0аналітик |

| 39. cost accounting | виробничий облік |

| 40. to forecast revenues | передбачати річний дохід |

| 41. to take into account | приймати до уваги |

| 42. net profit | чистий прибуток |

| 43. balance sheet | баланс |

Exercise 2. Find the odd one in each group:

1. to lend; to borrow; to estimate; to receive.

2. expenditures; cost; expenses; equity.

3. client; debtor; borrower; principal.

4. operations; activities; acts; account.

Exercise 3. Give the Ukrainian/Russian equivalents for the following words and word-combinations without using a dictionary:

Central bank; investor; depository institution; transaction; financial service; trust company; personal finance; corporate finance; margin; financial supermarket; adequate; project; liquid capital; process; machinery; structure; inventory; mixture.

II Reading and Speaking

Exercise 4. Skim the text A and be ready to answer the following questions:

1. What is banking?

2. What types of banks are there?

3. What does banking consist of?

4. What are depository institutions?

5. What is finance?

6. What is the key point of finance?

7. What sub categories can finance be broken?

Notes:

savings bank –ощадний банк

facilitating loans – сприяти позикам

creditworthiness – кредитоспроможність

depository institution – депозитна установа

mutual savings bank – взаємно ощадний банк

rate of return – ставка доходу

Text A Banking and Finance

Banking is the transactions carried on by any person or firm engaged in providing financial services to consumers or businesses. For these purposes there exist commercial banks, central banks, savings banks, trust companies, finance companies and merchant banks. Banking consists of safeguarding and transfer of funds, lending or facilitating loans, guaranteeing creditworthiness and exchange of money. In other words, banking is the acceptance, transfer, and creation of deposits. The depository institutions are central banks, commercial banks, savings and loan associations, building societies, and mutual savings banks.

Finance is the study of how investors allocate their assets over time under conditions of certainty and uncertainty. A key point in finance, which affects decisions, is the time value of money, which states that a unit of currency today is worth more than the same unit of currency tomorrow. Finance aims to price assets based on their risk level, and expected rate of return. Finance can be broken into three different sub categories: public finance, corporate finance and personal finance.

III Reading

Exercise 5. Read and translate the text B:

Text B Types of Banks

There are two types of banks: commercial banks and investment banks - or merchant banks as they are called in Great Britain. Commercial banks deal mainly with individual customers, for instance, private citizens, small businesses, and such like. They receive and hold deposits, lend money, exchange foreign currencies, advise their customers how to invest their money, and manage the customers' accounts (for instance, pay or invest money according to the customer's wishes). Commercial banks make their profit from the difference between the interest that they pay to people who deposit money and the interest they charge to people who borrow money. This difference is called a margin.

Investment banks deal mainly with rich corporate clients (companies or large firms) or rich individual clients. They aim not so much at lending money but at raising funds for industry (their corporate clients) in different financial markets. Therefore, investment banks act mainly as intermediaries for their customers. They do not themselves make loans, but make their profits from fees paid for their services. Merchant banks in Britain do the same, but they have greater authority because they also offer loans themselves. They finance international trade, deal with mergers, and issue government bonds.

In recent times the difference between commercial and investment banks has been slowly disappearing as the so-called "financial supermarkets" replace them. These are a combination of a commercial bank, an investment bank, and an insurance company, offering the full range of financial services.

Whether depositing or borrowing money, a customer is most interested in the bank's interest rate. The minimum interest rate within a certain country is usually determined by the central bank, and the interest rates offered by other banks sometimes fluctuate slightly from time to time, and are publicly advertised by any bank. They are always either higher than or equal to the minimum interest rate fixed for that country.

IV. Language

Exercise 6. Find in the text and put down English equivalents to the following word combinations:

Мати справу з багатими клієнтами; залучати кошти для промисловості; недавно; пропонувати повний ряд фінансових послуг; комерційні банки; відсоткова ставка банку; приватна особа; призначати відсоток; позичати гроші; коливатися злегка час від часу.

Exercise 7. Fill in the blanks with appropriate words:

1. … deal mainly with individual customers.

(Investment banks; merchant banks; commercial banks)

2. Investment banks aim at … for industry in different financial markets.

(Receiving deposits; lending money; raising funds)

3. The minimum interest rate within a certain country is usually determined by the ….

(Central bank; corporate clients; government)

4. Merchant banks in Britain have greater authority because they … themselves.

(Offer loans; exchange foreign currencies; hold deposits)

5. Whether depositing or borrowing money, a customer is most interested in the ….

(Bank’s service; bank's interest rate; fees)

Exercise 8. Make up the possible word combinations out of the following and translate them:

| 1. to deal with 2. to receive and hold 3. to lend 4.to manage 5. to pay 6. to act as 7. to offer 8. to issue | a. money b. customers’ accounts c. the interest d. individual customers e. government bonds f. loans g. intermediaries h.deposits |

Exercise 9. Find words or words combinations in the text that mean the following:

1. when one company unites with another company and they make a single company;

2. a combination of a commercial bank, an investment bank, and an insurance company offering different financial services;

3. a client of a bank that is a whole company or a large firm;

4. money put in a bank;

5. percentage of money paid by a bank to people who deposited their money with it; percentage of the loan paid to the bank by people who borrowed money from the bank;

6. to get money for some project (usually through an intermediary);

7. money charged by a bank for its services;

8. the money that is used in various countries;

9. a document issued by a government indicating that the money was borrowed and the government promises to give it back with interest to the holder of the document.

V Comprehension

Exercise 10. Which of the three summaries below reflects the contents of the text most accurately? What is wrong with the other two summaries? Identify the mistakes in them.

A)

There are two types of banks: commercial and investment banks (merchant banks in Great Britain). Commercial banks deal mainly with individual customers: they receive and hold their deposits, lend money, manage their customers' accounts, etc. Their profits are made from fees"-charged to their customers for the bank's services. Investment banks deal with corporate clients and raise funds for their clients' projects. Their profits are also made from fees paid to them. Now all commercial and investment banks have merged into 'financial supermarkets". Every bank determines its own interest rate that is advertised to the public.

B)

There are two types of banks: commercial and investment banks (the latter called merchant banks in Great Britain). Commercial banks deal mainly with individual customers: they receive and hold their deposits, lend money, manage their customers' accounts, etc. Their profits are mostly determined by the difference in the interest they pay to people who deposited their money with the bank and the interests they charge to those who borrow money. Investment banks principally deal with rich corporate and individual clients and raise funds for their projects. Their profits are from fees paid to them for their services. Now the difference between commercial and investment banks is slowly disappearing because "financial supermarkets" have appeared, combining the services of commercial banks, investment banks, and insurance companies. Every bank fixes its own rate of interest on the basis of the minimum interest rate determined by the central bank of the country.

C)

There are two types of banks: commercial and investment banks (the latter called merchant banks in Great Britain). Commercial banks deal with both individual and corporate customers: they receive and hold their deposits, lend money, manage customers' accounts, and raise funds for them. Their profits are determined mostly by the interest charged to people who borrow money from them. Investment banks only deal with corporate clients and raise funds for their clients' projects. Their profits are from fees they charge for their services. The difference between commercial and investment banks is slowly disappearing because "financial supermarkets" have appeared. They combine the full range of services offered by the two types of banks as well as by insurance companies. The minimum rate of interest offered by banks is determined by the central bank of the country, but other banks may fix their own interest rates at levels that may be higher or lower than those determined by the central bank.

VI Oral Practice

Exercise 11. Fill in the table and be ready to speak on it.

| Banks |

| Commercial banks |

| ….. |

| deal with |

| individual customers, e.g. … |

| …… |

| aim |

| 1.receive and hold deposits 2. … 3. … 4. … 5. … 6. … |

| 1. lend money 2. … 3. … |

| Financial supermarkets a combination of … |

VII Reading and Comprehension

Exercise 12. Read the text C

Text C Getting a Loan from a Bank

Banks make a profit by lending out money that has been deposited with them. People borrow money from banks for personal reasons (for instance, buying a house) or for business reasons (as starting a business). Only customers of the bank can get a loan from it because the bank has developed confidence in them as a sound financial investment. When granted, the loan is transferred to the customer's account. A loan is a fixed amount of money that is at the customer's disposal for a definite period of time. By the end of that time the money should be paid back.

The borrower must pay back the principal (the sum of money loaned) plus the interest on it. For business loans, the principal and the interest are due by the end of the term of the loan. Personal loans are more commonly paid back in equal parts (installments) during the full period of the loan.

When somebody applies for a loan, the bank always requests information regarding the purpose of the loan, the amount of money requested, as well as how and when the person or organization plans to pay back the principal and the interest. Since a business loan will be repaid from profits received in the business, the bank will try to estimate whether such profits are realistic or not. Personal loans are repaid out of personal income, so the bank will estimate whether the person's income is sufficient to make the required payments.

Some kind of security (usually personal property) will be required for personal loans. For business loans, some assets of the organization applying for a loan will act as security.

Besides these precautions, the bank will estimate whether the sum of money requested is adequate to achieve the purpose of the loan. Banks sometimes prefer to lend more money in order to make sure the project will work and so ensure repayment of the principal and the interest owed them. On the other hand, customers may request less money than they really need because they wish to make repayment easier. But lack of funds may lead to failure of the project, which the bank does not want.

Exercise 13. Identify whether each statement below is true (T) or false (F), according to what you have read in the text. Correct the false statements. Use the following phrases:

Agreement: I agree with you; You are right; Certainly; Exactly so; I fully support you

Disagreement: I can’t agree with you; I am afraid you are mistaken; Not quite so; This is not true; I disagree with the statement that…

1. Money is borrowed from banks for personal or business reasons.

2. Anyone can borrow money from a bank.

3. Bank loans are given to borrowers in cash from hand to hand.

4. Bank loans may be paid back whenever a borrower wants.

5. Both the principal and the interest of a loan must be repaid.

6. Security is seldom required when you borrow money from a bank.

7. Banks try to lend less money than borrowers request.

Exercise 14. Answer the questions:

Exercise 15. State in your own words what you have learned from the text about:

a). reasons for borrowing money from banks and who can borrow it;

b). conditions on which money is lent by banks;

c). information that should be supplied by an applicant for a loan, and the estimates that a bank makes when deciding whether or not to grant a loan;

VIII Reading and Comprehension

Exercise 16. Read the text E and identify the differences between:

a). financial capital and other types of capital;

b). stock capital and debenture capital;

c). preference shares, ordinary shares, and deferred shares.

Text E Financial Capital

Financial capital is the “liquid capital” of a company, such as cash, bonds, shares, etc. there may be other types of capital, including especially the company’s physical assets (land, buildings, machinery, and equipment).

Financial capital is usually subdivided into stock capital (that received from the company’s stocks) and debenture capital. Debenture capital is the money the company has gained from loans –i.e., borrowed by the company.

Stock capital can be classified according to the type of shares- preference shares, ordinary shares, or deferred shares.

Preference stocks have a fixed rate of dividends, meaning that people who hold these always receive an amount of money equal to their dividends. The advantage is that they receive this money before dividends are paid to the holders of ordinary or deferred shares, and even in bad years. The disadvantages are that holders of preference shares do not have the right to vote at shareholders’ meetings and cannot influence decisions.

Holders of ordinary shares have voting rights and the right to elect the company’s senior management. They also have the right to increased dividends when the company enjoys greater profits. The disadvantage is that their dividends go down when profits are smaller, and in bad years they may receive no dividends at all.

Deferred shares are shares with deferred (later) payment of dividends. For instance, they may be paid after a company has reached a certain level of development, or at the time of determining its annual profits.

Exercise 17. Read the text F.

Text F Financial Activities and Their Management

Any person or company starting or doing some business has three questions to answer, all connected to finance.

The first question is, "What long-term investments are necessary?" This means identifying the business to be done, and the buildings, machinery, and equipment needed to do it.

The second question is, "Where and how can the firm get long-term financing to pay for those investments?" Will the firm's own money be sufficient? If not, will it try to interest others to invest in the business and share ownership, or will it borrow money?

The third question is, "How will the firm manage everyday financial activities?" These activities include collecting money from customers, paying suppliers, paying salaries and wages, administrative costs, etc.

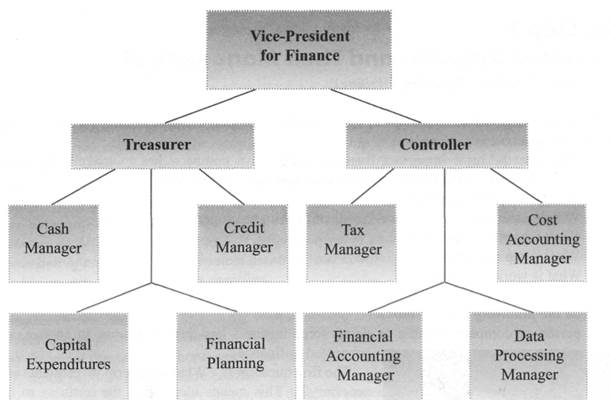

The financial structure of a company is called corporate finance. The Financial Department in a company is responsible for its corporate finance. Financial management is the responsibility of the Vice-President for Finance, who supervises the work of the Financial Department. In Fundamentals of Corporate Finance (Chicago: Irwin, 1995), the authors: Stephen A. Ross, Randolph W. Westerfield, and Bradford D. Jordan suggest the following organizational chart of financial activity in a large firm (p.3), supervised by the Vice-President for Finance.

All the financial activities are aimed at answering the three questions listed above. The answer to the first question is called capital budgeting. It is the process of planning and managing the firm's long-term investments. To do that, the Financial Manager has to try to find opportunities for investments which are worth more to the firm than they cost to be acquired. That means that the amount of cash to be received as a result of an investment should be greater than its cost, i.e., greater than the amount of money spent to gain it.

The answer to the second question is found in capital structure. This structure is a mixture of long-term debt and the equity that a firm uses to finance its operations. Debt is a result of the firm borrowing money to finance its operations. Equity is the value of its property (also used as security for the financing) after deducting all the charges to which that property may be liable. The Financial Manager should decide on the suitable balance of debt and equity - what mixture of debt and equity is best for the firm. He or she should also find the least expensive sources of funding for the firm.

The working capital management is the answer to the third question. Working capital is the firm's short-term assets - for instance, inventory. It also includes short-term liabilities, such as paying suppliers. Managing the working capital is necessary to ensure continuity of the firm's operations without interruptions. It requires a number of decisions, such as how much cash and inventory should be readily accessible at a moment's notice, how to obtain short-term financing, etc.

Decisions made regarding any of these three basic questions of finance involve risks. That is why no firm can avoid some financial losses. But efficient financial management can bring those losses to a minimum, thus maximizing the profits.

Exercise 18. Find in the text and put down English equivalents to the following word combinations:

Довгострокова інвестиція; розподіляти власність; керувати фінансовими діяльностями; корпоративне фінансування; наглядати за роботою; кошторис капіталовкладень; знаходити можливості; довгострокові запозичення; найменш дорогі джерела фінансування; управління оборотним капіталом; короткострокові зобов’язання; уникати фінансових витрат.

Exercise 19. Answer the questions:

1.What are the most important questions of finance?

2.What is a corporate finance?

3. Which managers does the Vice-President for Finance supervise?

4. What is capital budgeting?

5. What is capital structure?

6. What is working capital?

Дата добавления: 2015-10-24; просмотров: 94 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Б. Костная улитка | | | БИЛЕТНАЯ ПРОГРАММА ПО ПАТОЛОГИЧЕСКОЙ ФИЗИОЛОГИИ |