Читайте также:

|

Ratings Definitions

Moody's Rating Symbols

Gradations of creditworthiness are indicated by rating symbols, with each symbol representing a group in which the credit characteristics are broadly the same. There are nine symbols as shown below, from that used to designate least credit risk to that denoting greatest credit risk:

Aaa Aa A Baa Ba B Caa Ca C

Moody's appends numerical modifiers 1, 2, and 3 to each generic rating classification from Aa through Caa.

| Global Long-Term Rating Scale | |

| Aaa | Obligations rated Aaa are judged to be of the highest quality, subject to the lowest level of credit risk. |

| Aa | Obligations rated Aa are judged to be of high quality and are subject to very low credit risk. |

| A | Obligations rated A are judged to be upper-medium grade and are subject to low credit risk |

| Baa | Obligations rated Baa are judged to be medium-grade and subject to moderate credit risk and as such may possess certain speculative characteristics. |

| Ba | Obligations rated Ba are judged to be speculative and are subject to substantial credit risk. |

| B | Obligations rated B are considered speculative and are subject to high credit risk. |

| Caa | Obligations rated Caa are judged to be speculative of poor standing and are subject to very high credit risk. |

| Ca | Obligations rated Ca are highly speculative and are likely in, or very near, default, with some prospect of recovery of principal and interest. |

| C | Obligations rated C are the lowest rated and are typically in default, with little prospect for recovery of principal or interest. |

| Global Short-Term Rating Scale | |

| P-1 | Issuers (or supporting institutions) rated Prime-1 have a superior ability to repay short-term debt obligations. |

| P-2 | Issuers (or supporting institutions) rated Prime-2 have a strong ability to repay short-term debt obligations. |

| P-3 | Issuers (or supporting institutions) rated Prime-3 have an acceptable ability to repay short-term obligations. |

| NP | Issuers (or supporting institutions) rated Not Prime do not fall within any of the Prime rating categories. |

| National Scale Long-Term Ratings | |

| Aaa.n | Issuers or issues rated Aaa.n demonstrate the strongest creditworthiness relative to other domestic issuers. |

| Aa.n | Issuers or issues rated Aa.n demonstrate very strong creditworthiness relative to other domestic issuers. |

| A.n | Issuers or issues rated A.n present above-average creditworthiness relative to other domestic issuers. |

| Baa.n | Issuers or issues rated Baa.n represent average creditworthiness relative to other domestic issuers. |

| Ba.n | Issuers or issues rated Ba.n demonstrate below-average creditworthiness relative to other domestic issuers. |

| B.n | Issuers or issues rated B.n demonstrate weak creditworthiness relative to other domestic issuers. |

| Caa.n | Issuers or issues rated Caa.n demonstrate very weak creditworthiness relative to other domestic issuers. |

| Ca.n | Issuers or issues rated Ca.n demonstrate extremely weak creditworthiness relative to other domestic issuers. |

| C.n | Issuers or issues rated C.n demonstrate the weakest creditworthiness relative to other domestic issuers. |

| Bank Financial Strength Ratings | |

| A | Banks rated A possess superior intrinsic financial strength. Typically, they will be institutions with highly valuable and defensible business franchises, strong financial fundamentals, and a very predictable and stable operating environment. |

| B | Banks rated B possess strong intrinsic financial strength. Typically, they will be institutions with valuable and defensible business franchises, good financial fundamentals, and a predictable and stable operating environment. |

| C | Banks rated C possess adequate intrinsic financial strength. Typically, they will be institutions with more limited but still valuable business franchises. These banks will display either acceptable financial fundamentals within a predictable and stable operating environment, or good financial fundamentals within a less predictable and stable operating environment. |

| D | Banks rated D display modest intrinsic financial strength, potentially requiring some outside support at times. Such institutions may be limited by one or more of the following factors: a weak business franchise; financial fundamentals that are deficient in one or more respects; or an unpredictable and unstable operating environment. |

| E | Banks rated E display very modest intrinsic financial strength, with a higher likelihood of periodic outside support or an eventual need for outside assistance. Such institutions may be limited by one or more of the following factors: a weak and limited business franchise; financial fundamentals that are materially deficient in one or more respects; or a highly unpredictable or unstable operating environment. |

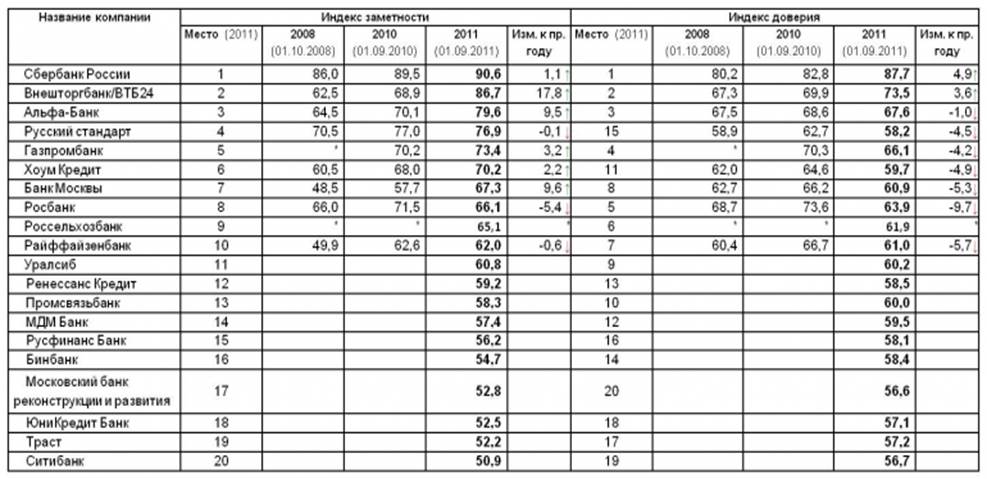

Рейтинг узнаваемости и доверия крупнейших банков 2011

Ромир – крупнейший независимый российский холдинг, специализирующийся на маркетинговых, медиа и социально-экономических исследованиях. Является эксклюзивным представителем международной исследовательской ассоциации Gallup International/WIN. Имеет наиболее мощную региональную исследовательскую сеть, состоящую из более чем 30 совместных компаний в ключевых регионах России.

Рейтинги узнаваемости и доверия потребителей были составлены на основе всероссийского опроса общественного мнения по международной методике Global Reputation Index (GRI).

Во всероссийском опросе приняли участие 1500 жителей России, в возрасте от 18 до 60 лет и старше, из 8 федеральных округов России.

Топ-20 лидеров среди крупнейших банков России по узнаваемости и доверию со стороны россиян

Дата добавления: 2015-10-23; просмотров: 62 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Тематика контрольных работ | | | Розрахунок шкали (R) рейтингу студента. |