A handful of listed businesses are showing all the signs of being well ‘behind the curve’ when it comes to their response to investor and stakeholder concerns on issues surrounding sustainability and climate change.

In the last year global oil, gas and coal companies have expanded their reported reserves, even though 80% of existing reserves cannot be used in order to avert the most damaging effects of climate change, according to the Intergovernmental Panel on Climate Change (IPCC).

The top five ranked oil and gas companies – Gazprom, Rosneft, PetroChina, ExxonMobil and Lukoil – account for over 50% of overall oil and gas list emissions and much of the emissions growth.

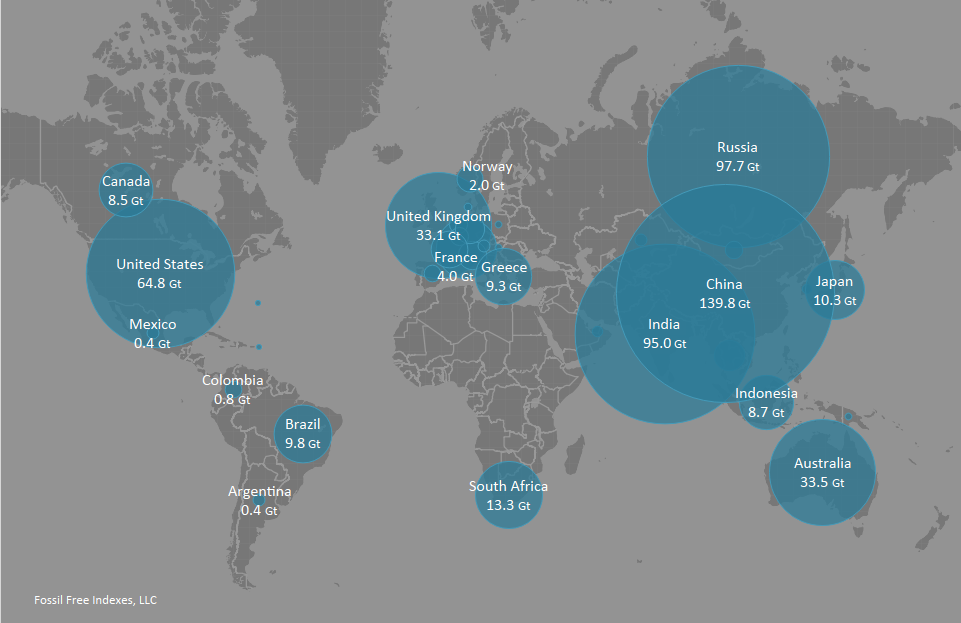

Today, ahead of #GlobalDivestmentDay, The Carbon Underground 2015: The World’s Top 200 Public Companies Ranked by the Carbon Content of Their Fossil FOSL -0.35% Fuel Reserves, a report by Fossil Free Indexes (FFI), finds that the potential carbon dioxide (CO2) emissions from the reported reserves of the top 200 public oil, coal and gas companies have increased to 555 gigatons (Gt) from 546 Gt last year and 504 Gt in 2010.

This amount is almost five times more than can be burned through the year 2050 for the world to have an 80% chance of limiting global temperature rise to two degrees celsius -the amount likely to prevent the most dangerous impacts of climate change, according to the report.

“The report’s primary finding, that reserves-based emissions of the Carbon Underground 200 continue to grow as the carbon budget gets smaller – shows the stakes are rising” says Stuart Braman, FFI founder and CEO. Its fossil free US large-cap index FFIUS – which is based on the S&P 500, outperformed it by 1.5% in 2014. While he doesn’t claim potential outperformance every year, the results “illustrate both the value of a carbon-aware investment strategy and the potential cost of ignoring the risk of stranded assets”, he says.

Ben van Buerden, CEO of Royal Dutch Shell, is making a speech in London tonight at International Petroleum Week. According to the Financial Times, he is expected to say that the industry must make the case that the world’s energy needs will underpin the use of fossil fuels for decades to come, so instead of ruling them out there should be a focus on lowering carbon emissions.

Mr van Buerden is also due to argue that the most important way to cut emissions is to shift from coal to natural gas. The FT quotes him as saying that when burnt for power, gas produces half the CO2 that coal does.

According to the FFI report, just 10 coal companies expanded reserves-based emissions by a combined 50 Gt CO2 since 2010. During the same period, 10 oil and gas companies increased reserves-based emissions by 11 Gt CO2. But the potential emissions from coal reserves increased by 5.6Gt CO2 last year, one and a half times more than the amount from oil and gas reserves.

The energy industry is bracing itself as representatives from more than 190 countries meet in Geneva today to create the negotiating text for a climate pact that is due to be signed in Paris at the United Nations Climate Conference (COP21) in December. The collapse in oil prices in 2014 has already had an impact on capital expenditure and has increased ‘stranded asset’ risks.

New research from University College London suggests one-third of oil reserves, one-half of gas reserves and over 80% of coal reserves must remain unused through 2050 to have a 50% chance of meeting the ‘two degree’ warming limit.

Governments, investors, advocacy groups and civil society continue to take note of these concerns. Ed Davey, the UK Energy Secretary, has suggested that fossil fuels could be the “sub-prime assets of the future” and a risk to pension funds. At the Bank of England, Governor Mark Carney expressed his views on stranded asset risks in letters to Joan Walley, Chair of the Environmental Audit Committee.

As climate change awareness grows, “divestment is increasingly perceived as a way to reduce financial risks and to protect the long-term results of investment portfolios, in line with fiduciary responsibilities of asset owners and managers” says the FFI report.

The Montreal Pledge promises to measure and disclose the carbon footprint of portfolios, and take action using that information. It is sponsored by the Principles For Responsible Investment (PRI) and has been taken to date by a group of institutional investors with $500bn in combined assets. It intends to attract $3 trillion in commitments by the end of 2015, in time for the conference in Paris.

Дата добавления: 2015-10-24; просмотров: 109 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Behind The Curve' On Climate Risk 2/12/2015 | | | Yeah yeah yeah, oh ohh... |