Pound;32 BILLION goes begging in uncollected tax... but that's still an improvement on last year, says HMRC

By HARRY GLASS

PUBLISHED: 15:35 GMT, 18 October 2012 | UPDATED: 15:55 GMT, 18 October 2012

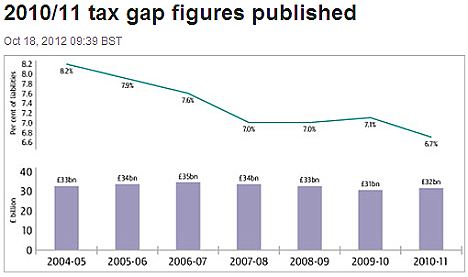

The Treasury suffered less through uncollected tax last year than in 2010, according to HM Revenue and Customs, but the 'tax gap' was still a sizeable £32billion.

Government coffers should swell by a certain amount each year, calculated by HMRC, and when there is any shortfall - for reasons from tax evasion to errors - this is known as the tax gap.

The estimated gap for 2010/11 was 6.7 per cent of tax due, compared to 7.1 per cent in 2009/10.

Tax evasion and avoidance, the hidden economy - people doing business hand-to-hand in cash, bypassing any tax - criminal attacks and where tax cannot be collected because businesses have become insolvent are all reasons behind the discrepancy.

Exchequer Secretary David Gauke MP said: 'These tax gap figures show that the vast majority of people and businesses pay the tax they owe on time.

'Last year £468.9billion was collected, including £13.9billion brought in through HMRC’s work policing the rules.

'Every pound of tax that is not collected puts a greater burden on honest taxpayers and public services, so the Government and HMRC will continue to work together to make it harder for individuals and businesses not to pay the taxes that are due.'

'We are determined to reduce the tax gap and have made £917million available to help HMRC tackle avoidance and evasion.'

The gap as a percentage of liabilities was 8.2 per cent in 2004/5, so it has declined 1.5 percentage points since.

HMRC’s tax gap estimates go back as far as 2004/5. These are regularly revised to take account of the latest available information - it it tricky, because it can take a long time to settle some tax enquiries. Today's figures include revisions going back to 2004, including downward revisions by the Office for National Statistics that affect the VAT gap.

Lin Homer, HMRC’s chief executive, said: 'Our determination to support the honest majority and to crack down on evasion, avoidance and fraud have kept downward pressure on the tax gap.

'We are determined to do more and we are devoting increasing resources to pursuing those who do not pay the tax they owe, while making it easier for people and business to comply with their tax obligations.'

The UK is one of the few countries to publish its estimate of the tax gap. Caution must be exercised when comparing internationally, as methodologies, the periods that estimates relate to, and tax systems differ, but figures indicate the UK compares favourably internationally (see table)

Tax gap as % of tax due

· Mexico 23%

· USA 14%

· Sweden 10%

· UK 6.7%

(2057s)

Дата добавления: 2015-10-28; просмотров: 103 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| http://tobaccofreecenter.org/taxation_and_price | | | РОЗДІЛ VIII. ЕКОЛОГІЧНИЙ ПОДАТОК |