Читайте также:

|

In addition, a federal foreign tax credit is allowed for foreign income taxes paid. This credit is limited to the portion of federal income tax arising due to foreign source income. The credit is available to all taxpayers.

Business credits and the foreign tax credit may be offset taxes in other years.

States and some localities offer a variety of credits that vary by jurisdiction. States typically grant a credit to resident individuals for income taxes paid to other states, generally limited in proportion to income taxed in the other state(s).

[edit]Alternative Minimum Tax

Main article: Alternative Minimum Tax

Taxpayers must pay the higher of the regular income tax or the Alternative Minimum Tax (AMT). Taxpayers who have paid AMT in prior years may claim a credit against regular tax for the prior AMT. The credit is limited so that regular tax is not reduced below current year AMT.

AMT is imposed at a nearly flat rate (20% for corporations, 26% or 28% for individuals, estates, and trusts) on taxable income as modified for AMT. Key differences between regular taxable income and AMT taxable income include:

[edit]Accounting periods and methods

The United States tax system allows individuals and entities to choose their tax year. Most individuals choose the calendar year. There are restrictions on choice of tax year for some closely held entities. Taxpayers may change their tax year in certain circumstances, and such change may require IRS approval.

Taxpayers must determine their taxable income based on their method of accounting for the particular activity. Most individuals use the cash method for all activities. Under this method, income is recognized when received and deductions taken when paid. Taxpayers may choose or be required to use the accrual method for some activities. Under this method, income is recognized when the right to receive it arises, and deductions are taken when the liability to pay arises and the amount can be reasonably determined. Taxpayers recognizing cost of goods sold on inventory must use the accrual method with respect to sales and costs of the inventory.

Methods of accounting may differ for financial reporting and tax purposes. Specific methods are specified for certain types of income or expenses. Gain on sale of property other than inventory may be recognized at the time of sale or over the period in which installment sale payments are received. Income from long term contracts must be recognized ratably over the term of the contract, not just at completion. Other special rules also apply.

[edit]Tax exempt entities

Main article: Tax exemption

U.S. tax law exempts certain types of entities from income and some other taxes. These provisions arose during the late 19th century. Charitable organizations and cooperatives may apply to the IRS for tax exemption. Exempt organizations are still taxed on any business income. An organization which participates in lobbying, political campaigning, or certain other activities may lose its exempt status. Special taxes apply to prohibited transactions and activities of tax exempt entities.

[edit]Special taxes

There are many federal tax rules designed to prevent people from abusing the tax system. Provisions related to these taxes are often complex. Such rules include:

[edit]Special industries

Tax rules recognize that some types of businesses do not earn income in the traditional manner and thus require special provisions. For example, Insurance companies must ultimately pay claims to some policy holders from the amounts received as premiums. These claims may happen years after the premium payment. Computing the future amount of claims requires actuarial estimates until claims are actually paid. Thus, recognizing premium income as received and claims expenses as paid would seriously distort an insurance company's income.

Special rules apply to some or all items in the following industries:

In addition, mutual funds (regulated investment companies) are subject to special rules allowing them to be taxed only at the owner level. The company must report to each owner his/her share of ordinary income, capital gains, and creditable foreign taxes. The owners then include these items in their own tax calculation. The fund itself is not taxed, and distributions are treated as a return of capital to the owners. Similar rules apply to real estate investment trusts and real estate mortgage investment conduits.

[edit]International aspects

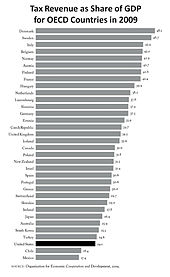

Total tax revenue as share of GDP for OECD countries in 2009. The tax burden in the US (black) is relatively small in comparison to other industrialised countries.[17]

Federal income tax is imposed on citizens, residents, and U.S. corporations based on their worldwide income. To mitigate double taxation, a credit is allowed for foreign income taxes. This foreign tax credit is limited to that part of current year tax caused by foreign source income. Determining such part involves determining the source of income and allocating and apportioning deductions to that income. States tax resident individuals and corporations on their worldwide income, but few allow a credit for foreign taxes.

Federal and state income taxes are imposed on foreign persons on their income within the jurisdiction. Federal rules tax interest, dividends, royalties, and certain other income of foreign persons at a flat rate of 30%. This rate is often reduced under tax treaties. Foreign persons are taxed on income from a U.S. business similarly to U.S. persons. Foreign persons are not subject to U.S. tax on capital gains and certain other income. The states tax non-resident individuals only on income earned within the state (wages, etc.) and tax individuals and corporations on business income apportioned to the state. Most of the states otherwise do not impose income tax on persons not resident in the state.

The United States has income tax treaties with over 65 countries. These treaties reduce the chance of double taxation by allowing each country to fully tax its citizens and residents and reducing the amount the other country can tax them. Generally the treaties provide for reduced rates of tax on investment income and limits as to which business income can be taxed. The treaties each define which taxpayers can benefit from the treaty.

[edit]Social Security tax

Main article: Federal Insurance Contributions Act tax

The United States social insurance system is funded by a tax similar to an income tax. Social Security tax of 6.2% is imposed on wages paid to employees. The tax is imposed on both the employer and the employee. For 2011 and 2012, the employee tax has been reduced by 2% to 4.2%. The maximum amount of wages subject to the tax for 2009, 2010, and 2011 was/is $106,800. This amount is indexed for inflation. A companion Medicare Tax of 1.45% of wages is imposed on employers and employees, with no limitation. A self-employment tax in like amounts (totaling 15.3%, 13.3% for 2011 and 2012) is imposed on self-employed persons.

[edit]Withholding of tax

Main article: Tax withholding in the United States

Persons paying wages or making certain payments to foreign persons are required to withhold income tax from such payments. The Social Security tax is one type of withholding tax. Withholding of income tax is also required. Income tax withholding on wages is based on declarations by employees and tables provided by the IRS. Persons paying interest, dividends, royalties, and certain other amounts to foreign persons must also withhold income tax at a flat rate of 30%. This rate may be reduced by a tax treaty. Additional backup withholding provisions apply to some payments of interest or dividends to U.S. persons. The amount of income tax withheld is treated as a payment of tax by the person receiving the payment on which tax was withheld.

[edit]Tax returns

Individuals (with income above a minimum level), corporations, partnerships, estates, and trusts must file annual reports, called tax returns, with federal and appropriate state tax authorities. These returns vary greatly in complexity level depending on the type of filer and complexity of their affairs. On the return, the taxpayer reports income and deductions, calculates the amount of tax owed, reports payments and credits, and calculates the balance due.

Federal individual, estate, and trust income tax returns are due by April 15 for most taxpayers. Corporate returns are due two and one half months following the corporation's year end. Partnership returns are due three and one half months following the partnership's year end. Tax exempt entity returns are due four and one half months following the entity's year end. All federal returns may be extended, with most extensions available upon merely filing a single page form. Due dates and extension provisions for state and local income tax returns vary.

Income tax returns generally consist of the basic form with attached forms and schedules. Several forms are available for individuals and corporations, depending on complexity and nature of the taxpayer's affairs. Many individuals are able to use the one page Form 1040-EZ, which requires no attachments except wage statements from employers (Forms W-2). Individuals claiming itemized deductions must complete Schedule A. Similar schedules apply for interest (B), dividends (B), business income (C), capital gains (D), farm income (F), and self-employment tax (SE). All taxpayers must file those forms for credits, depreciation, AMT, and other items that apply to them.

Electronic filing of tax returns may be done for taxpayers by registered tax preparers.

If a taxpayer discovers an error on a return, or determines that tax for a year should be different, the taxpayer should file an amended return. These returns constitute claims for refund if taxes are determined to have been overpaid.

[edit]Tax examinations

People filing tax forms in 1920.

The IRS and state, and local tax authorities may examine a tax return and propose changes. Changes to tax returns may be made with minimal advance involvement by taxpayers, such as changes to wage or dividend income to correct errors. Other examination of returns may require extensive taxpayer involvement, such as an audit by the IRS. These audits often require that taxpayers provide the IRS or other tax authority access to records of income and deductions. Audits of businesses are usually conducted by IRS personnel at the business location.

Changes to returns are subject to appeal by the taxpayer, including going to court. IRS changes are often first issued as proposed adjustments. The taxpayer may agree to the proposal, or may advise the IRS why it disagrees. Proposed adjustments are often resolved by the IRS and taxpayer agreeing to what the adjustment should be. For those adjustments to which agreement is not reached, the IRS issues a 30-day letter advising of the adjustment. The taxpayer mayappeal this preliminary assessment within 30 days within the IRS.

The Appeals Division reviews the IRS field team determination and taxpayer arguments, and often proposes a solution that the IRS team and the taxpayer find acceptable. Where agreement is still not reached, the IRS issues an assessment as a notice of deficiency or 90-day letter. The taxpayer then has three choices: file suit in United States Tax Court without paying the tax, pay the tax and sue for refund in regular court, or pay the tax and be done. Recourse to court can be costly and time consuming, but is often successful.

IRS computers routinely make adjustments to correct mechanical errors in returns. In addition, the IRS conducts an extensive document matching computer program that compares taxpayer amounts of wages, interest, dividends, and other items to amounts reported by taxpayers. These programs automatically issue 30-day letters advising of proposed changes. Only a very small percentage of tax returns are actually examined. These are selected by a combination of computer analysis of return information and random sampling. The IRS has long maintained a program to identify patterns on returns most likely to require adjustment.

Procedures for examination by state and local authorities vary by jurisdiction.

[edit] Tax collection

Taxpayers are required to voluntarily pay all taxes owed based on the self-assessed tax returns, as adjusted. The IRS allows taxpayers to extent payment in certain circumstances, and provides time payment plans that include interest and a "penalty" that is merely added interest. Where taxpayers do not pay tax owed, the IRS has strong means to enforce collection. These include the ability to levy bank accounts and seize property. Generally, significant advance notice is given before levy or seizure. However, in certain rarely used jeopardy assessments the IRS may immediately seize money and property. The IRS Collection Divisions are responsible for most collection activities.

[edit] Statute of limitations

Taxpayers and the IRS are both precluded from changing tax after a certain period of time. Generally, this period is three years from the later of the due date of the original tax return or the date the original return was filed. The IRS has an additional three more years to make changes if the taxpayer has substantially understated gross income. The period under which the IRS may make changes is unlimited in the case of fraud by the taxpayer.

[edit]Penalties

Main article: IRS penalties

Taxpayers who fail to file returns, file late, or file returns that are wrong, may be subject to penalties. These penalties vary based on the type of failure. Some penalties are computed like interest, some are fixed amounts, and some are based on other measures. Penalties for filing or paying late are generally based on the amount of tax that should have been paid and the degree of lateness. Penalties for failures related to certain forms are fixed amounts, and vary by form from very small to huge.

Intentional failures, including tax fraud, may result in criminal penalties. These penalties may include jail time or forfeiture of property. Criminal penalties are assessed in coordination with the United States Department of Justice.

[edit]History

[edit] Constitutional

Main article: United States income tax (legal history)

See also: Taxation history of the United States

President Abraham Lincoln and the United States Congressintroduced in 1861 the first personal income tax in the United States.

Article I, Section 8, Clause 1 of the United States Constitution (the "Taxing and Spending Clause"), specifies Congress's power to impose "Taxes, Duties, Imposts and Excises," but Article I, Section 8 requires that, "Duties, Imposts and Excises shall be uniform throughout the United States."[18]

The Constitution specifically limited Congress' ability to impose direct taxes, by requiring Congress to distribute direct taxes in proportion to each state's census population. It was thought that head taxes and property taxes (slaves could be taxed as either or both) were likely to be abused, and that they bore no relation to the activities in which the federal government had a legitimate interest. The fourth clause of section 9 therefore specifies that, "No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken."

Taxation was also the subject of Federalist No. 33 penned secretly by the Federalist Alexander Hamilton under the pseudonym Publius. In it, he asserts that the wording of the "Necessary and Proper" clause should serve as guidelines for the legislation of laws regarding taxation. The legislative branch is to be the judge, but any abuse of those powers of judging can be overturned by the people, whether as states or as a larger group.

The courts have generally held that direct taxes are limited to taxes on people (variously called "capitation", "poll tax" or "head tax") and property.[19] All other taxes are commonly referred to as "indirect taxes," because they tax an event, rather than a person or property per se. [20] What seemed to be a straightforward limitation on the power of the legislature based on the subject of the tax proved inexact and unclear when applied to an income tax, which can be arguably viewed either as a direct or an indirect tax.

[edit] Early federal income taxes

The first income tax suggested in the United States was during the War of 1812. The idea for the tax was based on the British Tax Act of 1798. The British tax law applied progressive rates to income. The British tax rates were 0.08% on income above £60 and 10% on income above £200. The tax proposal was developed in 1814. Because the treaty of Ghent was signed in 1815, ending hostilities and the need for additional revenue, the tax was never imposed in the United States.

In order to help pay for its war effort in the American Civil War, Congress imposed its first personal income tax in 1861.[21] It was part of the Revenue Act of 1861 (3% of all incomes over US $800).[22] This tax was repealed and replaced by another income tax in 1862.[23]

In 1894, Democrats in Congress passed the Wilson-Gorman tariff, which imposed the first peacetime income tax. The rate was 2% on income over $4000, which meant fewer than 10% of households would pay any. The purpose of the income tax was to make up for revenue that would be lost by tariff reductions.[24]

In 1895 the United States Supreme Court, in its ruling in Pollock v. Farmers' Loan & Trust Co., held a tax based on receipts from the use of property to be unconstitutional. The Court held that taxes on rents from real estate, on interest income from personal property and other income from personal property (which includes dividend income) were treated as direct taxes on property, and therefore had to be apportioned (divided among the states based on their populations). Since apportionment of income taxes is impractical, this had the effect of prohibiting a federal tax on income from property. However, the Court affirmed that the Constitution did not deny Congress the power to impose a tax on real and personal property, and it affirmed that such would be a direct tax.[25] Due to the political difficulties of taxing individual wages without taxing income from property, a federal income tax was impractical from the time of the Pollock decision until the time of ratification of the Sixteenth Amendment (below).

[edit] Ratification of the Sixteenth Amendment

Main article: Sixteenth Amendment to the United States Constitution

Amendment XVI in the National Archives

In response, Congress proposed the Sixteenth Amendment (ratified by the requisite number of states in 1913),[26] which states:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

The Supreme Court in Brushaber v. Union Pacific Railroad, 240 U.S. 1 (1916), indicated that the amendment did not expand the federal government's existing power to tax income (meaning profit or gain from any source) but rather removed the possibility of classifying an income tax as a direct tax on the basis of the source of the income. The Amendment removed the need for the income tax to be apportioned among the states on the basis of population. Income taxes are required, however, to abide by the law of geographical uniformity.

Some tax protesters and others opposed to income taxes cite what they contend is evidence that the Sixteenth Amendment was never properly ratified, based in large part on materials sold by William J. Benson. In December 2007, Benson's "Defense Reliance Package" containing his non-ratification argument which he offered for sale on the Internet, was ruled by a federal court to be a "fraud perpetrated by Benson" that had "caused needless confusion and a waste of the customers' and the IRS' time and resources."[27] The court stated: "Benson has failed to point to evidence that would create a genuinely disputed fact regarding whether the Sixteenth Amendment was properly ratified or whether United States Citizens are legally obligated to pay federal taxes."[28] See also Tax protester Sixteenth Amendment arguments.

[edit] Modern interpretation of the power to tax incomes

The modern interpretation of the Sixteenth Amendment taxation power can be found in Commissioner v. Glenshaw Glass Co. 348 U.S. 426 (1955). In that case, a taxpayer had received an award of punitive damages from a competitor for antitrust violations and sought to avoid paying taxes on that award. The Court observed that Congress, in imposing the income tax, had defined gross income, under the Internal Revenue Code of 1939, to include:

gains, profits, and income derived from salaries, wages or compensation for personal service... of whatever kind and in whatever form paid, or from professions, vocations, trades, businesses, commerce, or sales, or dealings in property, whether real or personal, growing out of the ownership or use of or interest in such property; also from interest, rent, dividends, securities, or the transaction of any business carried on for gain or profit, or gains or profits and income derived from any source whatever.[29]

(Note: The Glenshaw Glass case was an interpretation of the definition of "gross income" in section 22 of the Internal Revenue Code of 1939. The successor to section 22 of the 1939 Code is section 61 of the current Internal Revenue Code of 1986, as amended.)

The Court held that "this language was used by Congress to exert in this field the full measure of its taxing power", id., and that "the Court has given a liberal construction to this broad phraseology in recognition of the intention of Congress to tax all gains except those specifically exempted."[30]

The Court then enunciated what is now understood by Congress and the Courts to be the definition of taxable income, "instances of undeniable accessions to wealth, clearly realized, and over which the taxpayers have complete dominion." Id. at 431. The defendant in that case suggested that a 1954 rewording of the tax code had limited the income that could be taxed, a position which the Court rejected, stating:

The definition of gross income has been simplified, but no effect upon its present broad scope was intended. Certainly punitive damages cannot reasonably be classified as gifts, nor do they come under any other exemption provision in the Code. We would do violence to the plain meaning of the statute and restrict a clear legislative attempt to bring the taxing power to bear upon all receipts constitutionally taxable were we to say that the payments in question here are not gross income.[31]

Tax statutes passed after the ratification of the Sixteenth Amendment in 1913 are sometimes referred to as the "modern" tax statutes. Hundreds of Congressional acts have been passed since 1913, as well as several codifications (i.e., topical reorganizations) of the statutes (seeCodification).

In Central Illinois Public Service Co. v. United States, 435 U.S. 21 (1978), the U.S. Supreme Court confirmed that wages and income are not identical as far as taxes on income are concerned, because income not only includes wages, but any other gains as well. The Court in that case noted that in enacting taxation legislation, Congress "chose not to return to the inclusive language of the Tariff Act of 1913, but, specifically, 'in the interest of simplicity and ease of administration,' confined the obligation to withhold [income taxes] to 'salaries, wages, and other forms of compensation for personal services'" and that "committee reports... stated consistently that 'wages' meant remuneration 'if paid for services performed by an employee for his employer'".[32]

Other courts have noted this distinction in upholding the taxation not only of wages, but also of personal gain derived from other sources, recognizing some limitation to the reach of income taxation. For example, in Conner v. United States, 303 F. Supp. 1187 (S.D. Tex. 1969), aff’d in part and rev’d in part, 439 F.2d 974 (5th Cir. 1971), a couple had lost their home to a fire, and had received compensation for their loss from the insurance company, partly in the form of hotel costs reimbursed. The court acknowledged the authority of the IRS to assess taxes on all forms of payment, but did not permit taxation on the compensation provided by the insurance company, because unlike a wage or a sale of goods at a profit, this was not a gain. As the Court noted, "Congress has taxed income, not compensation".

By contrast, other courts have interpreted the Constitution as providing even broader taxation powers for Congress. In Murphy v. IRS, the United States Court of Appeals for the District of Columbia Circuit upheld the federal income tax imposed on a monetary settlement recovery that the same court had previously indicated was not income, stating: "[a]lthough the 'Congress cannot make a thing income which is not so in fact,' [... ] it can label a thing income and tax it, so long as it acts within its constitutional authority, which includes not only the Sixteenth Amendment but also Article I, Sections 8 and 9."[33]

Similarly, in Penn Mutual Indemnity Co. v. Commissioner, the United States Court of Appeals for the Third Circuit indicated that Congress could properly impose the federal income tax on a receipt of money, regardless of what that receipt of money is called:

It could well be argued that the tax involved here [an income tax] is an "excise tax" based upon the receipt of money by the taxpayer. It certainly is not a tax on property and it certainly is not a capitation tax; therefore, it need not be apportioned. [... ] Congress has the power to impose taxes generally, and if the particular imposition does not run afoul of any constitutional restrictions then the tax is lawful, call it what you will.[34]

[edit] Income tax rates in history

[edit] History of top rates

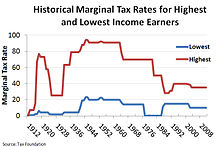

Historical federal marginal tax rates for income for the lowest and highest income earners in the US.[35]

| [hide]History of income tax rates adjusted for inflation (1913-2010)[39] | |||||||

| Number of | First Bracket | Top Bracket | |||||

| Year | Brackets | Rate | Rate | Income | Adj. 2011 | Comment | |

| 1% | 7% | $500,000 | $11.3M | First permanent income tax | |||

| 2% | 67% | $2,000,000 | $35M | World War I financing | |||

| 1.5% | 25% | $100,000 | $1.28M | Post war reductions | |||

| 4% | 63% | $1,000,000 | $16.4M | Depression era | |||

| 4% | 79% | $5,000,000 | $80.7M | ||||

| 10% | 81% | $5,000,000 | $76.3M | World War II | |||

| 19% | 88% | $200,000 | $2.75M | Revenue Act of 1942 | |||

| 23% | 94% | $200,000 | $2.54M | Individual Income Tax Act of 1944 | |||

| 20% | 91% | $200,000 | $2.30M | ||||

| 16% | 77% | $400,000 | $2.85M | Tax reduction during Vietnam war | |||

| 14% | 70% | $200,000 | $1.42M | ||||

| 14% | 70% | $212,000 | $532k | Reagan era tax cuts | |||

| 12% | 50% | $106,000 | $199k | Reagan era tax cuts | |||

| 11% | 38.5% | $90,000 | $178k | Reagan era tax cuts | |||

| 15% | 28% | $29,750 | $56k | Reagan era tax cuts | |||

| 15% | 31% | $82,150 | $135k | ||||

| 15% | 39.6% | $250,000 | $388k | Omnibus Budget Reconciliation Act of 1993 | |||

| 10% | 35% | $311,950 | $380k | Bush tax cuts | |||

| 10% | 35% | $379,150 | $379k |

[edit] Federal income tax rates

Дата добавления: 0000-00-00; просмотров: 123 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Income tax in the United States 2 страница | | | Income tax in the United States 4 страница |