Читайте также:

|

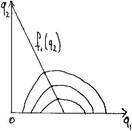

§ Profit ↑ as we move  down.

down.

§ As we move down, the firm 2’s output = 0=> firm 1 – monopolist.

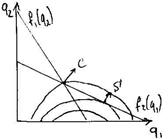

§ Cournot equilibrium.

§ Optimum q2 for F2 will be the function of beliefs concerning the output of F1.

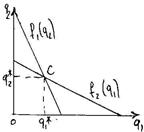

§ C – point when the market is shared – cournot equilibrium.

§  - optimum choices.

- optimum choices.

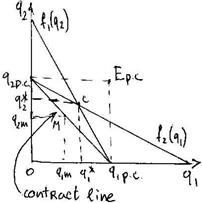

Market equilibrium in different market structures.

§  C – Cournot equilibrium.

C – Cournot equilibrium.

§ Contract line – firms collude and become a monopoly.

§ Output under monopoly<Output under duopoly<Output under perfect competition.

§ The final output of the industry and of two firms is now the lowest.

§

Algebraic explanation of the Cournot model.

|

|

à

à  à

à

If the costs are intro into the analysis the equilibrium quantities and output will be:

Stackelberg model (quantity leadership model).

2 firms are considered, but not identical. Firm1 is a leader, a dominant one, Firm2 – follower, who builds up the strategy according to the behavior of Firm1. Firm2 has a reaction function.

The leader doesn’t react to the steps of the Firm2. But he recognizes that it reacts to his behavior.

For the leader there won’t be a reaction function:

For the leader there won’t be a reaction function:

§  we shall combine reaction function of Firm2 with isoprofit of Firm1.

we shall combine reaction function of Firm2 with isoprofit of Firm1.

§ Firm1 dominates, Firm2 reacts, at point S both MAX their profits.

§ In Stackelberg model the market is not equally shared. Dominant produce more and have more power, the second produces less. Firm1 – leader in Q.

Contestable markets model.

If the costs of entry to an industry and exit from industry are very low, then there is always a high possibility of the numerous new firms appearance on the market. The market will lose its oligopolistic structure and will become competitive.

Oligopoly and public.

Minuses:

Pluses:

Дата добавления: 2015-10-28; просмотров: 228 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Rules of thumb models. | | | Monopolistic competition. |