Читайте также:

|

In the market there are the following most popular software. Packages and programs: Stadia, Statgraphics, SPSS, Statistica, Meta Stock, Statistica Neural Networks, Neuro Shell, Poly Analyst, Matlab & Simulink, Forecast Pro, …

Part of these programs offer general techniques, which carry either professionally - encyclopedic or training character. Besides the packages do not contain the latest development in the applied statistics.

The programs offer the users to design algorithms of forecasting themselves, and that demands deep theoretical knowledge. And at the same time they do not guarantee the desirable statistical properties of received estimations for the autoregressive analysis of time series (they are not optimal).

Neuropackages require the careful adjustment to a concrete task that is possible only to an expert in this area.

In many cases for the task of forecasting a forecast only a few steps foreword is

offered.

For the construction of forecasts many algorithms use preliminary estimations of the autocorrelation function, that in itself represents a complicated problem, taking into account the necessity of choice about model and operations on short samplings, in situations when there is no confidence of execution of conditions of a stationarity. All this brings methodical mistakes in algorithms and besides breaks the on-line mode.

The mixed models of autoregression-moving average (ARMA) - models in many situations have difficulties in solving the problems of stability, the choice of orders of autoregression and the moving average, that also leads to additional complexities and methodical mistakes.

The packages of the technical analysis do not compete with the statistical programs, as they represent the specific techniques of the study of the diagrams for Forex and Stock market.

The program "AR-CONTROL" is based on the modern algorithms of the estimation of the parameters and, guarantees the optimality of the received results:

Ø consistency

Ø unbiased estimate

Ø effectivness

Ø reaching Rao-Cramer bounds

The program gives the opportunity construction of top and bottom boundaries of the forecast, the opportunity to vary the forecast length in a wide range, short sequences operating, the program run automatically in full with regard to mathematics, in on-line mode and requires relatively small computing resources.

Within the framework of the autoregressive approach, by virtue of the optimality of the used algorithms, the program "AR-CONTROL" relieves the user from the choice between various ways of modeling and approximation of time series, allows to receive accuracy of estimations, wich cannot be done by other methods.

AR-CONTROL forecasting concept

Optimality

Ø Consistency

Estimate  of unknown parameter

of unknown parameter  is called consistent when with the growth of number of observations

is called consistent when with the growth of number of observations  , i.e.

, i.e.  , the estimate tends

, the estimate tends

on probability to  , i.e. for

, i.e. for

Consistency is assimptotic (on number of observations) characteristic and might take place only on large samples that generally are not reached in practice.

Ø Unbiased estimate

Estimate  of unknown parameter

of unknown parameter  is called unbiased if for

is called unbiased if for  the averaging on all possible samples of size

the averaging on all possible samples of size  gives real true value of the

gives real true value of the

assessed parameter:

Unbiasedness characterises “before” assimptotic behaviour of an estimate. The unbiasedness is very important on short sequences.

Ø Effectiveness

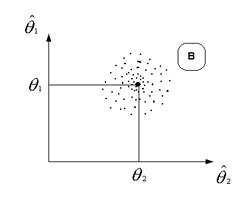

Let’s imagine we have two consistent and unbiased estimates that received with algorithms “A” and “B”:

Twenty realisations of algorithms “A” and “B” for an estimate of 2-dimentional parameter

|

|

| More effective estimate | Less effective estimate |

Effectiveness of estimate having measured by an average square of deviation from real value is the most important characteristic determining the quality and reliability of an estimate:

Ø Reaching Rao-Cramer’s bounds

,

,

where  - Fisher’s information

- Fisher’s information

This determines an effectiveness boundary, i.e. the minimum (on all possible estimates) of average  that can’t be overcome.

that can’t be overcome.

This minimum is the starting point for measuring effectiveness of an estimate.

Ø Know-How

By not fixing model’s order AR-CONTROL resolves the most difficult practical problem – choice for the data set of the best mathematical model.

(The random field method)

Ø Forecast concept

AR-CONTROL algorithm is based on construction of upper and bottom boundaries of forecast that enables depending on goal of analysis to select either the volatility or one of trajectories of output result.

Дата добавления: 2015-10-26; просмотров: 173 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Brief scientific review | | | Расчет количества потребителей |