Читайте также:

|

XVI. Match the words above with the definitions which follow:

| top management, staff, commercial bank, organisation chart, chief executive officer, audit, board of directors, branch banking |

1. Committee elected by shareholders to set the bank's policy and oversee the bank's performance.

2. Most common and most unrestricted type of bank, allowed the most latitude in its sevices and investments.

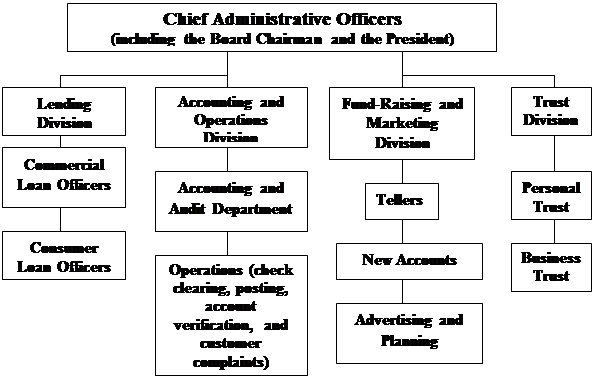

3. Chart showing the interrelationship of positions within an organization in terms of authority and- responsibility.

4. Banks that offer a full range of services from multiple locations, including a head office and one or more-branch offices.

5. Key people in an organization who make most important decisions.

6. Inspection of the accounting records and procedures of any reporting entity by a trained accountant, for the purpose of verifying the accuracy and completeness of the records.

7. Personnel in an organization.

8. Member of staff who has ultimate management responsibility for an organization. He reports directly to a board of directors.

XVII. Fill the spaces with words from the box. Translate the text into Ukrainian:

If a bank is owned and controlled by a holding company, its shareholders elect a... (1) to oversee bank and nonbank firms allied with the same holding company. Selected members of this board of directors... (2) on the bank's board as well. The key problem in such an... (3) is span of control, with... (4) often knowledgeable about banking practices, but less informed about the products and... (5) offered by other subsidiary companies. Moreover, because the bank itself... (6) so many different services in both domestic and foreign... (7), serious problems may not surface for weeks or months.

| organization, board of directors, departments, services, responsibilities, markets, offers, serve, top management |

XVIII. Render the following text into English:

Комерційні банки є основною ланкою кредитної системи держави. В зв’язку з тим, що їх діяльність залежить від суспільної довіри та значно впливає на економічне життя країни, їх організаційна структура і управління ними повинні бути на самому високому рівні.

Акціонери банку вибирають Раду Директорів, які мають великі повноваження для виконання своїх зобов’язань. Від них очікується прийняття таких стратегічних рішень і така якість керування діяльністю банку, які забезпечать безпеку фондів та рентабельність операцій. Однак Рада Директорів не керує безпосередньо повсякденними операціями банку. Директори вибирають голову Ради Директорів (голова правління), який постійно інформує Раду Директорів про становище банку та про практичну реалізацію прийнятої ним політики.

Президент є адміністративним головою банку і відповідає за управління оперативною діяльністю банку. Голова правління, президент, а також віце-голова складають вище керівництво банку. Вони ведуть справи банку, наймають службовців та контролюють їх роботу. До числа інших високих посадовців у банку відносять віце-президентів, що очолюють лінійні управління, робітників траст-відділу, скарбника і інших службовців, що відповідають за здійснення банківських операцій.

У банківських відділах вищою посадовою особою є управляючий, який підпорядковується керівнику відповідного управління у головній конторі.

Кількість банківських управлінь та відділів залежить від величини та характеру діяльності банку. Але відсутність того чи іншого відділу зовсім не означає, що ці операції банком не виконуються. Спеціальні відділи організують тільки в тих банках, де об’єм операцій настільки великий, що для виконання їх потребують декілька працівників.

В організаційній структурі банків реалізуються як оперативні так і штабні функції. До перших відносять функції, що безпосередньо пов’язані з виконанням поставлених перед банком завдань, - це такі види діяльності як кредитування, інвестування, довірчі операції, прийом внесків та їх обслуговування та ін. Функції штабного персоналу – це надання консультацій, а також бухгалтерський облік, аналіз господарської діяльності, прийом на роботу (надання робочих місць) та підвищення кваліфікації службовців, маркетинг, контроль, методична робота, планування будівництва та ремонт. У невеликих банках ці функції не розділяють і деякі керівники та рядові службовці займаються і тим, і іншим. Чим більший банк, тим чіткіше розмежовуються оперативні та штабні функції.

Text B

Included in this group are (a) London clearing banks (National Westminster Bank, Lloyds Bank, Barclays Bank, Midland Bank, Coutts & Co.), (b) Scottish clearing banks (Bank of Scotland, Clydesdale Bank. Royal Bank of Scotland), (c) Northern Ireland banks (Allied Irish Banks, Bank of Ireland, Northern Bank, Ulster Bank), (d) Trustee Savings Banks (TSB Bank, TSB Northern Ireland, TSB Bank Scotland), (e) Girobank, (f) other retail banks (Co-operative Bank, Abbey National, Abbey National Treasury Services, Yorkshire Bank), and (g) the Bank of England Banking Department. All of the above are involved in retail deposit-taking business and have access to their local clearing system. In order to conduct retail deposit-taking business, they maintain extensive branch networks. In 1999 the branch networks of the clearing banks alone totaled approximately 12,800.

As their names imply, Scottish clearing banks and Northern Ireland banks are regional clearing banks. On the other hand, the London clearing banks, particularly the so-called "big four" (Barclays, Lloyds, Midland, and National Westminster) have dominated in retail banking business throughout the UK either directly or through their regional subsidiary clearing banks. One of the basic functions of the clearing banks is the provision of the payment mechanism, namely the cheque clearing system and the electronic funds transfer system. Their two other fundamental functions are deposit taking and lending. They take retail deposits as well as wholesale deposits. Retail deposit facilities are offered to individuals and organizations primarily through branch networks. They include current accounts (equivalent to demand deposits), interest-bearing sight deposits (similar to checkable savings deposits), and regular savings deposits. Wholesale deposits are large interest-bearing deposits (usually at least £50,000) on which the interest rate is closely linked to money market instruments. They include time deposits and negotiable certificates of deposit. On the lending side, clearing banks provide credit to both personal customers and companies. Lending facilities offered to personal customers include overdrafts, personal loans, mortgage loans, credit card finance, and professional business loans, while those offered to corporate customers include overdrafts, term loans, syndicated loans, leasing, and factoring.

Trustee Savings Banks (TSBs) started out as unincorporated thrift institutions (similar to mutual savings banks in the United States) in the early nineteenth century to provide savings facilities for small savers. In the name of protecting small depositors, they were heavily regulated and their business was confined to taking savings-type deposits and investing received deposit money in public sector debt.

By the end of 1978, there were eighteen TSBs with over 1,600 branches. Each had its own clearly defined business region. Now the number has decreased to three, one covering Northern Ireland, another Scotland, and the third England and Wales. Meanwhile, their asset-based activities have been expanded to a full range of personal credit facilities including personal loans, overdrafts, credit cards, mortgage loans, and small business loans. Although they still aim their business predominantly at personal customers, they are today full-fledged retail banks.

Girobank was established in 1968, after years of debate in response to the recommendation of the Radcliff Report (1959), to provide an inexpensive, convenient, speedy money remittance service and cashing facilities for consumers through over 20,000 post offices. As additional services were added subsequently, such as a payments service for government units to the personal sector and there from, personal loans, and a remittance service for business, the bank has slowly transformed into a full-fledged retail bank. Meanwhile, it became a fully operational member of the London Clearing House in 1983.

Other retail banks include the Co-operative Bank, Yorkshire Bank and the recently converted Abbey National. The Co-operative Bank serves customers through a national network of branches and outlets of the co-operative societies. It receives deposits from individuals, various cooperative societies, trade unions, and local authorities. It provides loans to individuals and co-operative societies as well as to non-co-operative societies. The Yorkshire Bank operates as a retail bank in the North of England and the Midlands. Abbey National was a building society and became a bank in 1989. Its total assets then were £32 billion, compared with £190 billion for all building societies and £340 billion for banks' total sterling assets. Even without making their conversion into the status of banks, building societies have already been in direct competition with banks in savings deposit business. The conversion of such a large society is expected to create greater competitive environments in the banking and money markets.

The retail banks as a group had total assets of £426.1 billion as of December 2000, 33.1 percent of the total assets of the British banking industry. The major sources of funds for the retail banks were deposits taken from the nonbank UK private sector such as households and firms, comprising about 51 percent of total sources of funds. On the assets side, the retail banks as a group contributed about 55 percent of the total assets for advances to the UK private sector.

In lending, the retail banks have been guided by the real bills doctrine, which argues that, in trust of public money, clearing banks should lend only short-term loans based on real bills. These loans have the characteristics of being short term, productive, and self-liquidating in nature. That is money is loaned to borrowers to enable them to purchase inventories; then, inventories are sold on credit terms (thus creating accounts receivable); when payment is made, accounts receivable are retired into cash which is now ready for use for the loan repayment.

By and large following this doctrine, clearing banks, when faced with nontraditional business opportunities such as term loan lending or loan syndications in the 1960s and 1970s, opted to conduct such business through their subsidiaries. In this way, the clearing banks would be insulated from new unfamiliar risks. However, when a number of secondary banks, many of which were subsidiaries of clearing banks, got into financial difficulties in the early 1970s, it proved to be unwise to insulate in such a way. As a consequence, clearing banks started entering nontraditional markets more directly.

I. Key terms:

| Clearing system | - клірінг, розрахунки шляхом взаємного заліку вимог - the offsetting of liabilities and sales between two parties; |

| Factoring | - факторинг, придбання права та стягнення боргів - a business activity in which a company takes over responsibility for collecting the debts of another. Typically the client debits all its sales to the factor and receives immediate payment from it less a charge of about 2% to 3% and interest for the period of trade credit given to the customer; |

| Leasing | - лізинг, здача в оренду - an agreement between the owner of property (lessor) to grant use of it to another part (lessee) for a specified period at a specified rent. Leasing of business equipment, for example, may have tax advantages because the leasing company may receive tax relief on depreciation or investment allowances, that it can pass on to the lessee. |

| Giro | - система жиро - a system of payment in which a customer of one bank can make payments to a customer in another bank without the use of cheques. The customer fills in a form; |

| Subsidiary | - дочірня компанія, філія - generally a company controlled by another, parent company; |

| Inventories | - запаси товарів, сировини і готової продукції - a term for stock of raw materials, work in progress and finished goods; |

| Thrifts (US) Thrift institutions | - ощадні інститути - a general term covering non-bank institutions receiving deposits and making loans; |

| Advance | - кредит, позичка; авансовий платіж - a loan; to loan money; to lend money; |

| Syndication | - синдикування - to subject a credit or the issue of a security to management or underwriting by a syndicate (a group of banks or other financial institutions formed to provide a credit or to underwrite or manage an issue of security); |

| Credit card | - кредитна картка – a plastic card that enables the user to buy goods and services on credit (e.g. Visa and Mastercard). The account is held by the issuer of the card and a credit limit is established. The user receives a statement each month and must pay off a minimum amount (if not all) of the debt at that time. Credit card operators usually charge a very high rate of interest. |

II. Answer the following questions:

1. List the names of the British clearing banks.

2. What is their main business activity?

3. What banks dominate in retail banking business throughout the UK?

4. Name the fundamental functions of the clearing banks.

5. What kind of retail deposit facilities is offered to individuals and organizations primarily through branch network?

6. What kind of deposits is included in wholesale deposits offered by clearing banks?

7. Is there a difference between lending facilities offered to personal customers and corporate customers?

8. In what way does Girobank operate and what services does it offer?

9. Describe the operation of other retail banks mentioned in the text.

10. What is the main source of funds for the retail banks?

11. What is the lending doctrine of the retail banks?

III. After reading and translating the text:

Дата добавления: 2015-07-20; просмотров: 398 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Service operations of a small bank | | | State 10 different types of services provided by a typical retail bank for its corporate customers. |