Читайте также:

|

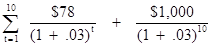

1. Young Corp. Bond Value (Vb) =

® ANSWER -$1,132.48

® ANSWER -$1,132.48

Thomas Resorts Bond Value (Vb) =

75.00

® ANSWER -$871.85

® ANSWER -$871.85

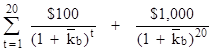

Entertainment, Inc. Bond Value (Vb) =

79.75

® ANSWER -$999.17

® ANSWER -$999.17

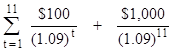

2. Young Corporation: $1,030 =

1,030

® ANSWER 7.37%

® ANSWER 7.37%

Thomas Resorts: $973 =

75.00

® ANSWER 7.79%

® ANSWER 7.79%

Entertainment, Inc.: $1,035 =

1,035

79.75

® ANSWER 6.94%

® ANSWER 6.94%

3. i. Young Corp. Bond Value (Vb) =

® ANSWER - $922.99

® ANSWER - $922.99

(Vb) =

(Vb) =

75.00

® ANSWER - $679.62

® ANSWER - $679.62

Entertainment, Inc. Bond Value (Vb) =

79.75

® ANSWER - $906.15

® ANSWER - $906.15

3. ii Young Corp. Bond Value (Vb) =

® ANSWER - $1,409.45

® ANSWER - $1,409.45

(Vb) =

(Vb) =

75.00

® ANSWER - $1,157.16

® ANSWER - $1,157.16

Entertainment, Inc. Bond Value (Vb) =

79.75

® ANSWER - $1,105.49

® ANSWER - $1,105.49

4. As the interest rates rise and fall, we see the different effects on the bond prices depending on the length of time to maturity and whether the investor's required rate of return is above or below the coupon interest rate. If the investor’s required rate of return is above the coupon interest rate, the bond will sell at a discount (below par value), but if the investor’s required rate of return is below the coupon interest rate, the bond will sell at a price above its par value (premium).

5. Duration of bonds

| Young Corp. | Thomas Resorts | Entertainment, Inc. | ||||||||

| Bond Value | $1,030.00 | $ 973.00 | $1,035.00 | |||||||

| Required rate of return | 6% | 9% | 8% | |||||||

| Year | Ct | t* PV(Ct) | Ct | t* PV(Ct) | Ct | t* PV(Ct) | ||||

| $ 78.00 | $ 73.58 | $ 75.00 | $ 68.81 | $ 79.75 | $ 73.84 | |||||

| 78.00 | 138.84 | 75.00 | 126.25 | 79.75 | 136.75 | |||||

| 78.00 | 196.47 | 75.00 | 173.74 | 79.75 | 189.92 | |||||

| 78.00 | 247.13 | 75.00 | 212.53 | 1,079.75 | 3,174.59 | |||||

| 78.00 | 291.43 | 75.00 | 243.72 | |||||||

| 78.00 | 329.92 | 75.00 | 268.32 | |||||||

| 78.00 | 363.12 | 75.00 | 287.19 | |||||||

| 78.00 | 391.51 | 75.00 | 301.12 | |||||||

| 78.00 | 415.51 | 75.00 | 310.79 | |||||||

| 1,078.00 | 6,019.50 | 75.00 | 316.81 | |||||||

| 75.00 | 319.71 | |||||||||

| 75.00 | 319.98 | |||||||||

| 75.00 | 318.02 | |||||||||

| 75.00 | 314.21 | |||||||||

| 75.00 | 308.86 | |||||||||

| 75.00 | 302.24 | |||||||||

| 1,075.00 | 4222.86 | |||||||||

| Sum of t*PV(Ct) | 8,467.02 | 8,415.17 | 3,575.11 | |||||||

| Duration | 8.22 | 8.65 | 3.45 | |||||||

The value of the Entertainment, Inc. bonds will be less sensitive to interest rate changes than will Young Corporation and Thomas Resorts bonds.

6. Although the Young Corporation bonds and the Thomas Resorts bonds have different terms to maturity, the duration of the two bonds is very similar. These two bonds will likely have similar sensitivity to changes in interest rates as evidenced by their duration values.

7. The Entertainment, Inc. and Thomas Resorts bonds have lower expected rates of return than your required rate of return. Young Corporation’s expected rate of return is greater than your required rate of return. So we would buy Young Corporation and not Entertainment, Inc. or Thomas Resorts.

Solutions to Problem Set B

7-1B. Value (Vb) =

® ANSWER -698.87

® ANSWER -698.87

7-2B. If the interest is paid semiannually:

Value (Vb) =

4.5

® ANSWER -1068.92

® ANSWER -1068.92

If interest is paid annually:

Value (Vb) =

® ANSWER -1068.05

® ANSWER -1068.05

7-3B. $950 =

® ANSWER 4.96%

® ANSWER 4.96%

The rate is equivalent to 9.92 percent annual rate, compounded semiannually or 10.17 percent (1.04962- 1) compounded annually.

7-4B. $975 =

® ANSWER 10.30%

® ANSWER 10.30%

7-5B. $1,175 =

® ANSWER 6.18%

® ANSWER 6.18%

7-6B. a. $1,100 =

® ANSWER 7.80%

® ANSWER 7.80%

b. Vb =

® ANSWER -926.33

® ANSWER -926.33

c. Since the expected rate of return, 7.80 percent, is less than your required rate of return of 10 percent, the bond is not an acceptable investment. This fact is also evident because the market price, $1,100, exceeds the value of the security to the investor of $926.33.

7-7B.

a. Value

Par Value $1,000.00

Coupon $ 80.00

Required Rate of Return 7%

Years to Maturity 20

Market Value $ 1,105.94

b. Value at Alternative Rates of Return

Required Rate of Return 10%

Market Value $ 829.73

Required Rate of Return 6%

Market Value $1,229.40

c. As required rates of return change, the price of the bond changes, which is the result of "interest-rate risk." Thus, the greater the investor's required rate of return, the greater will be his/her discount on the bond. Conversely, the less his/her required rate of return is below that of the coupon rate, the greater the premium will be.

d. Value at Alternative Maturity Dates

Years to Maturity 10

Required Rate of Return 10%

Market Value $ 877.11

Required Rate of Return 6%

Market Value $1,147.20

e. The longer the maturity of the bond, the greater the interest-rate risk the investor is exposed to, resulting in greater premiums and discounts.

7-8B. $1,110 =

® ANSWER 5.83%

® ANSWER 5.83%

7-9B. (a) Value (Vb) =  +

+

8.5

® ANSWER -867.62

® ANSWER -867.62

(b) (i) Value (Vb) =  +

+

® ANSWER -698.05

® ANSWER -698.05

(b) (ii) Value (Vb) =  +

+

® ANSWER -1,104.77

® ANSWER -1,104.77

(c) We see that value is inversely related to the investor's required rate of return.

7-10B.

Value Bond A

Par Value $1,000.00

Coupon $ 90.00

Required Rate of Return 7%

Years to Maturity 5

Market Value $ 1,082.00

Value Bond B

Par Value $1,000.00

Coupon $ 60.00

Required Rate of Return 7%

Years to Maturity 5

Market Value $ 959.00

Value Bond C

Par Value $1,000.00

Coupon $ 120.00

Required Rate of Return 7%

Years to Maturity 10

Market Value $ 1,351.18

Value Bond D

Par Value $1,000.00

Coupon $ 90.00

Required Rate of Return 7%

Years to Maturity 15

Market Value $ 1,182.16

Value Bond E

Par Value $1,000.00

Coupon $ 75.00

Required Rate of Return 7%

Years to Maturity 15

Market Value $ 1,045.54

Дата добавления: 2015-10-30; просмотров: 129 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| END-OF-CHAPTER PROBLEMS | | | Bond A B C D E |