|

Читайте также: |

We can see that Carrefour’s positions in the hypermarket sector and its experience in this field had to be rather valuable in 2009. French retailer opened its first Russian hypermarket in June 2009, in Moscow. The outlet, comprising 12,000 m², was housed in the Fili shopping centre.[24] This opening was followed by the company’s second store, in Krasnodar, which was opened in September 2009. The value of the investment involved in the second store in Russia came to €7.8m ($11.5m). Total area of the Krasnodar hypermarket takes up 14,500 m², including 8,500 m² of trading area.[25]

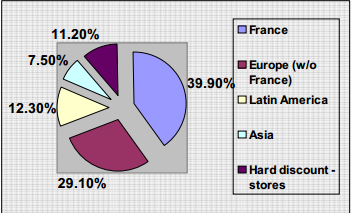

Carrefour Net Sale By Store Format (%) in 2008

Resource: Carrefour Investor Relations

In October 2009 retail was one of the fastest growing industries of the Russian economy. In recent years Russia has emerged as a leading name among the countries providing most conducive retail environment. Retail sales in Russia grew at the CAGR of almost 25% during 2004-2008.[26]But October 2009 the French retailer Carrefour decided to withdraw from the Russian market.

The company announced, "Carrefour has decided to sell its activities in Russia and pull out of the market, given the absence of sufficient organic-growth prospects and acquisition opportunities in the short- and medium-term that would have allowed Carrefour to attain a position of leadership. This decision is consistent with the Group's strategy which aims at building leadership positions that will ensure strong and lasting profitable growth."[27]

In every international market in which Carrefour operated, it essentially focused on becoming one of the top three players in terms of market share. Back in 2005 it made the strategic decision to withdraw from four countries where it was not in a position to maintain market leadership. This formed part of a rationalization of its international activities and its bid to focus on core growth markets including Eastern Europe and Latin America. Maybe Carrefour really didn’t see itself as a Russian retailer leader. This could be a signal that they are going to do everything they can to save costs and hit their targets. But we can also suggest that there were much more problems connected with Russian legislation if we remember the troubles the company faced trying to get the license for selling spirits and Carrefour’s management might decide that Russian business climate was too bad, competition – too strong and operating there would lead sooner to problems than to high revenues.

The reason for Carrefour’s international success is its ability to adapt to local taste through using local suppliers. Carrefour usually purchases about 95% of its products from local suppliers.[28] As we have already mentioned the company didn’t succeed in this direction in Russia during such short period of operations.

Percentage of Net Sales in regards to each Region[29]

Considering the percentage of Carrefour’s Net Sales in regards to each Region and some figures from 2 periods of time: the 2nd Quarter 2009, as 2 Carrefour’s hypermarkets were opened in Russia and the 3rd one, as the company left Russian retail market, we can suppose that the company decided to withdraw from Russian market in order to concentrate on its existing profitable markets for instance Chinese and Brazilian markets. In the second Quarter 2009 Brazil: gained 14.3% at constant exchange rates in H1, faster Q2 growth (+16.7% at constant exchange rates) and - China: +6.3% at constant exchange rates in H1, driven by better performance in Q2 (+11% at constant exchange rates). In most other growth markets, the Group reported market share gains, despite unfavorable consumer trends.[30]In the third Quarter 2009 Carrefour pulled out of Russian market. The features of the growth in Brazilian and Chinese markets are improving. Sustained growth in Brazil (+14.8% ex-petrol at constant exchange rates). Growth in China in line with H1 (+7.1% at constant exchange rates), although sales continued to be impacted by deflationary pressure. And at the end of 2009 the growth in Brazil was equal 14,2% and in China – 8,6%.[31]

Unlike some other mass retailers, like the British giant Tesco, Carrefour has not particularly benefited from the shift to bargain-hunting among consumers. Its shares are up 9.6 percent 2009, well below the 37.7 percent return on the Dow Jones Euro Stoxx retail index. The company said total sales during the third quarter were 24 billion euros ($35.7 billion), down 2.9 percent for stores open at least a year and the third successive quarterly decline in sales.[32] The company may think about the health food direction that is getting more popular nowadays and develop in some new directions.

Дата добавления: 2015-08-18; просмотров: 49 | Нарушение авторских прав

| <== предыдущая страница | | | следующая страница ==> |

| Weaknesses | | | Chapter 5. Recommendations |